What factors caused the historic rise in global wheat prices?

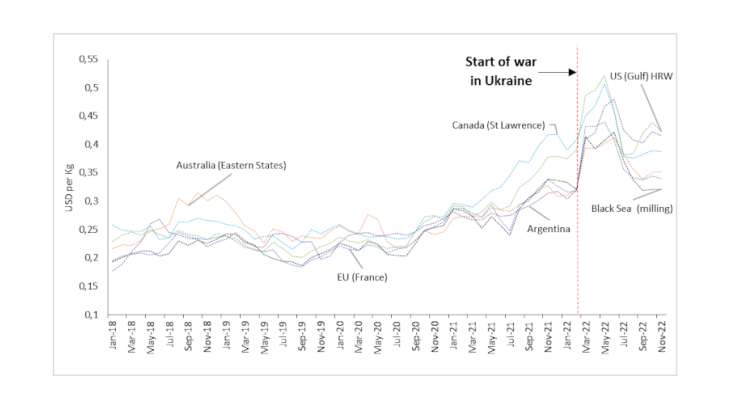

Global wheat prices have been rising since 2020 and have increased significantly since the start of the war in Ukraine in February 2022. The international price of US Hard Red Winter (HRW) wheat (the most traded variety) touched a historic high of USD 522.3 per metric tonne (MT) in May 2022, but eased in subsequent months. In line with the strong horizontal integration of agricultural commodity markets (Just and Echaust, 2022), international export prices of wheat increased substantially across various geographical markets (Chart 1).

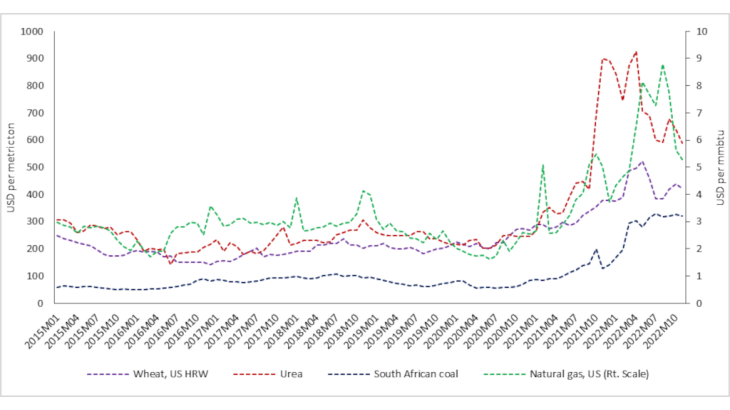

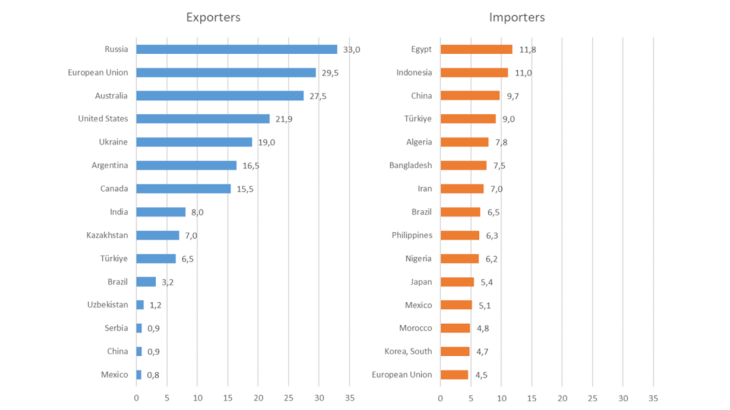

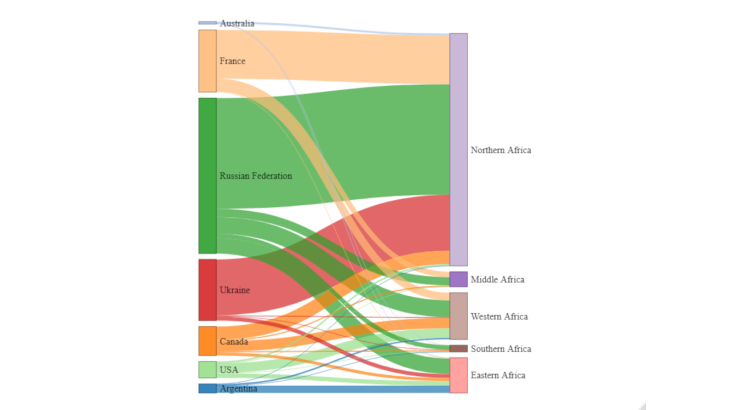

This recent surge in global wheat prices may be attributed, among other factors, to a steep rise in fertiliser prices, supply disruptions from Ukraine, and trade restrictions on wheat by some countries. First, crop-wise, wheat remains one of the most fertiliser-intensive crops in the world. The rise in urea fertiliser prices since 2020, mainly linked to the increase in natural gas and coal prices, has, therefore, contributed to the surge in wheat prices (Chart 2). Second, the war in Ukraine, which accounts for about one-tenth of global exports of wheat, flour and other wheat products, created supply disruptions from the Black Sea region. Third, trade restrictions are known for their role in driving up global wheat prices, which was also evidenced during the 2008 crisis (Headey, 2010). As of October 2022, eight countries still maintained export bans or taxes on wheat. Such trade restrictions could have also led to an increase in the global wheat prices. The easing of wheat prices in the third quarter of 2022 was supported, inter alia, by Black Sea Grain Initiative (BSGI), in July 2022, smoothening global supply of Ukrainian wheat and weakening global growth prospects.