- Home

- Publications et statistiques

- Publications

- The Fed’s monetary policy influences the...

Billet n°250. La politique monétaire de la Fed influe sur la structure de la dette des entreprises américaines. Une politique monétaire (PM) conventionnelle expansionniste accroît les prêts bancaires des entreprises et réduit leurs émissions d’obligations, tandis qu’une PM non conventionnelle expansionniste stimule les émissions d’obligations via le canal du rééquilibrage des portefeuilles, plutôt que via celui des prêts bancaires.

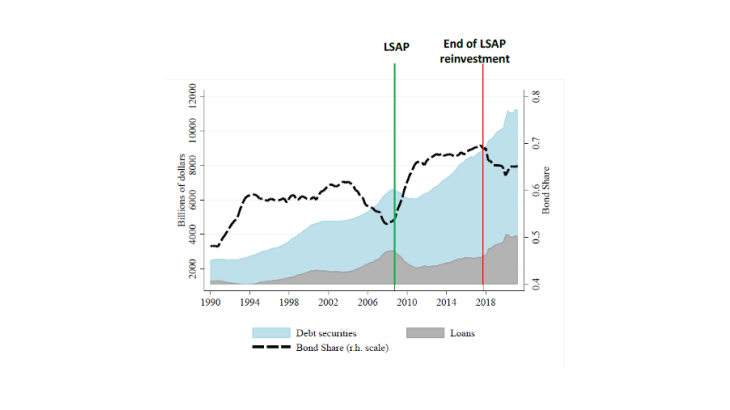

Note: Bond share is the ratio of debt securities to the sum of debt securities and loan volumes of non-financial corporations. Green line (announcement of the Large Scale Asset Purchase (LSAP)), red line (end of LSAP reinvestment).

The composition of corporate debt in the United States changed significantly after the Great Recession (Chart 1). While in 1990, the amount of loans and debt securities of non-financial corporations (NFC) appear to be almost equivalent (bond share of about 47%), the share of securities in total debt has considerably increased since 1990 to account for two-thirds of debt in 2020. Several studies have documented a decline in bank loans to non-financial corporations and a simultaneous increase in corporate bond issuance (Adrian et al. 2013). Interestingly, the significant increase in the bond share at end-2008 seems to coincide with the announcements of Large Scale Asset Purchases (LSAP) by the Federal Reserve, and the decline in the bond share at end-2017 is associated with a reduction in the Fed’s LSAP security holdings.

As highlighted by Lhuissier and Szczerbowicz (2021), the Fed’s monetary policy was one of the factors underlying the change in the US corporate debt structure that occurred between 2008 and 2015. This can be explained by the fact that conventional and unconventional monetary measures affect corporate bonds and loans in opposite ways.

NFC debt securities and loans react differently to monetary policy shocks

Until 2008, the Fed mostly used conventional monetary policy (CMP), i.e. interest rate policy, to achieve its inflation target. Empirical studies show that following a conventional monetary policy tightening, firms move towards bond market financing (Kashyap et al, 1993). This substitution effect between bank credit and securities is in line with the bank lending channel of monetary policy. The implementation of unconventional monetary policy (UMP) revived interest in this issue, as asset purchases were shown to increase corporate bond issuance (Lo Duca et al., 2016).

In order to provide more systematic evidence of the effect of US conventional and unconventional monetary policy easing on the US corporate debt structure, Lhuissier and Szczerbowicz (2021) estimate vector autoregressions (VARs) using monthly variables from 1990 to 2015: 1-year and 10-year US bond yields, the unemployment rate, consumer prices, excess bond premium, NFC bonds and loans. To identify a causal effect of monetary policy on firms’ debt structure, they use external instruments based on high frequency changes (surprises) in the term structure of interest rates around Federal Open Market Committee (FOMC) announcements. Conventional surprises capture unexpected current and short-term future changes in the target federal funds rate, while unconventional surprises reflect shifts in long-term interest rates that are mainly driven by large-scale asset purchases (Swanson, 2021).

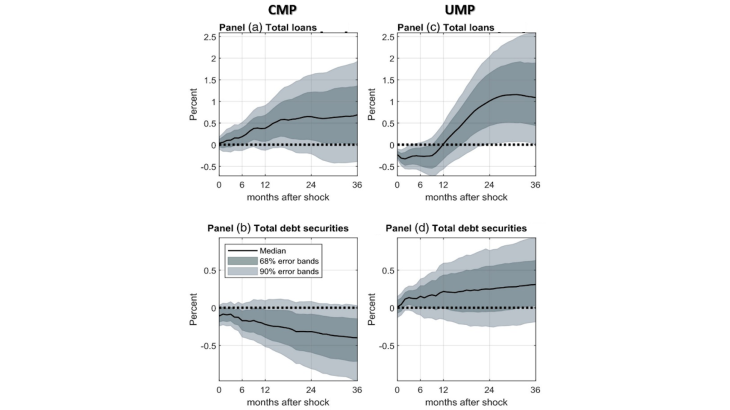

The results show that a one standard-deviation expansionary CMP shock induces a progressive increase in total bank loans granted to non-financial corporations that reaches 0.5% after 18 months, and an immediate and persistent fall in total debt securities outstanding (panel (a) and (b) of Chart 2). A one standard-deviation expansionary UMP shock has the opposite effect. Debt securities post a rapid and persistent growth rate, rising by 0.25% after one year. Total loans to non-financial corporations show a fall within 6 months, with a subsequent recovery after 12 months (panel (c) and (d) of Chart 2).

UMP has a greater impact on debt securities: portfolio rebalancing channel

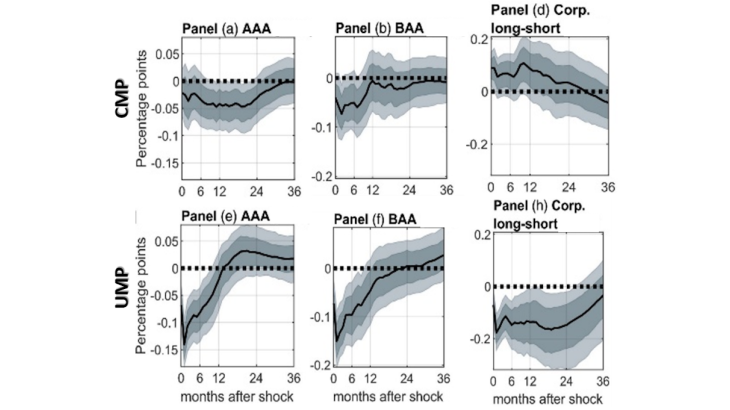

In order to provide further evidence on the underlying transmission mechanisms of both types of monetary policy shocks, Lhuissier and Szczerbowicz (2021) estimate several VAR models, in which they add additional variables on credit prices. Chart 3 shows the responses of corporate bond yields to conventional and unconventional monetary policy shocks. Corporate yields with both high and medium credit quality (AAA and BAA, respectively) decline significantly after UMP shocks, while their response to CMP is muted on impact and the subsequent decline is much smaller in magnitude (Panels (a), (b), (e) and (f)). These different responses can possibly be explained by the so-called ‘portfolio rebalancing’ channel of monetary transmission, where investors respond to the central bank’s asset purchases by increasing their demand for higher-yield assets, such as corporate securities. This channel turns out to be more active following an unconventional monetary policy shock. By supplying a large amount of liquidity, asset purchases provide incentives to investors to sell their safe assets to the central bank in order to rebalance their portfolio towards riskier assets, which in turn drives up the price of these assets.

Another aspect of portfolio rebalancing is linked to duration risk and can provide an additional explanation for the different effects of conventional and unconventional monetary policy on the US corporate debt structure. Following an unconventional monetary policy shock, the long-short corporate spread (Panel (h)), which is defined as the difference between the long-term corporate yield and the 3-month commercial paper interest rate, shows an immediate and persistent decline. This decline is consistent with the ‘duration risk channel’ of unconventional monetary policy; by purchasing long-term assets, the central bank is able to lower the duration risk in the hands of investors, reduce the term premium and thereby alter the yield curve, in particular reducing long-term bond yields relative to short-term yields. A decrease in the long–short corporate spread after an unconventional monetary policy shock could promote the issuance of long-term debt securities, such as corporate bonds. This channel is clearly not at play following a conventional monetary policy surprise, since in this case the short-term rate decreases relatively more than long-term yields (Panel (d)).

The Fed’s monetary policy has thus different effects on intermediated and direct credit to firms. Conventional monetary policy works through a bank lending channel: conventional monetary policy easing raises the availability of loans and lowers security issuance. Conversely, unconventional monetary policy measures, and in particular asset purchases, stimulate debt security issuance and reduces the amount of loans, which is suggestive of a substitution effect from bank loans to bonds.

Updated on the 25th of July 2024