The Phillips Curve (PC) –the structural relationship between inflation and unemployment– is an important ingredient of macro-economic models and it plays a central role in monetary policy and the ability of central banks to influence prices. In fact a steep PC implies that the monetary authority can affect prices by triggering small movements of unemployment around its natural –non-inflationary– level. Vice-versa, if the PC is flat, monetary policy needs to strongly intervene on the economic slack to be able to move inflation towards its target. The paper investigates the pre-pandemic years, and draws some lessons on the post-Covid period.

In pre-pandemic years, both in the European Monetary Union and the U.S., the relationship between unemployment and prices has become weaker over time. The literature has deeply focused on the structural reasons behind the progressive flattening of the PC, e.g. technological change, labor market transformation, ageing population, inflation anchoring. This paper considers an important channel so far overlooked: the integration of the domestic production structure in Global Value Chains (GVCs) and the role that GVCs play for the transmission of monetary policy.

GVCs entail the international sharing of production, where its processes are broken down into various activities and tasks carried out across different borders. There are two important metrics measuring the effect of GVCs: participation and positioning. Participation in GVCs assesses the extent to which a country is integrated into international production networks. Positioning, on the other hand, refers to the specific activities it undertakes within the chain. For instance, a country participating in a GVC might engage in downstream activities such as the assembly of components or product distribution. Alternatively, it might specialise in upstream activities, such as producing raw materials.

Theoretically, the presence of GVCs could push the slope of the PC either ways. It would flatten the curve if: (1) the use of international intermediate inputs is subject to imperfect exchange rate pass-through; (2) price rigidities accumulate at each step of the production chain; (3) the desired markup for domestic producers declines due to strategic complementarity; (4a) GVCs increase market power (enhancing the ability to adjust markups). On the other hand, it would result in a steeper PC if: (4b) firms would be pushed in the position of the production network with lower markups; (5) the increase in the number of varieties reduces firms' market shares. Our empirical analysis will allow us to asses which forces are predominating in the data.

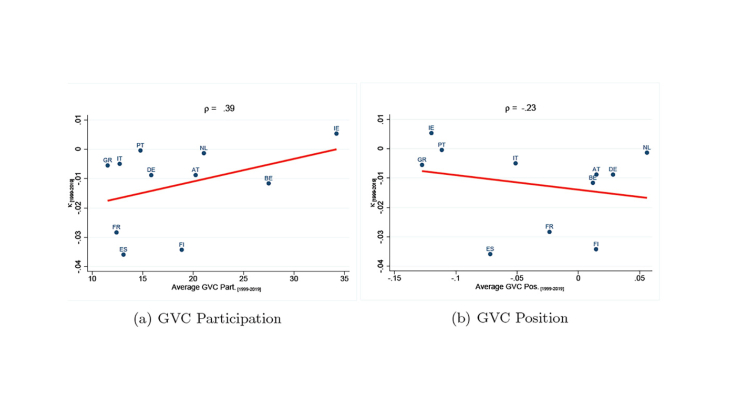

To do so, we focus on a panel of 11 countries the European Monetary Union (EMU) and estimate the standard New Keynesian Phillips Curve (NKPC) augmented with GVCs indicators of participation and position for periods before the Covid-19 crisis. We find that only the participation channel significantly affects the slope of the PC. In particular, higher participation leads to a flatter PC. This result is in line with the theory on imperfect pass-through, strategic complementarities and increased market power (i.e. channels (1), (3), (4a)). Through a back-of-the-envelope exercise, we claim that the participation channel accounts for 13% of the flattening of the PC in pre-Covid years. Conversely, we do not find any significant evidence for the GVC position channel. This could be due to the fact that, in this case, there are two opposing forces –(2) and (4b)– which are equally strong and therefore do not allow to find an average effect. However, the negative point estimates suggest that the higher is the position in the GVC, the steeper is the PC. This seems somehow supporting the theory of compounding effect of price stickiness at each step along the production chain.

Thereafter, we exploit the Covid-19 crisis to study how the exogenous variation in GVC participation and position, due to the pandemic shock, has affected the PC in recent years. The pandemic indeed led to a decline in participation of all countries, but resulted in heterogeneous changes in GVC positions. We exploit this variation and confirm previous results: in the post-Covid years, the fall in GVC participation explains 8% of the recent steepening of the PC. GVC position does not play a significant role.

Keywords: Monetary Policy, Global Value Chains, Phillips Curve, Price Stickiness, Variable Markups.

JEL classification: E32, F41, F62