Principles of economic forecasting under uncertainty

In order to correctly interpret economic predictions, it is essential to recall that we consider the future to be uncertain, i.e. probabilistic, and not deterministic. Simply put, many different outcomes are possible and we do not know which will occur. This implies that we do not aim to predict the actual event. Instead, forecasts aim to make a statement about the central tendencies (also called point forecasts, i.e. which event we expect on average to occur) or how certain we are that some events will not occur (an assessment of economic risk).

The probabilistic perspective implies that we cannot discard a forecast that did not exactly coincide with the realised event. Instead, broadly speaking, there are two ways to assess the quality of a prediction: absolute and relative performance evaluations. In an absolute evaluation, forecasts are supposed to fulfil a set of desirable properties. For predictions of central tendencies this typically includes the fact that the forecasts, on average, should neither over- nor under-predict the data.

In a relative performance evaluation, the forecaster investigates which model produces the smallest forecast errors and a few stylised facts have been established in the macroeconomic forecasting literature:

- Simple models often beat more complex models.

- Combining forecasts from a variety of models typically improves upon the prediction of any individual model.

- Pooling the opinion of many professional forecasters, where individual forecasts can be “judgment-based” instead of being estimated by an economic or econometric model, often outperforms the benchmark economic or econometric competitors.

Gánics and Odendahl (2019) make use of the last point, i.e. “the wisdom of the crowds”, and find that euro area real GDP growth, inflation and unemployment predictions improve by incorporating information from professional forecasters into an otherwise standard econometric model.

How to assess macroeconomic risk: looking beyond the central tendency

Although the most commonly reported type of prediction is the central tendency, the uncertainty associated with the point forecast has gained importance. Density forecasts provide a way to assign a probability to each possible outcome and they are particularly useful to analyse macroeconomic risks: what is the probability of a contraction in GDP growth over the next quarters?

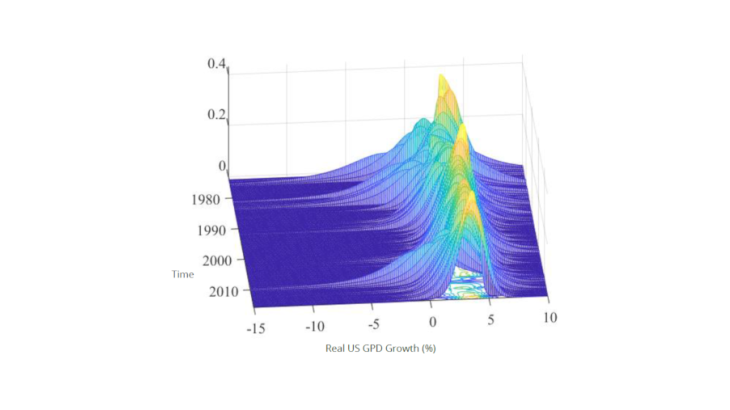

Figure 1, taken from Adrian et al. (2019) displays the one-year-ahead density forecasts of US real GPD growth, conditioned on an index of the health of the financial system. Importantly, not only the centre of the distribution moves over time but its shape as well. In particular, the graph allows to measure downside risk by looking at the fat left-tail of the distribution, i.e. the probability of negative GDP growth. The fat tail appears before and around recession periods, most prominently during the financial crisis of 2008/2009, and it becomes clear that the information about macroeconomic risk is not conveyed when looking at the central tendency alone. Besides, in a recent contribution, Cohen et al. (2019) computed growth-at-risk forecasts for the euro area and found similar results.

Predicting the macroeconomic risk of several variables jointly

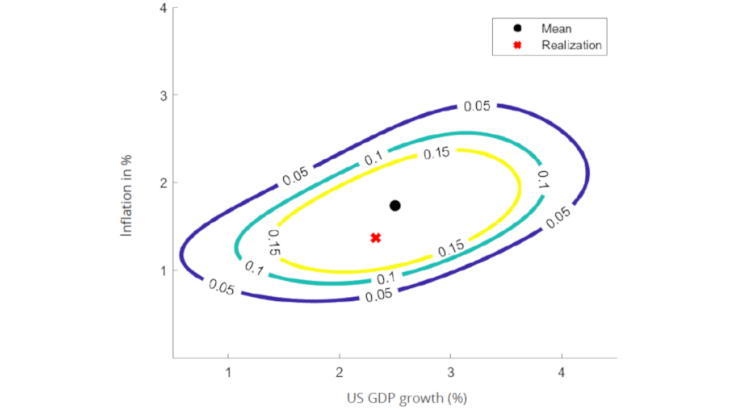

Although the density forecast of Figure 1 provides a thorough summary of the possible future outcomes of GDP growth itself, there is still an important piece of information missing: how are the possible paths of GDP growth related to, say, the possible paths of inflation? Multivariate density forecasts, rather than univariate density forecasts, can provide an answer to these questions.

Odendahl (2019) explores this topic by estimating a bivariate (two variables) density forecast based on survey responses from professional forecasters. Figure 2 shows the one-year-ahead multivariate density forecast of inflation and real US GDP growth for 2014:Q1. The lines display iso-density levels: for each point on the line the bivariate density forecast has the same density. For instance, all points on the yellow line are equally “likely” to occur. The dot displays the central tendency of the distribution and the cross shows the realisation. Although the realised outcome is fairly close to the predicted mean, ex-ante there was a risk of low inflation jointly with low real growth. In contrast, combinations of high inflation and low growth, and vice versa, were considered rather unlikely due to the predicted positive correlation. The figure conveys this information by showing that the joint density assigns more probability to outcomes in the lower-left and upper-right than to the upper-left and lower-right corner.