ICT diffusion as a driver of these phenomena

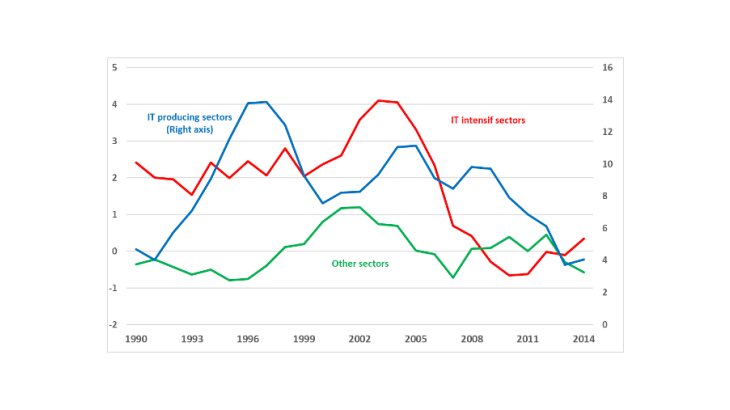

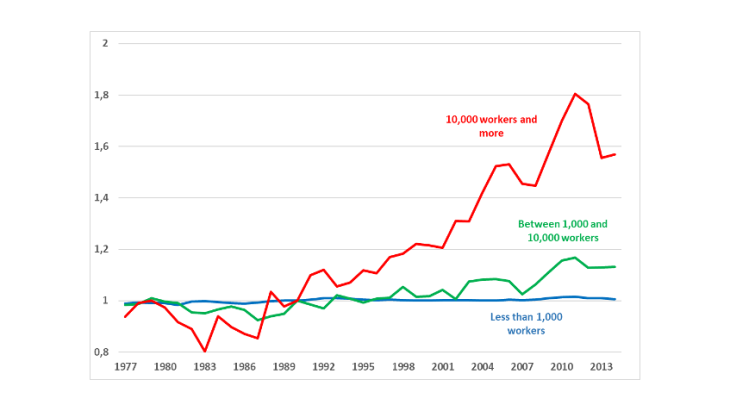

To explain these phenomena, in Aghion, et al. (2019), we argue that ICTs, and in particular the acceleration in their diffusion between 1995 and 2005, facilitated the hegemony of certain firms by enabling them to become increasingly dominant in their sector, to the detriment of their competitors. In particular, we take the example of Walmart, whose expansion was made possible by a large-scale logistics plan incorporating a wide range of optimisation technologies. Other studies such as Lashkari et al. (2019) also show that the largest firms invested more in ICT and intangible assets than the others. The decline in the cost of ICTs thus appears to have benefited the largest and most efficient firms more.

If ICTs have been more beneficial to the most productive firms, it might seem consistent to expect a positive effect on growth. In Aghion et al. (2019), we argue that the effect is more subtle over the longer term, as these technologies disrupt the market structure and competition and may hamper growth by discouraging innovation. Our model is based on the idea that a company will decide to invest in R&D and enter a new market if the cost of this investment added to the cost of managing an additional product line does not exceed the profits that would be generated. When costs are too high, the entry of new companies is more complicated and incumbents are protected from competition.

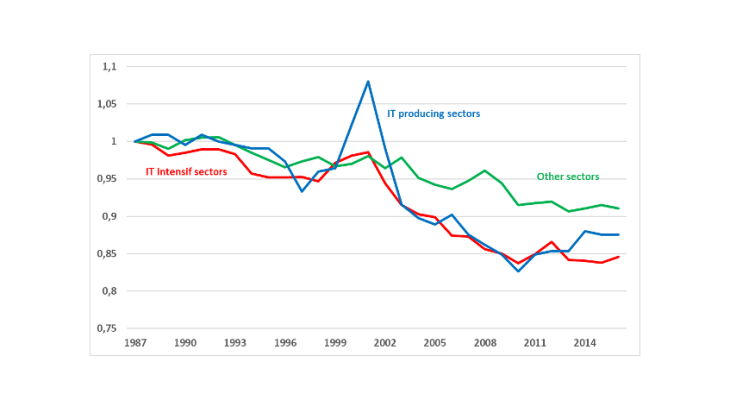

What the digital revolution initially made possible was a significant reduction in the cost of adding a product line. As a result, the intensity of innovation, and therefore of growth, increases and the best-performing companies are then able to expand rapidly in several markets. But, subsequently, as these firms become increasingly dominant, they become more and more exposed to competition from other efficient firms, which reduces their profit margins (particularly because it means lowering prices). The drop in potential profits therefore discourages them from innovating, and hampers growth. This idea is consistent with both Autor et al. (2019) who show that the increase in sectoral concentration has been accompanied by a fall in profits within companies and with Rossi-Hansberg et al. (2018) who show that locally, large companies are more likely to compete with each other, paradoxically leading to a fall in sectoral concentration at more detailed geographical levels.

Following a technology shock, the model we propose thus converges towards an equilibrium in which concentration is higher, i.e. the market share of the most efficient firms has increased sharply, and in which growth is low. Moreover, since these efficient companies have a lower share of labour than the others, our model also predicts a decline in the latter via a composition effect, which is consistent with reality. It is interesting to note that while the decline in productivity seems to be a widespread phenomenon among OECD countries, it is not always accompanied by a decline in the share of labour particularly in France but more generally in Europe. And indeed, Europe did not have an ICT wave in the 1995-2004 period.

Qualitatively and quantitatively, our model is thus able to account for the many structural changes observed in the United States and described above.