In this paper, we address a critical limitation of the gravity equations of international trade—the assumption of the Independence of Irrelevant Alternatives (IIA), which posits that all varieties of goods are equally substitutable. Gravity equations are widely used empirical models in trade economics that explain bilateral trade flows based on factors such as economic size, distance, and trade costs between countries. These equations, grounded in analogy to Newtonian gravity, predict that trade between two countries increases with their economic size and decreases with the distance between them. While they are celebrated for their predictive power and theoretical elegance, traditional gravity models rely on simplifying assumptions, including the IIA assumption, which posits that all varieties of goods are equally substitutable. This constraint neglects the nuanced ways competition unfolds across countries, particularly among exporters with similar characteristics such as price or geographical origin. As a result, conventional models fail to capture the heterogeneous effects of trade shocks across competing exporters.

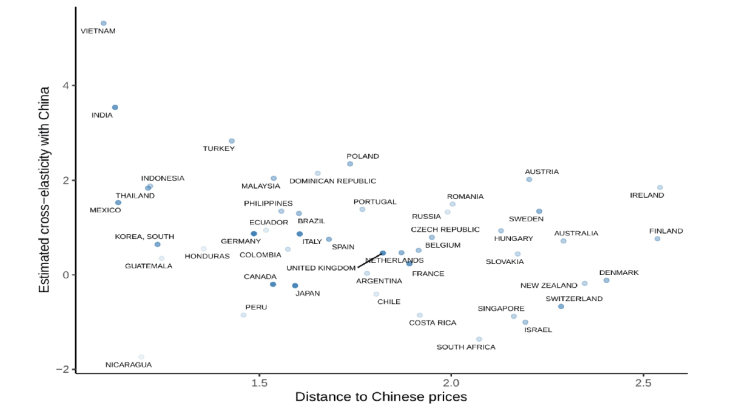

We propose an alternative approach by deriving a linearized gravity equation that incorporates observable characteristics to capture realistic substitution patterns. Building on recent econometric developments, our method rejects the restrictive IIA assumption and introduces artificial regressors that quantify the role of price and regional differentiation in trade competition. Our model allows for richer substitution dynamics, demonstrating that exporters with similar prices or shared regional traits are closer substitutes. Importantly, our framework retains the simplicity of estimation associated with traditional models, requiring no additional data and leveraging on two-stage least squares (2SLS) for implementation. We empirically validate our approach using trade data in two significant contexts: the "China shock" (the massive surge in Chinese exports following its entry into the WTO in 2001) and the U.S.-China trade war in 2018-2019. Our findings reveal that countries with similar prices to China were disproportionately impacted by the rise of Chinese exports during the China shock. Conversely, during the U.S.-China trade war, countries such as Vietnam, India, and Turkey (on the right hand side of the chart below), which offer goods similar to those from China, benefitted the most from the reallocation of trade flows. These outcomes stand in sharp contrast to the predictions of standard CES-based models, which suggest uniform effects across competitors, regardless of their characteristics.

Our method offers a practical and tractable framework for analyzing trade dynamics. By introducing heterogeneity in substitution patterns, we enhance the explanatory and predictive power of gravity models. This improvement is particularly relevant for policymakers, as it provides a more detailed understanding of how trade policies redistribute market shares and affect global competition. Furthermore, our results underscore the significance of vertical and geographical differentiation, highlighting their role in shaping trade outcomes in response to shocks.

Keywords: Gravity Equation; Trade Wars; Substitution Patterns; Mixed Preferences

JEL classification: F14, F13