Financial fragmentation is a recurrent topic in the euro area since the European debt crisis of 2010/12. Though the concept of fragmentation is not easily pinned down, policymakers define it as episodes in which financing conditions and capital flows diverge across member countries due to self-fulfilling market dynamics that decouple macroeconomic outcomes from fundamentals. As a result, monetary policy transmission is impaired, thereby threatening price stability since a single monetary policy is ill suited to deal with the arising asymmetries.

This paper provides a theory for financial fragmentation in monetary unions that combines a role for animal spirits in the determination in capital flow dynamics and financing conditions in monetary unions with implications for prices, employment, and the conduct of monetary policy. Our key insight is that currency unions may experience endogenous breaking of symmetry, which are episodes in which identical countries react differently when exposed to the same shock, purely from intrinsic forces. We find that the shape of equilibrium at the union level is determined by fundamentals. While good fundamentals lead to symmetric outcomes, the picture changes dramatically with bad fundamentals.

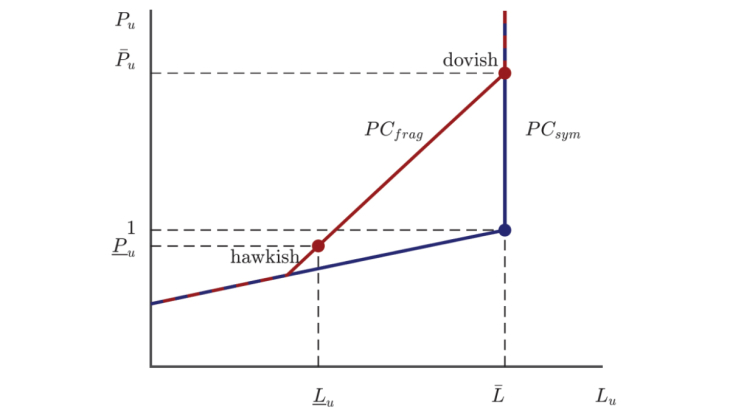

With bad fundamentals, animal spirits lead to episodes of fragmentation in which parts of the union suffer a capital flight, leading to low investment and employment, while the rest acts as a safe haven and receives capital inflows. Financial fragmentation thus acts like an asymmetric demand shock. The outcome is a combination of low employment and inflation above target at the union level. In other words, the monetary union experiences a cost-push shock. Since the central bank can address higher inflation only by pushing down demand in both countries, policymakers face a worse inflation-employment trade-off compared to a symmetric union (Figure 1). This is a significant threat to price stability, as it makes the task for the central bank harder to pursue its mandate.

There are two important ingredients for the mechanism in our model to operate. First, financial integration is imperfect, such that the return to investment may differ across the countries in the union. Second, fiscal policy plays an important role, in particular in the absence of a fiscal union. When a country is expected to enter a fiscal crisis, agents start anticipating that the government will have to tax capital income, which triggers beliefs that returns to capital diverge between countries. With financial integration, an amplification mechanism kicks in through capital flight that erodes the domestic tax base, further feeding into beliefs of lower returns to capital from higher tax rates.

We use the framework to analyse anti-fragmentation policies in the form of a flexible allocation of the monetary income among national governments. By counteracting private capital flows with public ones, a central bank can mitigate the effects of fragmentation. Public flows crowd-in private ones, increasing the effectiveness of the tool. Two cases are shown. First, with full fiscal backing and a commitment on the side of central banks to prevent fragmentation, self-fulfilling adverse dynamics disappear completely and the union is stabilized on the symmetric equilibrium. Second, without full fiscal backing, anti-fragmentation tools still mitigate the rise in inflation and unemployment caused by financial fragmentation. However, involved transfers render international cooperation pivotal for the successful implementation. Overall, we find that conventional and anti-fragmentation monetary tools complement each other in maintaining price stability within the monetary union.

Keywords: Monetary Unions, Euro Area, Fragmentation, Optimal Monetary Policy in Open Economies, Capital Flows, Fiscal Crises, Anti-Fragmentation Policies, Inflation, Endogenous Breaking of Symmetry, Optimal Currency Areas

JEL classification: E31, E52, F32, F41, F42, F45