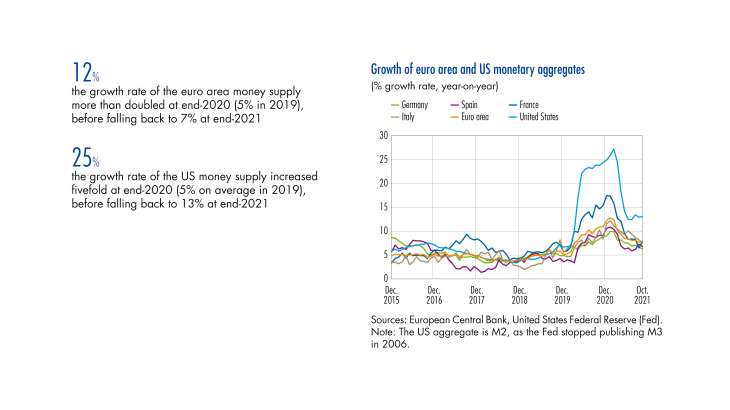

Between 2019 and 2020, the growth rate of the money supply (M3, a broad aggregate capturing potential transfers between liquid assets, see definition in the appendix) in the euro area increased markedly from 5% to approximately 12%, corresponding to an annual flow of EUR 1,589 billion. This 7 percentage point (pp) increase over one year was the fastest ever recorded since the euro’s inception. An even more pronounced increase was observed in the United States, where the M2 growth rate climbed from roughly 5% to 25% (see Chart 1). This sustained pace of money expansion has raised concerns among economists about possible inflationary pressures.

Monetary dynamics in 2020 were primarily fuelled by the fiscal response to the Covid crisis, which was itself facilitated by large-scale purchases of government debt securities by monetary financial institutions (MFIs), and, in particular, by central banks. The unique nature of this period is highlighted by the subsequent normalization trend that began in early 2021, as the annual growth rate eased to approximately 7% in the euro area in December 2021. This article explains the main mechanisms driving these developments and explores the relationship between this additional monetary creation and the price level, with a focus on the initial phase of the crisis, which featured the most pronounced developments.

1 A sharp increase in euro area monetary aggregates, mainly fuelled by massive purchases of government debt by MFIs

Strong growth in deposits held by households and non-financial corporations

In the euro area, the money supply (or broad money) is defined as the sum of all banknotes and coins, deposits and short-term debt securities and money market fund shares/units held by resident agents other than MFIs and central government. The money supply is recorded on the liabilities side of the MFI balance sheet. The deposits of non-financial corporations (NFCs) grew the most over the recent period in the euro area, followed by household deposits. In 2020, the growth rate of deposits was fairly similar across euro area countries, with the exception of France, where it was much higher, echoing a pattern seen in 2017 (see Box 1).

Euro area NFCs accumulated deposits of EUR 518 billion in 2020, including EUR 445 billion in the first three quarters of the year.

[to read more, please download the article]