Macroeconomic dynamics strongly depend on expectation processes. Monetary policy consists for a large part in managing inflation expectations of different agents (households, firms, professional forecasters). It is therefore of utmost importance for central bankers to know the strength of informational frictions that affect inflation expectations within and across different categories of economic agents.

These informational frictions are characterized by the frequency of revisions and disagreement in inflation expectations. Because the cost of collecting and processing information may be different for various categories of agents, the strength of information frictions within and across various categories may vary dramatically.

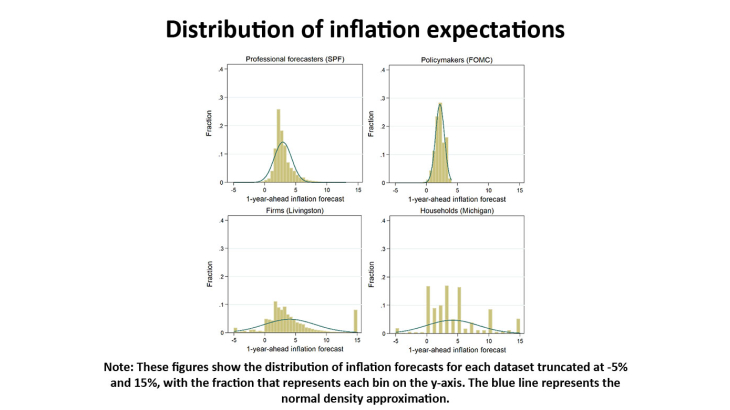

We compare the frequency of inflation forecast revisions and disagreement in inflation expectations among five categories of agents: households, firms, professional forecasters, policymakers and participants to laboratory experiments. We document a heterogeneous frequency of forecast revisions across the five categories of agents, with policymakers revising more frequently than participants to experiments, firms and professional forecasters, who themselves revise much more frequently than households. We also provide evidence of disagreement within all categories of agents, although there is a strong heterogeneity across categories: while policymakers, professional forecasters and participants to experiments exhibit low disagreement, firms and households show strong disagreement.

Our results question the external validity of experimental inflation expectations: in terms of disagreement, the behavior of participants to experiments is closer to that of central bankers; in terms of frequency of forecast revisions, the behavior of participants to experiments is relatively close to that of professional forecasters or firms.

In terms of policy implications, our findings may inform central banks about the public they should target to improve their communication strategy in order to cope with information frictions, both within and across categories of economic agents. In particular, acknowledging the size of disagreement within and across each category of agents (implying that the information released by the central bank may not reach all categories of agents and also all agents within each category in the same manner), targeted communication towards each category and towards specific groups of agents (presenting the same characteristics) within each category might represent a useful tool.