- Home

- Publications et statistiques

- Publications

- Do highly indebted large corporations po...

Post n°147. At the end of 2018, “at-risk” firms in France were estimated to have total gross debts of EUR 187 billion. A 100 basis-point rise in their cost of financing could push this amount up by 60%, potentially posing a risk to the financial system. This result supports the measures taken by the High Council for Financial Stability (HCSF) as of 2018 to strengthen the resilience of the banking system.

Note: ICR = Interest coverage ratio, or the ratio of earnings to interest payments. Net leverage is defined as the ratio of debt net of cash holdings to total equity.

The continuing policy of ultra-low interest rates and highly accommodative liquidity conditions in the euro area is justified by the need to strengthen credit supply to businesses and support economic activity. In this context, French firms have significantly increased their borrowing, not just to maintain a high rate of investment but also to finance external acquisitions and to accumulate cash. To what extent can high debt levels among certain firms be considered a source of systemic risk?

How is systemic risk transmitted from large corporations?

Large corporations (LCs) and intermediate-sized enterprises (ISEs) can pose two risks to financial stability.

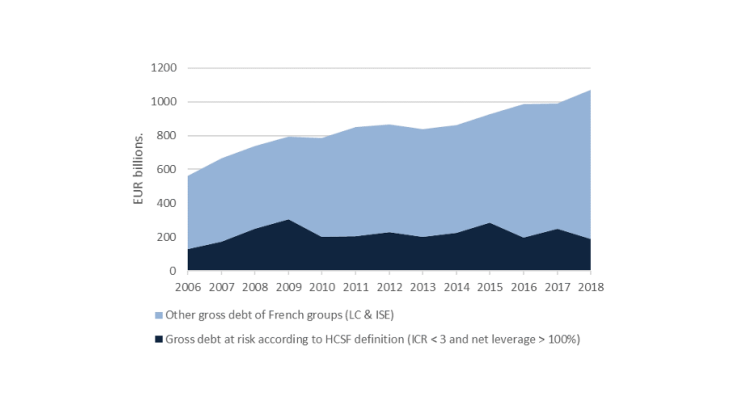

First, financial institutions that have financed large loans can run into trouble if they are not repaid. At the end of 2018, the aggregate debt of French firms of all sizes amounted to EUR 1.71 trillion. ISEs and LCs had gross consolidated debt of EUR 1.07 trillion (see Chart 1) with the 20 largest firms accounting for EUR 500 billion or 30% of this total.

These firms play a key role in the functioning of the economy: the economy can be viewed as granular, meaning that the individual dynamics of large entities do not offset each other at the aggregate level, but can instead have a macroeconomic impact (Gabaix 2011).

A large corporation contributes to the dynamics of the economy beyond its own perimeter through its client-supplier relationships in a multisectoral production network. If the financial position of an LC deteriorates, the financial system does not suffer an individual default, but rather a cascade of correlated defaults. Banks or investors may then be obliged to reduce their commitments in order to clean up their balance sheets, triggering a devastating domino effect.

A deteriorated interest coverage ratio coupled with a high leverage calls for increased vigilance

The High Council for Financial Stability has defined two indicators that can be used to assess a firm’s financial health:

- The interest coverage ratio or ICR measures a firm’s interest payment burden. It is defined as the ratio between a firm’s earnings before interest and tax (EBIT) and the interest payments on its debt. An ICR below 1 indicates that a firm does not generate sufficient income to pay its creditors. Financial analysts generally consider an ICR below 3 to be risky. Firms need to be able to withstand a temporary, one-off decline in their earnings (assuming their expenses do not adjust downwards at the same speed) or a rise in their financing costs (38% of French corporate debt carries a floating interest rate or is due to mature within a year and will have to be renewed). In addition, a firm that is unable to generate higher returns than its cost of equity can no longer afford to pay dividends to its investors.

- The net leverage ratio is the ratio between a firm’s debt net of cash holdings and its equity. It thus provides a picture of a firm’s financing structure, and shows the amount its creditors could potentially recover in the event of a default. If this occurs, the firm will have to liquidate its assets in order to repay its creditors. A high net leverage ratio indicates that the value of a firm’s assets may be insufficient to cover its debts. It also suggests that the firm will be more vulnerable to a wealth shock – i.e. a sudden drop in the value of its assets.

If a firm’s ratios deteriorate, it may struggle to find financing on acceptable terms, which will in turn affect its financial health. In this blog ”debt at risk” is defined as the outstanding debt of LCs and ISEs with an ICR below 3 and a net leverage ratio above 100%. Although these thresholds are of course arbitrary, this definition makes it possible to monitor the outstanding debt issued by firms that are considered financially fragile.

The fall in rates has had a mixed effect on the financial health of large French groups

The fall in rates has reduced firms’ interest payments but has also encouraged them to take on more debt. This has led to an improvement in ICRs, but at the same time a deterioration in net leverage ratios. In France, the total volume of debt carried by ISEs and LCs with an ICR of less than 3 has fallen from EUR 301 billion (35% of the total) to EUR 213 billion in 2018 (20%), whereas the volume of debt to firms with a leverage ratio in excess of 100% has risen from EUR 344 billion (40%) to EUR 474 billion (44%). The Banque de France has already highlighted a rise in the net leverage of LCs over the recent period. If we combine the two criteria, some EUR 187 billion of gross debt (slightly less than 20% of the total) can be considered to be “at risk” in 2018. The improvement in ICRs has thus offset the deterioration in leverage ratios, resulting in an overall decline in the amount of debt at risk.

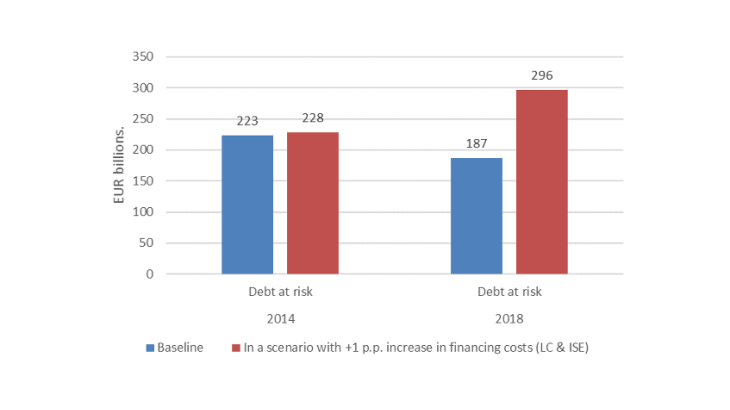

However, despite this slight fall in the outstanding amount of debt at risk, the vulnerability of firms to a financing shock may have evolved. Using a scenario of a 100 basis-point rise in the cost of financing, we measured the sensitivity of debt at risk to financing conditions, at constant leverage, by looking at the impact on interest payments. This estimation represents the upper bound of the total impact of a rate hike, as individual firms could respond by reducing the amount of their debt (for example by using their liquidity or restructuring their activities). The impact would also differ if the rise in financing costs was accompanied by a deterioration in corporate earnings (compared with the scenario of a standalone hike to interest rates).

This simple exercise reveals that the outstanding amount of debt at risk in 2018 would increase from EUR 187 billion to EUR 296 billion (close to 30% of the total), representing a rise of nearly 60% (see Chart 2). The increase is primarily due to the fall in the ICR of several large corporations below the threshold of 3. Compared with 2014, the sensitivity of debt at risk to a rate hike has increased markedly. A rise in rates would have triggered a marginal increase in the amount of debt at risk in 2014. The impact on ICRs is similar in both periods. However, as leverage ratios were lower in 2014, fewer firms would have found themselves in the category at risk.

Source: FIBEN group data and authors’ calculations.

Note: The stress is applied to 11% of outstanding debt securities and 52% of outstanding loans, which corresponds to the fraction of debt that is floating rate or equivalent.

This assessment supports the HCSF’s decision in 2018 to restrict systemically important French banks’ exposure to highly indebted firms to a maximum of 5% of their own funds. The aim was to limit the adverse consequences for the French banking sector of a possible incident affecting one of these firms, and to break the link between the health of financial institutions and that of non-financial corporations. The measure complemented the increase in the countercyclical capital buffer, which was designed to strengthen the resilience of banks in a context of a general acceleration in the financial cycle. Together, these measures help to safeguard financial stability, and by extension the financing of the economy. This analysis echoes the one presented in the last “Assessment of risks to the French financial system” by the Banque de France.

Updated on the 25th of July 2024