- Home

- Publications et statistiques

- Publications

- Interest rate hikes: short-term gain, lo...

Interest rate hikes: short-term gain, long-term pain for debtor countries

Post n° 341. In 2022, central banks around the world tightened monetary policy. Debtor countries such as France saw their Net International Investment Position (NIIP) improve as the market value of their debt plummeted. Yet, interest rate payments from newly contracted debt will deteriorate future current accounts over time, thus turning short-term gain into long-term pain.

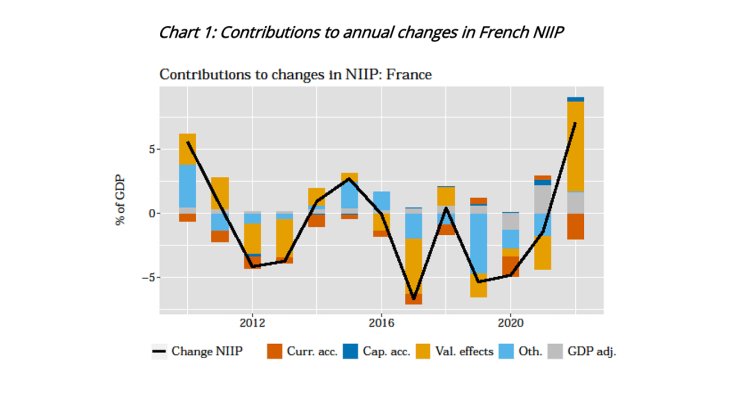

Following the global inflation surge that started in 2021, central banks around the world raised interest rates, often at unprecedented speed, to bring inflation rates back to target. Higher interest rates mechanically lowered the price of debt securities, including those held abroad and owned by non-residents. This affected the Net International Investment Position (NIIP), which is defined as the stock of external assets minus external liabilities at market values. The NIIP, a stock value, changes from year to year due to flow and valuation effects. First, the most important underlying flow is the current account which comprises the trade balance (net exports) as well as net income flows, notably those from external assets held abroad minus those that need to be paid on external liabilities. Second, the NIIP stock valuation varies when market prices of the underlying stocks change from one year to the other. France’s NIIP improved by EUR 143 billion in 2022 (5% of GDP), largely driven by valuation effects (Chart 1). The hike in nominal GDP due to inflation contributed mechanically to alleviate the NIIP, when expressed in percent of GDP, by an additional 2 percentage points.

Rising interest rates improve the net foreign asset position of debtor countries

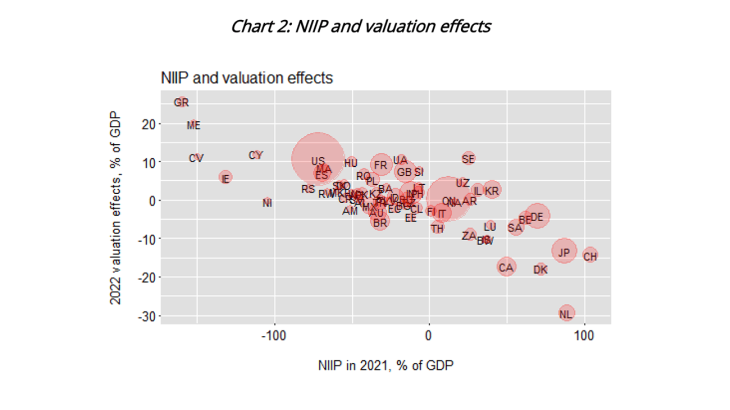

More generally, higher interest rates improve the NIIP of debtor countries and vice versa for creditor countries (Chart 2). Rising interest rates therefore reduce global NIIP imbalances.

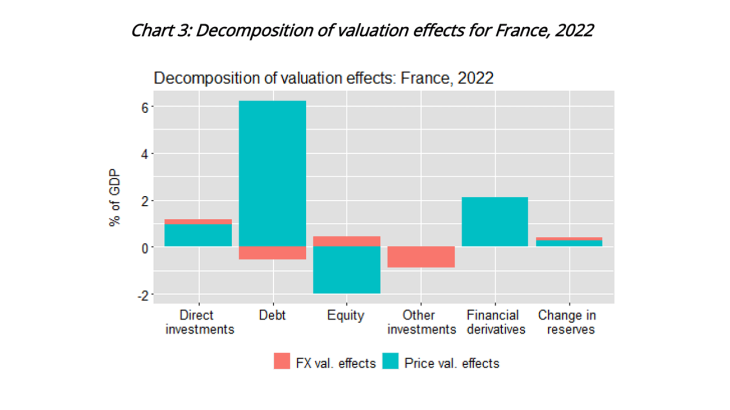

In France (Chart 3), as in other countries, valuation effects in 2022 arose primarily from asset price changes (“price valuation effects”) rather than from exchange rate changes on assets denominated in a foreign currency (“FX valuation effects”). Portfolio debt (government and corporate bonds) contributed massively with a valuation effect of +EUR 164 billion (6% of GDP), mostly because France’s 2021 net position was largely negative. Hence, when asset prices decline, the effect is larger on liabilities than assets for countries with a negative NIIP.

Portfolio debt: from short-term gain to long-term pain

For debtor countries, these improvements in the net external debt to GDP ratio were quantitatively large and unusual. This short-term gain, however, will be counterbalanced over time by both the reversal of valuation effects when interest rates return to normal and higher interest payments that deteriorate the current account of the balance of payments. At first order, higher interest rates raise the external debt burden for debtor countries independently of the maturity structure of its debt assets and liabilities when long-term rates anticipate short-term rates; the mix of short-term and long-term instruments determines simply when the interest rate hikes bite. At second order, the term premium rewards investors for holding long-term assets, thus driving a wedge between long rates and expectations of future short rates.

In the short-run, interest payments were pushed up by higher interest rates for short-term debt rolled over every year as well as by inflation-linked debt. Indeed, interest payments on inflation-indexed bonds increased with the inflation rate. In France, interest rate payments to non-residents related to inflation dynamics tripled in 2022 with respect to 2021 (Banque de France, 2022). Inflation-linked bonds make up roughly 11% of French sovereign debt, compared to 25%, 9% and 5% for the United Kingdom, the United States and Germany respectively.

In the long-run, inflation rates return to target and interest rates decrease, thus interest payments on newly issued short-term and inflation-linked debt subside while staying above the 2021 level. Conversely, the issuance of long-term debt

during times of higher interest rates weighs on the current account when sold to non-residents.

Large impact of higher interest rates in simple back-of-the-envelope calculations

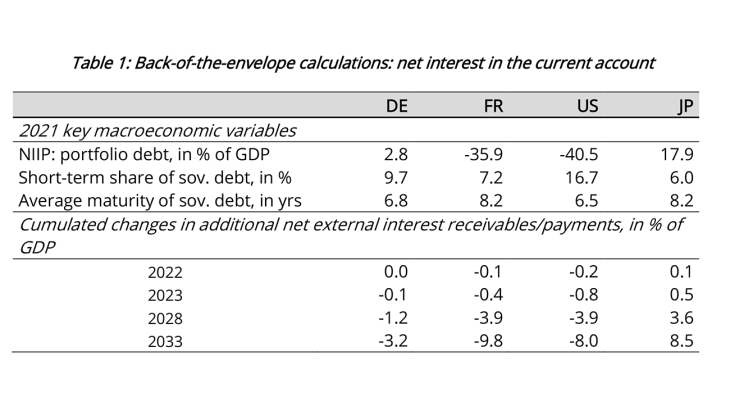

These effects can be illustrated by simple calculations of how interest rate payments affect the current account. Future net interest rate payments are determined by interest rate paths and the share of short-term and long-term debt, while their ratios to GDP also depend on future inflation and real growth that affect the denominator. The scenario is taken from OECD and Consensus Forecasts. Notably, interest rates rise up to 2024-25 by around 3 percentage points, subside and stay constant from 2029 onwards, though on a higher level than 2021 in the United States and in Europe. They are much flatter in Japan. The stocks of portfolio debt on the asset and liability sides of the NIIP are supposed to stay constant at their 2021 values. Private debt evolves in line with sovereign debt, the split between short-term and long-term debt stays constant and all economies hold the same portfolio on the asset side. Inflation-indexed debt is not considered here. Table 1 expresses such a simulation as a difference with respect to a hypothetical scenario, had interest and inflation rates remained at their 2021 values.

The cumulated impact of higher interest rates on the current account is of similar magnitude for France and the United States, two debtor countries. Higher income receipts from their assets are more than compensated by higher income payments. While interest rates are expected to decrease from their currently high levels around 2024 (as will the burden from rolling over short-term debt), the bulk of the cumulated changes in 2033 is driven by interest flows from newly rolled over long-term debt. The contribution of long-term debt amounts respectively to -9.2% (out of a total of -9.8%) in France and -5.8% (total: -8.0%) of GDP in the United States: the slope of the yield curve is expected to be steeper in the United States after 2025 but the debt maturity is longer in France.

Future interest rate movements might affect creditor countries like Germany and Japan differently. Interest rate incomes on the asset side increase in both countries. However, interest rate payments in Germany increase more than incomes mainly because interest rate differentials between the asset and liability sides shrink with respect to 2021. Higher liabilities to GDP and a shorter maturity structure also contribute negatively in Germany.

Our simplified calculation illustrates the importance of initial debt positions and the impact of the maturity of debt on net interest revenue. Although the impact is already sizable, it likely presents a lower bound for debtor countries. Indeed, outstanding debt might increase if future interest rate payments have to be financed by additional issuance. In addition, future lower levels of interest rates will reverse the decrease in the market value of outstanding debt. In this respect, the 2022 short-term gain that results from the measurement at market prices – which does not affect public finances as long as debt is not bought back – appears even more elusive.

Download the PDF version of the publication

Updated on the 25th of July 2024