- Home

- Publications et statistiques

- Publications

- Measuring the carbon footprint of French...

Measuring the carbon footprint of French direct investment abroad

Post No. 409. As part of the G20 initiative to develop new climate indicators, we propose an original measure of the carbon footprint of French companies' foreign direct investment based on the CO2 emissions of around 2,500 French multinational groups. This footprint is greater in Asia and Africa, even though the amounts invested are relatively lower.

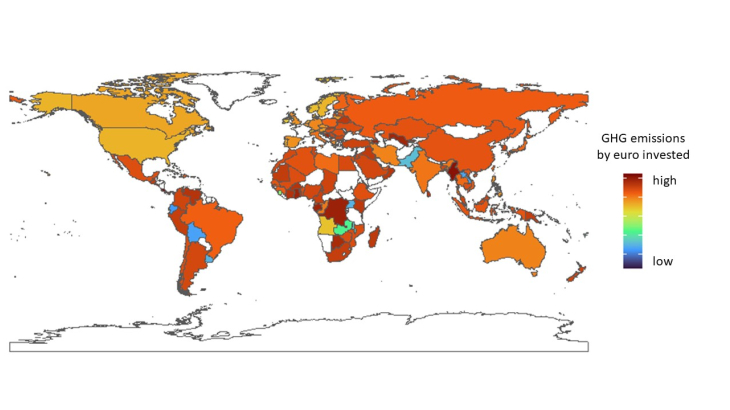

Chart 1 – Carbon intensity of French direct investment abroad (2022)

Note: For each country, the carbon intensity of FDI corresponds to the weighted sum of emissions from French FDI subsidiaries relative to the total capital of the companies concerned; the logarithmic scale makes it simpler to read but harder to interpret the levels. The highest intensitiesaround 0.5 tonnes of CO2e per EUR thousand invested, shown in dark red, are approximately ten times higher than those shown in orange.

In 2009, in the wake of the financial crisis, the G20 launched the Data Gaps Initiative to address data gaps that had hampered crisis forecasting and policy decision-making. Today, this initiative includes recommendations on the development of climate indicators, including the measurement of the carbon footprint of foreign direct investment (FDI). To meet this objective, the International Monetary Fund has proposed an estimation method based on macroeconomic data.

In France, INSEE’s carbon accounts also provide a macroeconomic approach for assessing France's carbon footprint, which includes French emissions and the balance of imported and exported emissions. Lastly, the Banque de France recently published an estimate using a fairly similar method.

An approach based on the availability of granular data

In an article published in March 2025, we propose a granular approach, with the carbon footprint of FDI estimated in particular using the carbon assessments published by the companies themselves.

This approach supplements the conceptual framework used by the IMF. This approach is based on a particularly strong assumption of homogeneity in the carbon intensity of the production of companies owned by non-residents in different sectors of activity, or, in other words, a lack of differentiation in production processes within each sector. Drawing on microeconomic data, notably greenhouse gas (GHG) emissions for each company, makes it possible to relax the assumption of homogeneity and thus capture the diversity of companies' production processes.

In the medium term, our granular approach will enable us to test the robustness of the assumptions of the IMF's approach. Ultimately, our objective is similar in that it seeks to assess the extent to which French multinationals contribute to GHG emissions through their production abroad and, analogously, the GHG emissions of French subsidiaries owned by foreign parent companies.

The main challenge is to allocate the total GHG emissions reported by a multinational group to the various entities that comprise it.

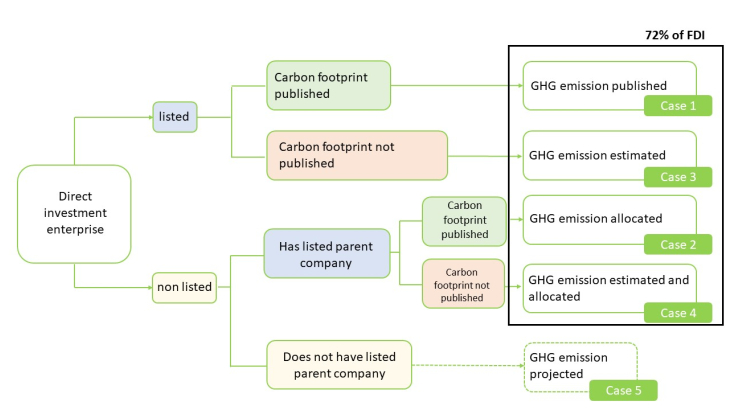

A decision tree summarises the entire process (Chart 2). When a company is listed, it generally publishes a carbon footprint and its data are accessible, either in its detailed financial statements or in non-financial reports. When GHG emissions data are available, we use them directly (Case 1). However, for the few listed entities for which GHG emissions data are not available (Case 3), we have to estimate them. All links with the direct investment enterprise are determined by the direct investor's shareholding.

Chart 2 – Decision tree for estimating GHG emissions for companies receiving FDI

Note: A direct investment enterprise is a resident company in which at least 10% of the ordinary shares or voting rights are held by a non-resident.

As regards cases 2 and 4, our approach can be summarised in two steps. First, we collect (or estimate) the total GHG emissions of the group concerned via a commercial data provider (ISS). We then allocate these emissions to its different direct investment enterprises.

The model that allows GHG emissions to be allocated to different entities within a group works in three stages: (i) GHG emissions at group level are allocated to its entities based on their stocks of long-term tangible assets; (ii) this initial estimate is adjusted for the average carbon intensity of the country and sector in which each entity operates; (iii) estimates are normalised so that the final results at the direct investment enterprise level are consistent with the group's total emissions.

Case No. 5, which concerns groups with no listed entities, falls outside the scope of our model due to a lack of available data. Even so, our approach makes it possible to measure the carbon footprint for nearly three-quarters of the value of French direct investment abroad.

The carbon intensity of FDI depends more on the sector of activity than on the FDI recipient country

Our approach reallocates GHG emissions based on a principle of ‘responsibility’ rather than jurisdiction. It implies that a multinational company is responsible for the GHG emissions of all its direct subsidiaries abroad. Consequently, it makes it possible to measure the “carbon content”, shown here for the stock of French direct investment abroad.

Chart 1 shows carbon intensity by country, i.e. the ratio of each country's GHG emissions to the amount invested by French multinationals in that country. The “warmer” – even “rustier” – the shade of a country, the more GHG emissions its local French subsidiaries emit in relation to the total amount invested in that country. Conversely, when a country is shown in blue, carbon emissions are low in relation to the amounts invested.

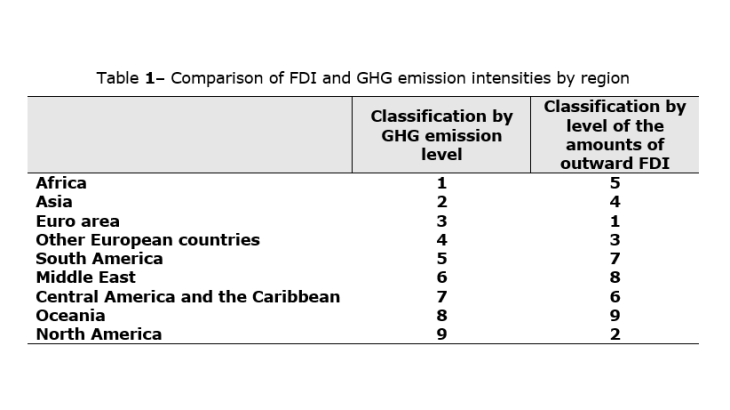

Table 1 ranks regions of the world in terms of the intensity of GHG emissions of the French subsidiaries located there. Accordingly, this intensity is highest in Africa and lowest in North America. This ranking is compared with the ranking in terms of FDI amounts for these same subsidiaries.

Table 1– Comparison of FDI and GHG emission intensities by region

Chart 1 and Table 1 confirm that France's carbon-intensive investments are mainly concentrated in Africa and Asia, although France channels most of its FDI flows to countries in the euro area and North America. This pattern may reflect the relocation of carbon-intensive industries to other parts of the world, particularly to lower-income countries, but it is also compatible with investment choices driven by the location of resources and the productive structure of these regions, and not necessarily by relocation in the strict sense of the term. This concentration on GHG-emitting activities offsets the effect of this low capital intensity. This explains why the carbon footprint of French direct investment is particularly high in these regions (see Chart 1 for more details in this article).

This variability in carbon intensity can largely be attributed to the specific nature of the sectors of activity in each region. Africa is the area with the highest emissions for French FDI and is dominated by investment in extractive industries. It is followed by Asia, which has attracted significant investment in manufacturing. Conversely, the weight of these sectors, which are much higher emitters of GHGs, is less significant in French investments in the euro area or North America, where the sectors invested in are more diversified and more concentrated in the tertiary sector.

An innovative method that can be further improved

This microeconomic approach aims to analyse FDI-related GHG emissions in greater detail. The results remain incomplete due to limited data availability – 28% of French FDI holdings are still not covered (Case 5 in Chart 2), particularly in Asia, where unlisted groups are more common.

We are fairly confident that these statistics will evolve in the near future. The new European CSRD directive, which came into force in January 2024, imposes new non-financial reporting requirements on companies. These requirements enhance the transparency of accounting practices and the accuracy of emissions reporting, which are essential for accurately assessing the carbon footprint of FDI. These advances, combined with improved availability of climate data, including corporate GHG emissions, should pave the way for more comprehensive assessments of FDI-related emissions.

Download the full publication

Updated on the 27th of October 2025