Post n°320. According to the Banque de France's projection, French inflation measured by the Harmonised Index of Consumer Prices (HICP) will gradually return towards 2% in 2025. How is this projection produced? This post describes our main tools and shows how, by combining modelling and expert judgement, we produce disaggregated inflation forecasts that are consistent with the overall macroeconomic scenario.

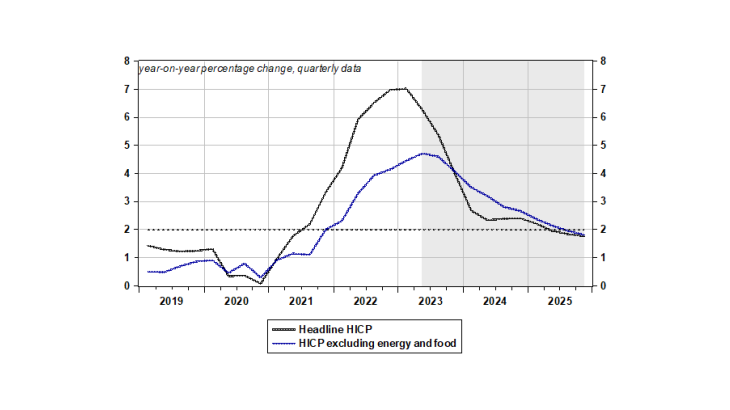

Source: HICP inflation (Harmonised Index of Consumer Prices), INSEE up to Q1 2023, Banque de France projections in the shaded area

French inflation is expected to gradually fall back towards 2% in 2025

Over 2023, in the absence of any further shocks, headline inflation is expected to fall sharply over the second half of the year according to our June 2023 Macroeconomic Projections. In annual average terms, it should come out at 5.6%, but is expected to stand at 4.0% year-on-year in the fourth quarter of 2023 (Chart 1). This marked fall in headline inflation in the second half of 2023 should be mainly due to the slowdown in food prices, following that in energy prices in the first half.

In 2024, as commodity prices (energy and food) ease, the main driver of inflation should be services prices, which are supported by delayed wage increases. In 2025, headline inflation should continue to decline under the dual effect of the ongoing normalisation of commodity prices and the gradual transmission of monetary policy tightening to core inflation. In particular, services inflation should start to slow, reflecting smaller nominal wage increases than in previous years.

MAPI, a disaggregated inflation model at the heart of our tools

Banque de France forecasters use a range of tools to produce inflation projections, which is based on the model for the analysis and projection of inflation known as MAPI (Ulgazi & Vertier, 2022). Using a disaggregated approach, i.e. component by component, this model is used to forecast price trends in the four main aggregates, i.e. food, energy, industrial goods and services, over a 12-month horizon. This model meets the Eurosystem's need for monthly forecasts over a one-year horizon and quarterly forecasts over a three-year horizon produced by the national central banks.

In the very short term, i.e. over a three-month horizon, we produce inflation projections for very detailed components such as fruit, fuel and air and rail transport. More precisely, forecasts are produced for twenty disaggregated components. We base our forecasts on recent economic data (producer prices, budget documents, trade federations), which provide us with information on weather conditions, revisions to public prices or taxes, and negotiations between producers and distributors in the agri-food sector amongst others, all of which are useful for forecasting prices in the short term. We also take account of seasonality, which we adapt to the context of each forecast. For example, in the air transport sector, plane tickets are more expensive in the summer or in the run-up to the Christmas holidays, and this effect may need to be reinforced if oil prices are high.

Over a one-year horizon, our projections model focuses on larger aggregates such as manufactured goods and services. In this case, the inflation projections are broken down into twelve aggregates. The forecast is largely based on the econometric equations of our MAPI model. This model enables us to rely both on robust theoretical relationships, such as the link between services prices and labour costs, and on econometric estimates that allow the model to "fit the data" (Kalantzis & Ouvrard, 2018). Our projections also take account of the international context and, in particular, assumptions about the forward prices of food and energy commodities on world markets. These assumptions are common to the entire Eurosystem (A guide to the Eurosystem/ECB staff macroeconomic projection exercises, 2016).

An inflation projection based on expert judgement and learning from past errors

Beyond the mechanical projection produced by the model, the forecast is based to a large extent on expert judgement. Indeed, we must always take account of shocks that may be specific to a given period, such as the disruption of supply chains, or of certain policies in response to these shocks, such as the energy price shield. These different elements require a fine understanding, which does not necessarily involve a model, as the latter is essentially based on historical regularities. This also serves as a reminder of what is essential: inflation projections are first and foremost the product of a team of forecasters, which uses robust and consistent models, but which also relies on the fullest possible assessment of economic reality.

The exogenous shocks that have affected the global economy since 2020 have led to greater forecast errors than in previous years. The Covid-19 pandemic created a disinflationary shock, which led to an overestimation of inflation, in particular for components linked to mobility (transport services, petroleum products). Conversely, the post-Covid economic recovery and then the war in Ukraine have resulted in a sharp, unanticipated rise in energy and food commodity prices, which has led to an underestimation of inflation for these volatile components. Each time, these forecast errors are analysed in order to refine forecasters' judgement for subsequent projections.

An inflation projection consistent with our macroeconomic scenario

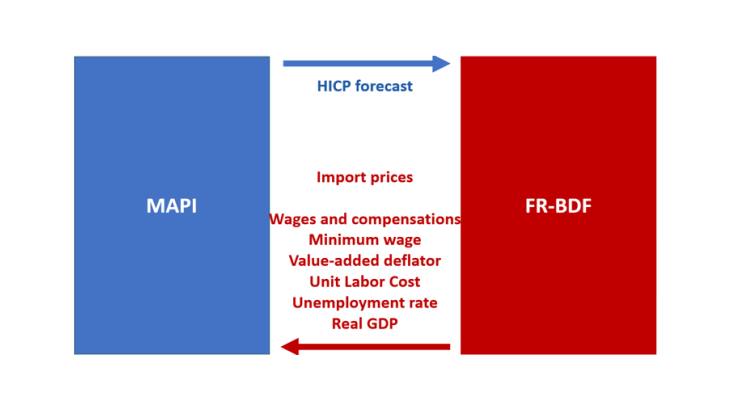

Beyond a one-year horizon, we continue to use our "MAPI" inflation forecasting model, while placing greater emphasis on the interactions with our overall macroeconomic scenario. In particular, this scenario is based on our “FR-BDF” semi-structural model» (Lemoine et al., 2019), which enables us to make detailed projections over a three-year horizon for so-called "real" macroeconomic variables such as GDP, employment, consumption and household income. Thanks to FR-BDF, we are also able to forecast the so-called 'nominal' variables, especially wages, which depend in particular on the anticipated trend in the unemployment rate. In practice, we combine the advantages of our two models, i.e. the level of detail and reliability of MAPI's forecasts of the various components of inflation, with the macroeconomic consistency and robustness of the FR-BDF model over a medium-term time horizon.

Source: author

More precisely, we make the two models communicate within a coherent framework: the FR-BDF model projects macroeconomic variables such as wages and the unemployment rate and sends them to MAPI, which in turn provides it with its HICP inflation forecast, thus guaranteeing a full link between the dynamics of the real and nominal spheres of the economy.

Thus, in the medium term, our inflation projections are essentially driven by the evolution of our macroeconomic scenario. In particular, wage dynamics, which are the main driver of services prices, play a key role in determining headline inflation over the medium term.

Finally, we also use Phillips curves (see Berson et alii, 2018) to ensure the consistency of our inflation projections. Indeed, by comparing our disaggregated inflation forecast with estimated statistical relationships between macroeconomic variables (unemployment rate, import prices), we make sure that our assessments on the disaggregated components are consistent with the evolution of the macroeconomic variables that have an impact on price developments.

Updated on the 25th of July 2024