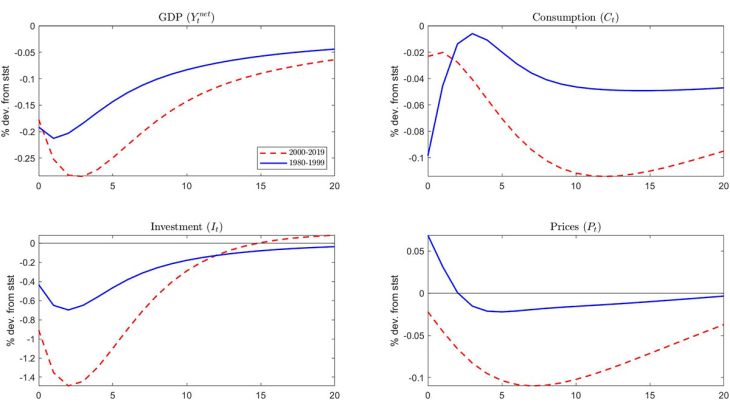

Series no. 997. Uncertainty shocks, by propagating through the banking sector, play a crucial role in driving business cycle fluctuations. To examine how the recent decline in U.S. banking competition has affected the transmission of these shocks, I develop a dynamic stochastic general equilibrium model featuring heterogeneous banks, imperfect banking competition and financial frictions. The model shows that reduced competition in the banking sector leads to higher borrowing rates and increased risk-taking by borrowers. As a result, uncertainty shocks generate more pronounced increases in defaults and sharper contractions in investment and output in less competitive banking environments. Quantitatively, the model implies that the recent decline in U.S. banking competition results in a 0.1 percentage points larger drop in GDP one year after an uncertainty shock. This finding is supported by panel local projection evidence indicating that lower banking competition amplifies the negative impact of uncertainty on GDP.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche