Inflation started to rise in 2021 in most countries, following almost two decades of moderation. There is consensus that the main drivers of current inflation are related to global variables, in particular disruptions in global value chains, input shortages in key manufacturing sectors, and rising energy and food prices. Aside from current discussions about whether these shocks are temporary in nature and whether inflation will normalize once the effects of the pandemic and geopolitical tensions have subsided, the question of the medium‑term impact of globalisation on price dynamics remains open (Blanchard, 2020)

This article aims to contribute to current debates by re‑examining the relationship between globalization and inflation. In an open economy, external shocks affect domestic economic and financial conditions. Therefore, the question of whether the globalization process will continue to progress and what long term impact will it have on inflation remains crucial. In order to shed light on this issue, this article discusses the following questions: what are the channels through which globalisation affects inflation? To what extent was globalisation responsible for the pre‑pandemic low levels of inflation? What can we learn from the past to better understand the current situation?

Globalisation exerted downward pressure on inflation between 1995 and 2019

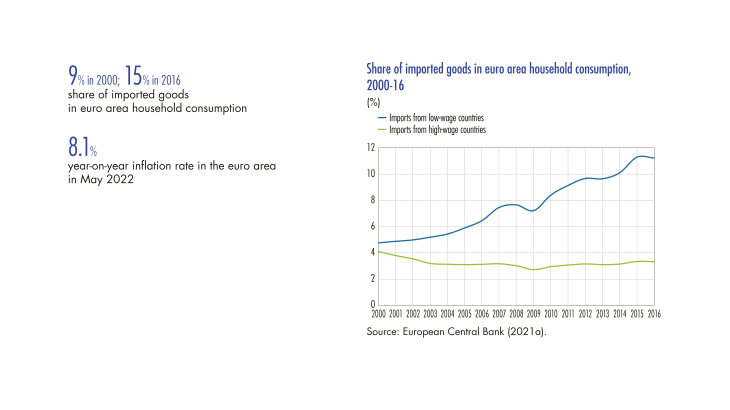

We illustrate the discussion with an analysis of euro area countries’ inflation dynamics during 1995‑2019. We study the extent to which globalisation explains the particularly low levels of inflation recorded during the last decade. This has been a long‑standing concern for central banks, as exemplified by the fact that the European Central Bank (ECB) devoted attention to globalisation in the context of its 2021 monetary policy strategy review (ECB, 2021a).

There is a widespread view among economists, confirmed by the findings of this article, that globalisation has had a negative but quantitatively small impact on headline euro area trend inflation over 1995‑2019. The impact of globalisation has however been larger on short‑term business cycle fluctuations. Importantly, the influence that global variables exert on inflation in euro area countries increased after the Great Financial Crisis of 2008‑09. In particular, external shocks in the form of movements in oil prices, exchange rate shocks and global value chains had a greater impact for the 2008‑19 sub‑period than for 1995‑2007 (in technical terms, our estimates show a higher transmission of these shocks to euro area inflation).(…)

[to read more, please download the article]