- Home

- Publications et statistiques

- Publications

- France’s Pacific territories: nickel, to...

France’s Pacific territories: nickel, tourism and the challenge of the health crisis

Post n°216. In the face of the Covid-19 crisis, New Caledonia’s economy, which is highly dependent on nickel, is showing some resilience thanks to the buoyant global nickel market, while French Polynesia’s economy is being harder hit by the lockdown measures due to the high weight of tourism. The impact of the crisis is nonetheless being limited by non-market services, which are a key source of resilience in both territories.

Source: Institut National de la Statistique et des Études Économiques (INSEE – French National Institute for Statistics and Economic Research).

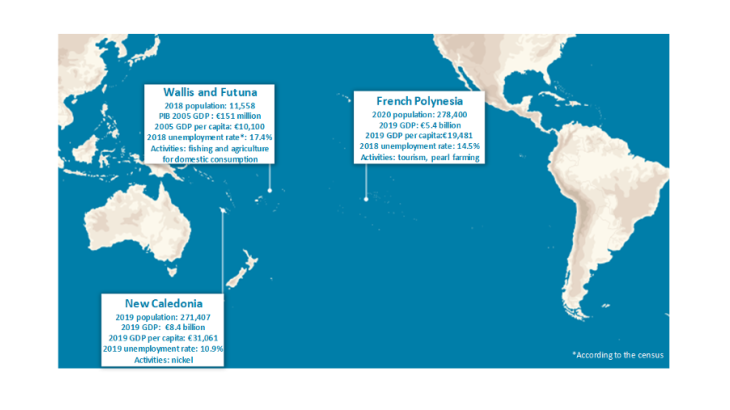

Note: These territories are not included in France’s balance of payment statistics and have their own balances of payments, compiled by the IEOM. Wallis and Futuna does not have a balance of payments due to the small size of its economy.

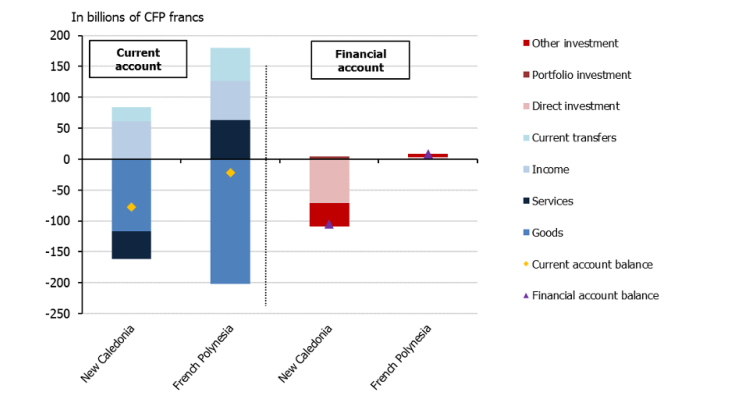

The balances of payments for New Caledonia and French Polynesia, two collectivities in the Pacific Ocean, are typical of French overseas economies: they show large structural deficits in trade and government transfers, linked to the islands’ institutional attachment to mainland France. However, due to the respective specialisations of the two economies, which are dictated by their local resources, the structure of their balances of payments provides a unique insight into the challenges posed by the health crisis in these regions (see Chart 2).

Nickel and tourism: the French Pacific region’s strong international exposure

New Caledonia is the world’s fifth largest nickel reserve, accounting for 7% of global stocks (behind Indonesia with 22% and Australia with 21%), and in the past decade has benefited from the construction of two large metal plants. Although the projects initially drew significant foreign capital inflows and boosted nickel exports (94% of total exports in 2019, by value, a rise of 115% since 2009), the collectivity’s current account deficit has widened significantly and, since 2015, inward foreign direct investment (FDI) has mainly financed the deficits built up by operators in the sector. Price volatility, together with technical, strategic and social problems, have caused all three metal operators in the collectivity (SLN, the longstanding Caledonian operator and a subsidiary of Eramet; KNS; and Vale NC, a subsidiary of the Canadian-Brazilian group Vale which recently sold its stake to the Prony Resources consortium) to run into financial difficulties.

Sources: Institut d’Emission D’Outre-Mer (IEOM – Central Bank for the French Overseas Territories in the Pacific Region). Notes: €1 = 119.33 CFP francs // 1 CFP franc = €0.00838.

In contrast, French Polynesia’s specialisation in tourism means it generates a recurrent services surplus, which balances its current account. After being severely hit by the 2008 global economic crisis, tourist numbers had started to rise again prior to the Covid-19 pandemic, growing by an average of 6.3% per year as of 2013. In 2019, a record 237,000 tourists visited the islands, generating revenues of 50.7 billion CFP francs (tourist expenditure excluding transport). Ranking a distant second behind tourism, French Polynesia’s other main source of external revenues, pearl farming, has struggled to position itself in a highly fluctuating global market (problems with overproduction, pollution, distribution channels and competition). In 2019, pearl exports (50% of total exports, by value) only brought in 5 billion CFP francs for 10 tonnes of product (compared with 8.3 billion CFP francs for 9 tonnes in 2008).

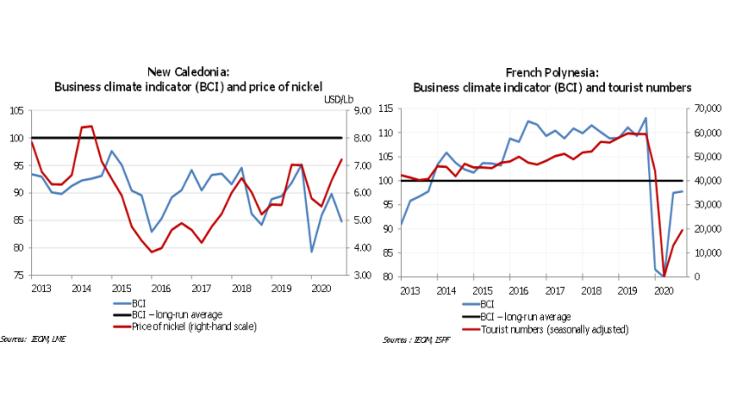

The two economies are hence highly dependent – on the one hand on world prices and demand for nickel, and on the other on tourism (Chart 3). As a result, their growth is extremely volatile and vulnerable to external shocks.

Is the Covid-19 crisis having a profound impact on structural trajectories?

The public health crisis has triggered an unprecedented economic crisis in the French Pacific territories, and there is still no certainty over how long it will last. New Caledonia and French Polynesia are being affected to differing extents due to the specific structures of their economies and to differences in local lockdown measures.

Sources: IEOM, London Metal Exchange (LME), Institut de la Statistique de Polynésie Française (ISPF – French Polynesia Institute for Statistics)

In New Caledonia, the strict four-week lockdown (from 24 March to 20 April 2020) was followed by a rapid lifting of the domestic restrictions, but external borders have been kept firmly closed. Although highly dependent on external demand, the collectivity’s nickel sector does not appear to have been badly affected by the crisis. Its main customer, China (accounting for 61% of metal ore exports), has seen a rapid return to growth and has maintained its demand. Meanwhile, global demand for nickel is being buoyed by the development of electric batteries and corrosion-resistant metals, and the second half of 2020 saw a rebound in global nickel prices. At the local level, although metal production has been hit by internal disruptions (decline of 4% in volume terms in 2020), mining production and exports have increased (growth of 17% in volume and 22% in value). However, owing to its negative effect on other sectors, the pandemic is estimated to have caused GDP to deviate from its growth trajectory by between –5.6 percentage points and –6.7 percentage points in 2020.

In French Polynesia, the lockdown was introduced on 20 March 2020 and was not completely lifted until 21 May. Flight links with France and the rest of the world only began operating again on 3 and 15 July respectively. As a result of the border closures, tourism on the islands came to a complete standstill. It has since only recovered partially, thanks to very high-end and domestic customers, and is not expected to return to normal any time soon. 77,000 tourists visited the islands in 2020 compared with 237,000 in 2019. The pearl farming industry, which was already struggling before the pandemic, is now in a critical position as it no longer has access to foreign workers (greffeurs) or markets (Hong Kong, Japan), leading export revenues to drop sharply in 2020. After seven years of steady expansion (GDP growth of 2.7% in 2019), French Polynesia’s economy collapsed in 2020, with preliminary estimates showing a 10% slump in GDP over the year.

Government transfers from mainland France: a cushioning role in the event of a crisis

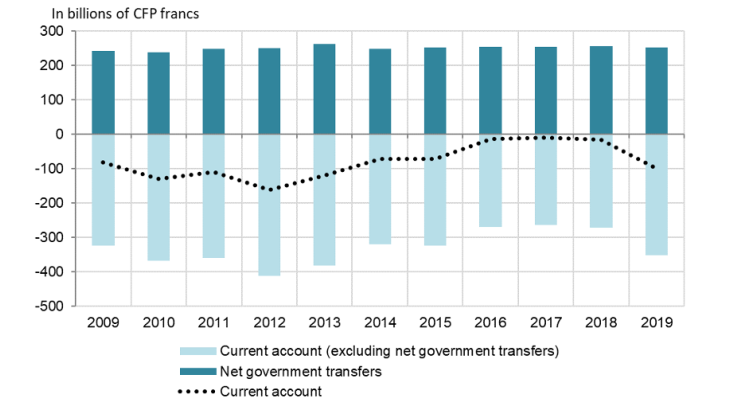

The Pacific collectivities’ economic model shows a certain degree of resilience thanks to the cushioning role played by general government and non-market services (24% and 37% of value added respectively, compared with 22% in mainland France), as public sector activity has been little affected by the health crisis.

The collectivities’ balances of payments show that their public sectors are supported by government transfers from mainland France (16% of 2019 GDP in New Caledonia and 22% in French Polynesia). These transfers consist mainly of payments by the French state (public sector wages and pensions, spending on investment in local authorities and the armed forces, and on their operation and intervention), and offset the deficit in the other current account items – either completely, as in the case of French Polynesia, or partially as in the case of New Caledonia (see Chart 4). In 2020, business support measures similar to those in mainland France were also put in place, both by local government (short-time work scheme, deferral of taxes and social security contributions) and the French state (European Social Fund, state-guaranteed loans, guarantee on the EUR 240 million of loans granted by the French Development Agency to the two collectivities).

Although French Polynesia was in a sounder position before the crisis, public finances in both collectivities have been severely impacted by the spending linked to the health crisis and the drop in tax receipts.

For 2021, despite the uncertainty over New Caledonia’s institutional future, which is weighing on economic agents’ confidence, the announcement that the Usine du Sud is to restart operations is a promising sign for the islands’ metal production activities. In French Polynesia, on the other hand, the resurgence of the pandemic and introduction of new travel restrictions at the start of the year have pushed back the prospect of a recovery in tourism. In the short term, the continuing provision of public aid and state support will prove vital to preserve the fabric of the local economy. In response to the tensions in public finances, the state has already announced it will provide 10 billion CFP francs of exceptional aid to New Caledonia.

Updated on the 25th of July 2024