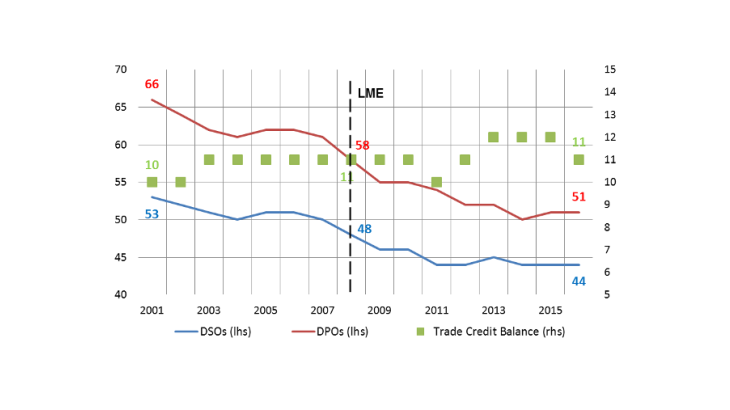

Note: scope, non-financial corporations as defined by the Economic Modernisation Act. Unweighted averages of individual ratios: DSOs and trade credit balance expressed in days of turnover; DPOs expressed in days of purchases.

Thanks to the Economic Modernisation Act, DSOs and DPOs have been reduced, but late payments persist

DSOs and DPOs have an impact on companies’ cash flows. They often reflect a balance of power between trading partners. Since the entry into force of the Economic Modernisation Act in 2008, trade credit has been the subject of binding regulatory provisions aimed at defining a common legislative framework for all businesses. This framework essentially provides for the introduction of 60-day (or in certain cases 45-day end-of-month) payment deadlines. Chart 1 shows that the Economic Modernisation Act has significantly contributed to reducing DSOs and DPOs since its implementation.

However, while payment periods have stabilised at levels below the legal threshold in recent years, late payments remain numerous (Boileau & Gonzalez, 2018).

Indeed, in 2016 almost one-third of companies suffered from late payments on the part of their customers. This share, which has remained unchanged over the past 5 years, suggests that a ceiling has been reached. These late payments particularly affect the most fragile companies. According to our calculations, if the Economic Modernisation Act were applied strictly, a EUR 16 billion cash flow gain could be generated for small and medium‑sized enterprises (SMEs), which would contribute to strengthening them or even to promoting their development.

Late payments persist even though the legislation has been reinforced with the introduction of penalties for late payments, a lump sum indemnity for late-paying clients and administrative fines in the event of breaches of the law, as noted by General Directorate for Competition Policy, Consumer Affairs and Fraud Control (see also the annual report of the Trade Credit Observatory).

Everything thus happens as if, despite a complete legal arsenal, the coercive model was no longer enough to convince certain companies to further reduce payment periods. It will only be possible to make additional progress if companies measure the extent to which it is in the common interest to adopt more favourable practices in terms of client/supplier relations.

At the individual level, the persistence of late payments shows that companies are reluctant to relinquish some of the resources that trade credit represents. Yet it is possible to reduce DPOs while preserving financial balances.

Reducing payment periods and preserving financial structures: two reconcilable objectives

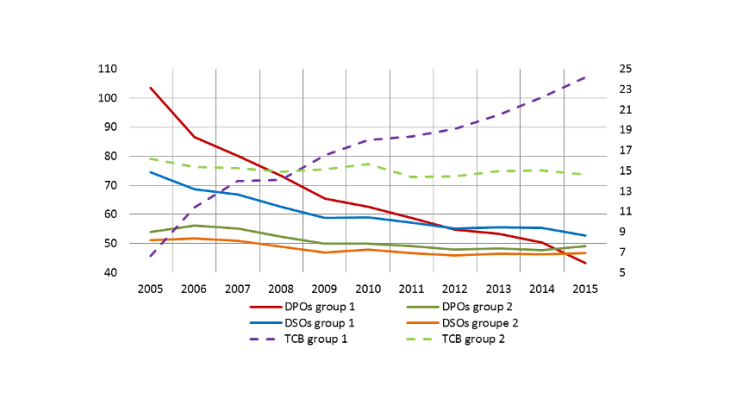

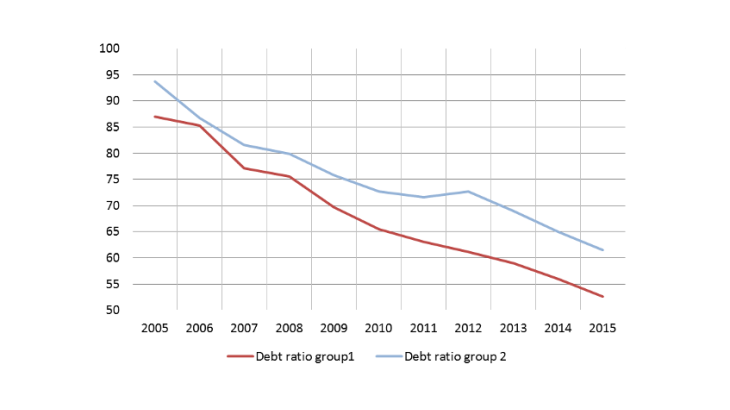

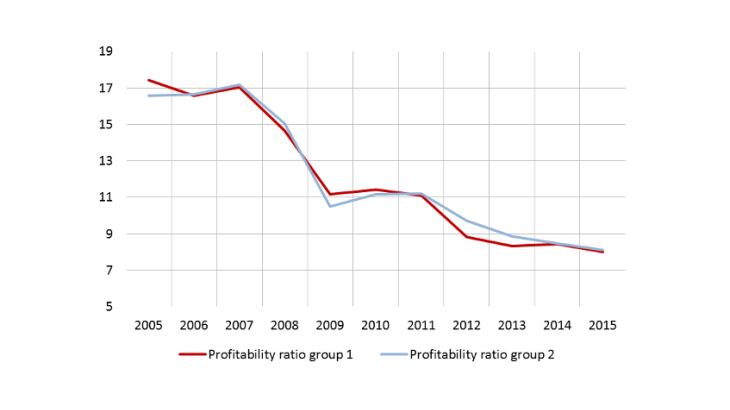

To carry out this analysis, companies were broken down into two groups: the first (called group 1) was made up of the 10% of companies that most reduced their DPOs over the period 2005-2015 and the second (group 2) of the remaining companies. The objective was to measure the impact of this reduction on the profit and loss account, the balance sheet structure and the investment policy in these two groups.

The main lever used to finance a significant reduction in DPOs is intuitive, it involves better controlling trade receivables. However, DPOs have been cut back faster than DSOs. This has led to a rise in the trade credit position (see Chart 2) of group 1 companies.