Over the last two decades, the rapid integration of low-cost countries like China into the global economy has profoundly affected manufacturing firms in developed nations. While consumers have benefited from a wider variety of products at lower prices, the competitive pressures have disproportionately impacted firms that produce lower-cost goods. This paper investigates how French firms have navigated this wave of competition, particularly focusing on how they adjusted their prices and product quality in response.

The study finds that firms producing low-cost cost goods experienced the greatest losses in market share and profits due to the rise of Chinese imports. These firms often serve price-sensitive consumers who are more likely to switch to cheaper foreign alternatives. Conversely, firms producing higher-priced and higher-quality goods were less affected, benefiting from a more stable consumer base willing to pay a premium for differentiation.

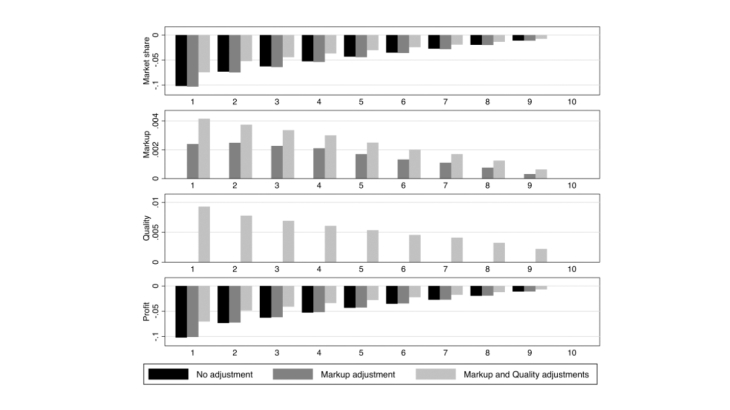

An important mechanism explored in the study is quality upgrading, a strategy where firms improve their products to target less price-sensitive consumers in response to heightened competition. While this approach mitigated some adverse effects, it was insufficient to fully counteract the negative impacts, particularly for firms in the lower price tiers. The associated costs of producing higher-quality goods constrained the effectiveness of this strategy. As shown in the Figure below, low-cost firms, being most exposed to the China shock, increased their quality the most. This shift attracted wealthier customers and allowed these firms to charge higher mark-ups. However, despite these adjustments, low-cost firms suffered the greatest losses in profits and market share among French firms. These findings carry significant policy implications. Supporting innovation and facilitating quality upgrades could help domestic firms remain competitive in the face of globalization. Policies that encourage firms to differentiate their products through higher quality might reduce their vulnerability to low-cost competition.

Keywords: Low-Cost Competition; Mixed Preferences; Quality Upgrading

JEL classification: E52, E58, D83