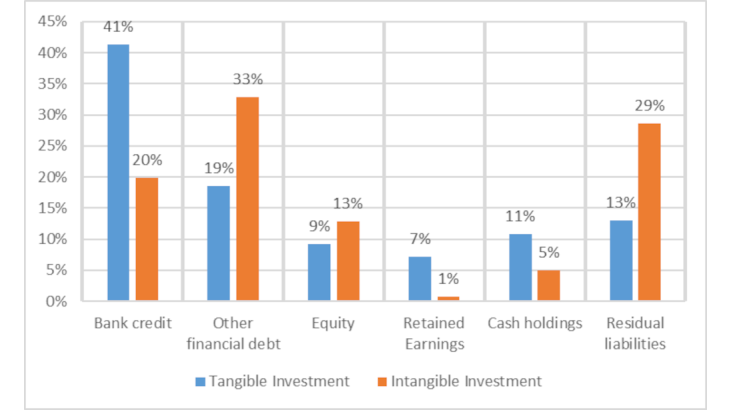

The low productivity growth of recent years can only be reversed by sustained investment, especially in intangible assets, in order to foster innovation. It is therefore important to better understand how investment is financed in general, and intangible investment in particular.

In a recent paper, Lé and Vinas (forthcoming) study the financing of business investment using accounting and financial data from the balance sheets of some 177,000 firms between 1992 and 2016. The method used consists in analysing the systematic changes in investing firms' liabilities. Using this method, we can estimate how companies finance one euro of investment using a combination of different funding sources.

On average, 34% of an additional euro of investment is financed by bank credit, 21% by other financial debt (e.g. bonds), while equity, retained earnings and cash holdings each contribute around 10%. The remaining 10% or so comprises residual liabilities, i.e. mainly tax and social security contributions. Thus, the small share of bank credit in firms' balance sheets (11% of total liabilities on average) contrasts with the crucial role of bank credit in the financing of investment, highlighted by these estimates.

Investment financing varies significantly according to the size and listing status of companies

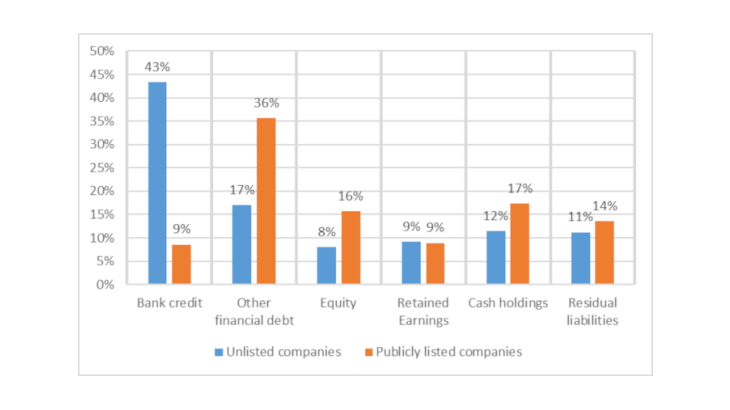

The above estimates take into account all firms indifferently. However, the ways in which investment is financed may vary significantly according to the specific characteristics of the firms. In particular, listed companies are generally expected to have greater access to equity and bond financing. We investigate this assumption by examining how the contribution of each financial resource varies depending on whether or not the firm is publicly listed.

It appears that listed and unlisted companies have a different mix of funding sources for investment (see Chart 1): whereas unlisted firms largely finance their investments through bank credit (43%), bank credit plays only a marginal role in the financing of investment by listed companies (9%). In contrast, we find a much greater use of equity and bond financing among listed companies. While unlisted companies finance only 8% and 17% of their investments with equity and bonds respectively, listed companies finance almost 16% of their investments with new equity and up to 36% with bonds.