FDI is at the origin of a creative destruction phenomenon

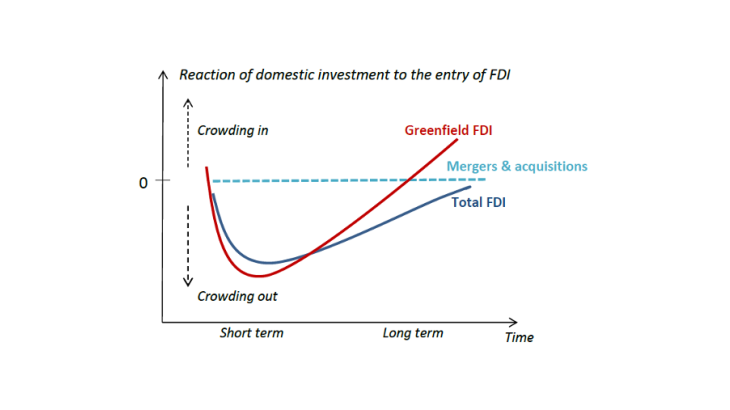

We highlight a two-step impact (J-shaped curve) of FDI on domestic investment (see Chart 1). In the short term, domestic investment, which is penalised by increased competition, declines following the entry of foreign companies. As domestic companies adjust and establish trade linkages with foreign companies, the crowding out effect diminishes. The time needed for the crowding out effect to fade is estimated at 4-5 years. In the longer term and under certain conditions, domestic investment is spurred by the spillover effects resulting from the integration of foreign subsidiaries into the economy. However, this complementarity is not systematic.

The reaction of domestic investors depends on the entry mode of foreign investors

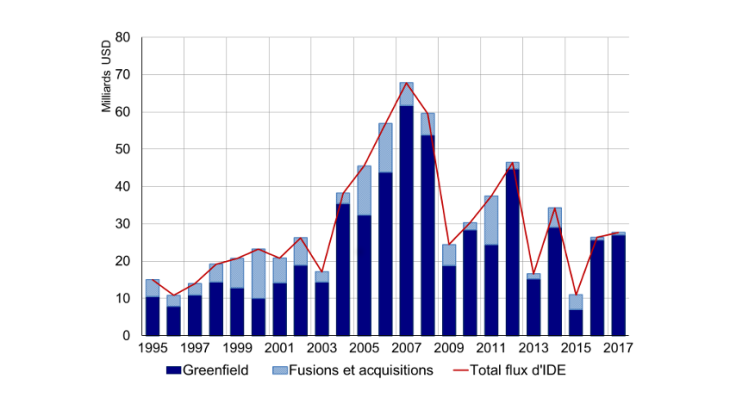

Depending on the entry mode of foreign investors, FDI can take the form of so-called “greenfield" investment (i.e. the creation of a new company ex nihilo) or mergers and acquisitions (i.e. the acquisition of an existing company).

Greenfield companies which display higher productivity and lower marginal costs rapidly capture some of the demand addressed to domestic companies. As a result, they generate a stronger crowding out effect in the short term. However, greenfield companies also establish trade linkages within the domestic economy, especially if they rely on local suppliers: this will benefit domestic companies in the long term.

Conversely, mergers and acquisitions do not have a significant effect on domestic investment. Indeed, they consist in transferring ownership of existing assets, without any immediate increase in the capital stock. In addition, market competition is not significantly altered as the companies concerned by these transactions are already present on the market. While upgrading and expansion investments may take place following a merger or an acquisition, the effect is more gradual and leaves domestic companies with more leeway to adjust.

If the crowding out effect is dominant, financial development can still contain it

As capital flows, FDI is likely to fuel domestic financial systems, by increasing the supply of liquidity and lowering interest rates. Subsequently, developed financial systems - be it the banking sector or the capital market - can facilitate access to financing for domestic investors, thanks to their ability to effectively redistribute resources. Using interaction variables, we show that developed financial systems offset, to a certain extent, the crowding out effect.

From the perspective of financial development, the entry mode of foreign investors appears again crucial. While mergers and acquisitions do not immediately contribute to capital accumulation, they can nevertheless be complementary to domestic investment, provided the financial systems are sufficiently developed. Indeed, in the case of mergers and acquisitions, the funds are not immediately allocated, and are thus mostly channelled into the domestic banking sector and used to finance domestic investment projects.

Finally, insofar as the short-term crowding out effect results from a competitive mechanism, leaving the most productive firms on the market, the average productivity level of the economy increases and the overall effect on national welfare should be positive. Nevertheless, encouraging the entry of FDI in underdeveloped domestic industries or introducing incentives to use local inputs may be useful in mitigating the crowding out effect in the short term.