Financial technology (FinTech) has developed rapidly in China, and on a large scale. The annual volume of mobile payments was equivalent to 38 percent of GDP in 2018, compared to less than 2 percent of GDP in the USA (FSB, 2020). This trend is linked to several key factors. The first is the shortcomings of the existing financial system (Arner et al., 2015). Financial repression in China has channelled capital to large state-owned enterprises at preferential rates (Lardy, 2015). This allocation of finance has been at the expense of households and SMEs, particularly in rural areas. Second, the rise of smartphones and the low agility of the traditional banking sector have paved the way for the mass adoption of mobile payments. In addition to inefficiencies in the traditional financial system, a fragmented network of local merchants, for example, has created a huge opportunity for e-commerce.

Literature has been abundant on the impact of FinTech on financial inclusion of firms and households. Several studies show a positive impact of FinTech development on financial inclusion, in particular in emerging and developing economies where financial needs are not met by traditional lenders (Bazarbash et al., 2020; Demirguc-Kunt et al., 2018; Shrader and Duflos, 2014). We investigate the impact of these developments on entrepreneurship.

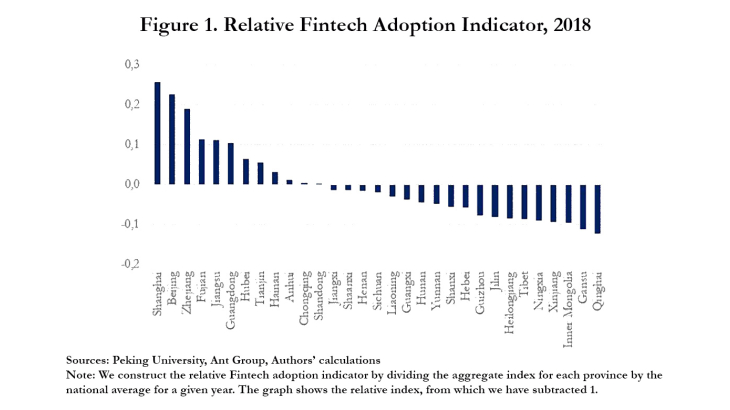

Because FinTech firms in China have long been exempted from banking regulation requirements and reporting standards, granular data on their different business lines were not fully captured by policymakers and academics. Unless data is made available by FinTech firms themselves, it remains scarce. We overcame this challenge by exploiting a dataset of Peking University Digital Finance Inclusion Index, built on data provided by a major Chinese FinTech player: Ant Group, which operates Alipay, one of the two dominant digital financial platforms in China. The index compiles information collected at the provincial level on different dimensions of FinTech penetration (coverage breadth, usage depth, and digitalization level), as well as on different product lines (credit, insurance, payments). We construct a relative FinTech adoption indicator, showing the degree of Fintech penetration in each province, relative to the national average on a given year.

We show that the digitalization of financial services at an aggregated level is associated with a higher share of self-employed individuals in the total population. In rural areas, coverage breadth of digitalized financial services drives the positive impact on the share of self-employment. We argue that this result illustrates the underlying hypothesis that the digital finance infrastructure created by FinTech firms allows entrepreneurs to draw from a wider network of formal and informal contacts to address unmet financing needs, especially in rural areas. In urban areas, digitalized insurance services appear to have more influence. We argue that insurance can help entrepreneurs better manage and balance both their personal and business risks. Traditional services may be not well suited for the needs of the financially underserved, especially in developing economies (Raithatha & Priebe 2020, Benami & Carter 2021), whereas digitalised services might meet these needs. We also show that the shift to self-employment does not come at the expense of employment in private firms in the country.