- Home

- Publications and statistics

- Publications

- GDP-indexed bonds: a solution to debt cr...

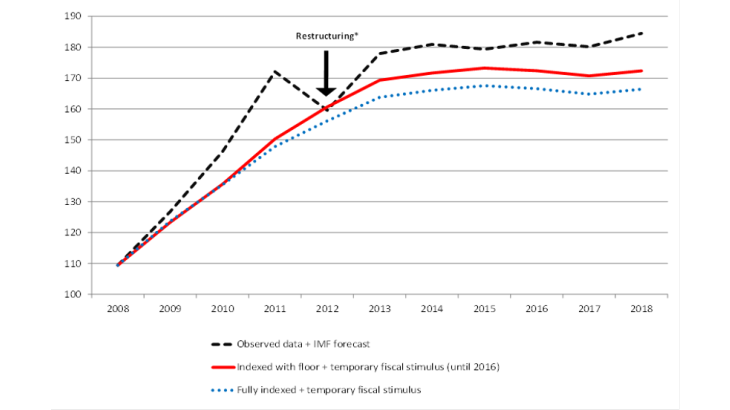

Post n°62. In countries with very high public debt, a major shock could prevent the implementation of countercyclical fiscal policies and increase default risk. GDP-indexed bonds would help to mitigate these risks and avoid a costly and disruptive restructuring. A counterfactual analysis of the Greek case illustrates this idea.

Source: IMF and authors’ calculations.

* In 2012, Greek public debt was restructured through private sector involvement requiring a EUR 107 billion haircut.

Fully indexed: principal indexed to nominal GDP and a 1% coupon.

Indexed with a floor: principal indexed to nominal GDP but cannot lose value (floor at zero) and a 1% coupon that goes down to zero during periods of negative nominal growth.

In both cases, 50% of public debt is converted to GDP-indexed bonds (GIBs) in 2009 and the remaining conventional debt is not restructured in 2012.

A solution that mitigates the risks associated with high levels of public debt?

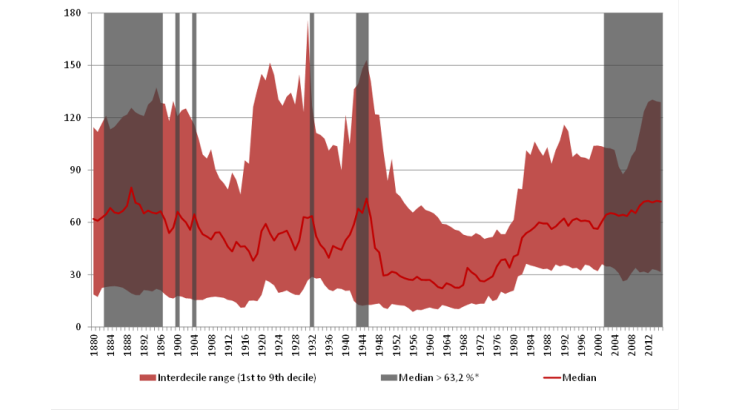

The economic crisis of 2008 led to an increase in public debt ratios which had already hit historically high levels since the mid-2000s. This degree of debt persistence had not been observed since the end of the 19th century (Chart 2), and imposes a significant constraint on the magnitude of the stimulus measures that could be taken in the face of a new macroeconomic shock. Issuing GDP-indexed bonds (GIBs) in amounts representing a significant proportion of total debt would play a stabilising role that would help to limit the deterioration of debt levels and create leeway for fiscal policies to boost activity.

Sources: IMF and Maddison, authors’ calculations.

* This threshold represents the 3rd quartile of the instant median (red curve).

An old and simple idea...

The idea of indexing sovereign debt to changes in economic activity emerged in the 1980s and was first applied in Latin America in the early 1990s with the use of "Brady Bonds" in debt restructuring. The bond issuances that followed were partially indexed and were limited to restructuring operations (Argentina in 2005 and 2010, Greece in 2012 and Ukraine in 2015). At an academic level, important contributions on the subject were published from the 1990s onwards, particularly by Barro and Shiller.

Several recent contributions (Benford, Ostry and Shiller, in particular) envisage a GIB as a simple debt instrument, with a design as close as possible to a conventional, "plain vanilla", bond. Its principal is perfectly indexed to nominal GDP in local currency and the coupon – whether fixed or floating – also varies on the basis of the principal. This type of debt instrument would help to stabilise the debt ratio and interest costs in the face of macroeconomic shocks (on real growth, inflation or the exchange rate). Governments would therefore have additional fiscal space to conduct countercyclical policies during periods of recession, and the probability of default or of a long and detrimental restructuring process would be reduced.

From the investors' perspective, Cabrillac et al. identify several benefits associated with holding GIBs. The weak correlation of GIBs with other financial assets would extend investment portfolio diversification strategies, and furthermore, GIBs would provide an opportunity to invest in the long-term development of economies. Historical changes in the nominal GDP in USD of emerging economies show that this debt instrument would also provide hedging against currency or long-term inflation risks and would allow investors to take advantage of the real and nominal catching-up process in those countries.

... that is now sparking renewed interest

In 2016 and 2017, in a context of significantly increasing public debt levels following the great financial crisis, the G20 presidencies sought to relaunch debate on the issue as part of a broader reflection on sovereign debt sustainability. The G20 document "Compass for GDP-linked bonds" provides an overview of the different characteristics, benefits and limitations of GIBs based on findings of recent studies from the IMF, the Bank of England and the Banque de France.

During a Banque de France conference in March 2017, finance sector professionals were able to discuss the challenges associated with this debt instrument, particularly from a legal and regulatory perspective. The development of a market for GIBs in the medium term firstly requires robust and standardised contracts that guarantee the reliability of the indexation mechanism and prevent the possibility of statistical manipulation. Furthermore, an accounting and prudential treatment similar to that applied to fixed-rate products would help to cultivate investor appetite. To do so, investors, like rating agencies, therefore recommend that the principal be protected against all capital losses. The rating agency S&P recently indicated that there would have to be a guarantee that the principal would be repaid in full for a GIB to be assigned a rating. Therefore, in the simulations that follow we introduce a floor in the indexation mechanism to eliminate the possibility of nominal losses on the principal.

What difference would using GIBs have made in the case of Greece ?

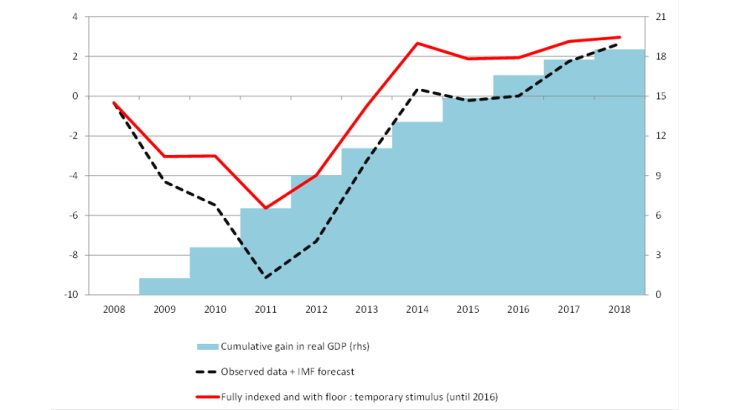

The simulations we performed for Greece demonstrate that converting half of the public debt into GIBs in 2009 would have resulted in far more favourable trajectories for the economy and for the country's debt (Charts 1 and 3) and above all would have avoided the need for restructuring in 2012, as debt would have automatically adjusted to a level below that attained following the restructuring.

For the purpose of these simulations, the GIBs' principal is indexed to nominal growth but cannot lose value (floor at zero), to avoid investors suffering haircuts (red curves in Charts 1 and 3). A priori, this advantage for investors is a disadvantage for the country issuing the debt, as their debt-to-GDP ratio would not stabilise during periods of recession. To compensate, a coupon rate of 1% of the principal (which is thus also indexed to nominal growth) goes down to zero in the event of negative nominal growth. This reduces the issuer's debt service during times of crisis. Therefore, during downturns in nominal GDP, no coupon is paid on GIB debt. In addition, we assume that the savings that are generated are reinjected into public spending, creating a growth surplus proportional to the fiscal multipliers estimated by the ECB. The level of debt however, remains lower due to GDP indexation.

Ultimately, assuming that Greek GDP statistics are sufficiently credible, this mechanism could have offered significant gains both to the country and to its creditors. Greece's debt service would have been limited and the countercyclical stimulus would have led to a shallower recession as well as a more rapid economic recovery. Meanwhile, investors would have retained the full nominal value of their bonds during the crisis. Furthermore, thanks to the earlier economic recovery and the interest surplus generated by indexation, as early as 2014, investors would have started to make up for their losses in terms of the interest they failed to receive from 2009 to 2013.

Source: IMF and authors’ calculations.

Updated on the 25th of July 2024