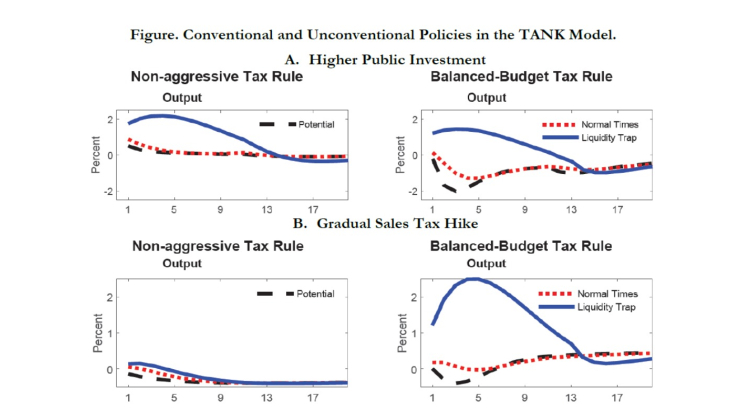

Working Paper Series no. 799. Recent influential work argue that a gradual increase in sales tax stimulates economic activity in a liquidity trap by boosting inflation expectations. Higher public infrastructure investment should also be more expansive in a liquidity trap than in normal times by raising the potential interest rate and increasing aggregate demand. We analyze the relative merits of these policies in New Keynesian models with and without endogenous private capital formation and heterogeneity when monetary policy does not respond by raising policy rates. Our key finding is that the effectiveness of sales tax hikes differs notably across various model specifications, whereas the benefits of higher public infrastructure investment are more robust in alternative model environments. We therefore conclude that fiscal policy should consider public investment opportunities and not merely rely on tax policies to stimulate growth during the COVID-19 crisis.

Banque de France - Menu Principal

Press Enter to search. Example: financial stability