Published on 5th of December 2022

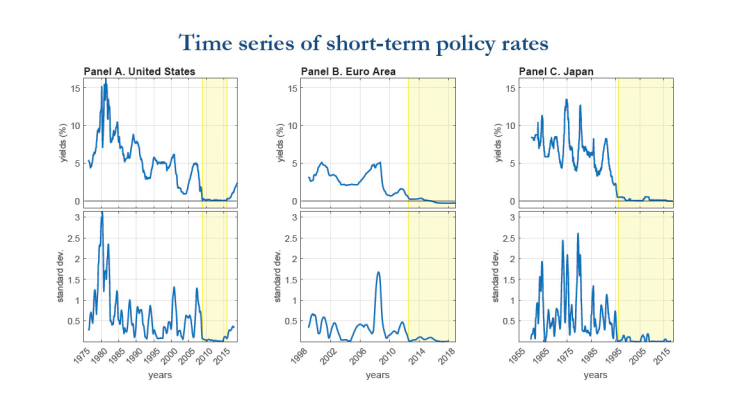

Working Paper Series no. 762. The liquidity trap is synonymous with ineffective monetary policy. The common wisdom is that, as the short-term interest rate nears its effective lower bound, monetary policy cannot do much to stimulate the economy. However, central banks have resorted to alternative instruments, such as QE, credit easing and forward guidance. Using state-of-the-art estimates of the effects of monetary policy, we show that monetary easing stimulates output and inflation, also during the period when short-term interest rates are near their lower bound. These results are consistent across the United States, the euro area and Japan.