Many economists, including at the Fed, are pondering the current situation of low unemployment coupled with low inflation. This configuration had already been observed in the United States at the end of the 1990s, giving rise, both then and now, to extensive literature. Cette, Frey and Moëc (2005) have since shown that subsequent revisions of labour cost data could be used to reconsider the conundrum of this coexistence at the end of the 1990s. But economic policies, and in particular monetary policy, are reliant on real-time data. This is an inherent difficulty at times when such conundrums appear, such as in this case. Here, we summarize our findings of 2005 to shed light on the current debate.

Two periods of low unemployment and low inflation

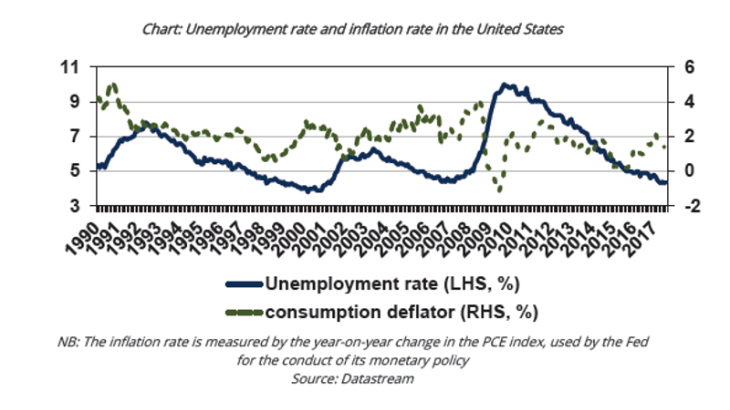

The current situation of low unemployment and low inflation in both the United States and some other countries has given rise to much conjecture about a possible flattening of the short-term Phillips curve, which shows an inverse relationship between unemployment and inflation. A similar phenomenon had also sparked equally heated debates at the end of the 1990s in the United States. While the Non Accelerating Inflation Rate of Unemployment (NAIRU) was estimated at close to 6% at the time, the unemployment rate stood at 4% without a marked resurgence of inflation, both in terms of consumer price inflation (around 1% in 1998 and 1999, against the backdrop of a sharp decline in energy prices) and wage inflation. There is however one major difference between these two contexts. Indeed, while productivity gains are historically low in the current period, they were high at the time due to the growing diffusion of information and communication technology (ICT), with a significant impact on potential growth as substantiated by Cette and Pfister (2003).

A heated debate in both academic circles and at the Fed

At the time, economists were considering the possibility that the NAIRU may have temporarily or lastingly fallen below 6%. For example, Ball et Tchaidze (2002) among many others, attributed this to the transitory impact of a lagged indexation of wages on increasing productivity, leading to a temporary drop in the NAIRU. Katz and Krueger (1999) put forward a variety of other explanations: demographics, related to the proportion of younger workers or the prison population, or to the reduction in worker bargaining power. Stiglitz (1997) believed that these temporary or lasting effects could be attributed to a combination of the two explanations.

The minutes of the FOMC show that this situation has also given rise to much debate at the Fed, as we reviewed in our 2005 paper. Greenspan appeared to attribute the situation to a decline in workers’ wage bargaining power due to the acceleration in the obsolescence of human capital. This seems to have been spurred by the emergence of ICTs whose replacement rate was very high at the time. In this respect, he stated at the meeting of 1 and 2 July 1997: “I think that the uncertainty associated with the rapid introduction of the new technology created insecurity. [...] the uncertainties stemming from the rapid introduction of technology are engendering a considerable amount of fear that has induced lower wage gains as a trade-off for increased job security. It is very difficult not to acknowledge that that is happening in some form or other.” In this approach, the decline in the NAIRU driven by the weakening of workers’ wage bargaining power could be just as sustained as the acceleration of technological renewal associated with ICTs.

Corrective effects of the revisions of national accounts on the debate

This debate lost much relevance due to the major revisions to national accounts in the United States between 2000 and 2002. These revisions resulted in a significant increase in wage dynamics and, as a result, a reduction of profit and corporate margin dynamics in the second half of the 1990s. The fact that there was not a marked resurgence of inflation despite the low unemployment rate was therefore unsustainable because it was largely attributable to a contraction in corporate margins. However, at the turn of the 2000s, the rise in the natural interest rate driven by that of productivity gains and the sharp acceleration in demand led the Fed to raise its policy rate. The recession of the early 2000s then warded off inflationary threats.

There nevertheless remains the important question as to why these developments were not identified in real time when they occurred. One explanation was given by Himmelberg, Mahoney, Bang and Chernoff in an article published in 2004 by the New York Fed. These authors attribute this to both poor preliminary estimates of employee stock options exercised, which had seen an unexpected surge, as well as “aggressive accounting” by some large firms, especially in the communications sector.

Difficulties in the real-time conduct of monetary policy

Reviewing the statistics has enabled us to reassess the conundrum of a low unemployment rate without inflationary pressures at the end of the 1990s in the United States, highlighting other explanatory factors than those considered in real time. In the current environment, Janet Yellen (2017) justifies this coexistence by the transitory impact of the prices of some goods, while admitting that this analysis is subject to a high degree of uncertainty: “But our understanding of the forces driving inflation is imperfect, and we recognize that something more persistent may be responsible for the current undershooting of our longer-run objective. Accordingly, we will monitor incoming data closely and stand ready to modify our views based on what we learn.”

It is too early to know whether the same amount of hindsight will allow us to explain this coexistence for the current period. As mentioned above, the contexts of the two periods in terms of productivity growth are very different: high at the end of the 1990s and historically low in the current period. But the conduct of economic policies and in particular monetary policy requires the use of real-time data. This is an inherent difficulty at times when such conundrums appear. If central banks attribute most of the difference to a structural change, they may have to adjust their estimate of the equilibrium interest rate. If, rather, they only identify a temporary shock, they may “simply” adapt the adjustment of their monetary policy while keeping the same objectives.