In the coming years, emission trading systems worldwide are expected to play a critical role in countries' efforts to achieve the goals of the Paris Agreement. Nevertheless, considerable uncertainty remains concerning future cap trajectories and the way companies adjust their permit banking strategies and production processes, ultimately affecting overall economic costs. Thus, a comprehensive economic assessment is crucial for designing and implementing effective environmental policies, as it enables policymakers to strike a balance between environmental targets and economic growth.

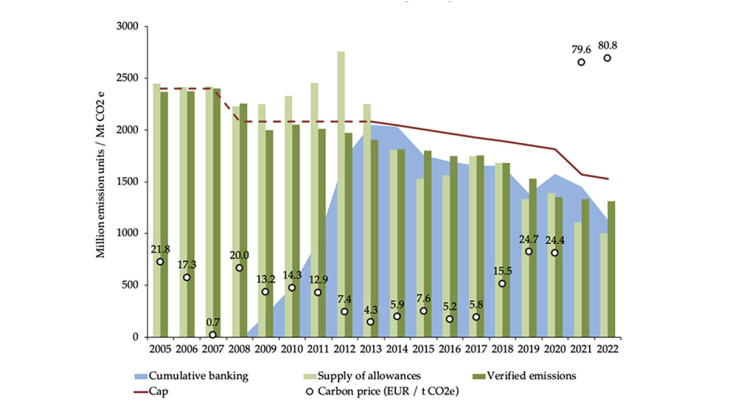

We propose a general equilibrium approach to carbon permit banking and assess the macroeconomic effects of various cap policies within this context. To this end, we first develop an environmental dynamic stochastic general equilibrium (E-DSGE) model that embeds a generic emission trading system with permit banking. The model includes (i) households that maximize intertemporal utility by choosing consumption, hours worked and capital accumulation, and (ii) firms that produce a homogeneous final good, which could in turn be used for consumption and investment. As firms' activities generate CO2 emissions, regulatory authorities implement an emission cap policy that grants them legal authorization to release a specified quantity. This allocated amount is contingent on the number of pollution permits issued by the regulators. We allow firms that purchase carbon emission permits to either use them directly or bank them for later use, without the possibility of borrowing between allowance periods. Finally, we assume that firms can reduce their carbon emissions by conducting expensive abatement activities. This nonlinear model is estimated by applying full-information methods to monthly EU data. Bringing the model to the data underscores the critical role of accounting for permit banking in understanding business cycle fluctuations. Notably, plugging the estimated shocks into an alternative version without permit banking results in excessive volatility for most of the variables. This empirical confrontation reveals that overlooking the intertemporal banking of permits would steer a policymaker toward an inappropriate representation of the economy.

Practical applications derived from recent decisions or regulations concerning the EU-ETS lead to the following results. Implementing the EU-ETS 2023 cap reform in the model, defined as a new sequence of linear reduction factors of the cap for stationary installations (4.3% from 2024 to 2027 and 4.4% from 2028 onward), leads to a more significant reduction in both permit banking and carbon emissions, as well as a 40% to 50% increase in the carbon price (depending on whether the market stability reserve is accounted for) compared to pre-reform projections, without substantial additional GDP loss by 2060. The market stability reserve, which triggers adjustments to annual auction volumes if the requirements based on the level of the aggregate bank of allowances are met, is a powerful tool that slows down firms' permit banking and reduces emissions more quickly. This approach facilitates the achievement of the objective of net zero emissions prior to 2050. Announcing a policy in advance allows agents to modify their behavior accordingly, thus reducing emissions from the day of the announcement and not at the time of its implementation. Importantly, forgetting permit banking when assessing cap policies would lead to a significant underestimation of total macroeconomic effects and an incorrect carbon emission path.

Keywords: Emission Trading Systems, Cap Policies, Carbon Permit Banking, Environmental Dsge Model, Occasionally-Binding Constraints, Nonlinear Estimation

JEL classification: C32, E32, Q50, Q52, Q58.