In recent years, the debate over how monetary policy shapes inequality has gained momentum. While the effects of conventional interest rate changes on household consumption and income have been widely studied, less is known about the distributional consequences of unconventional tools. Gaining a clearer understanding of how different monetary instruments affect households beyond their aggregate impact is crucial for designing effective and optimal policy strategies.

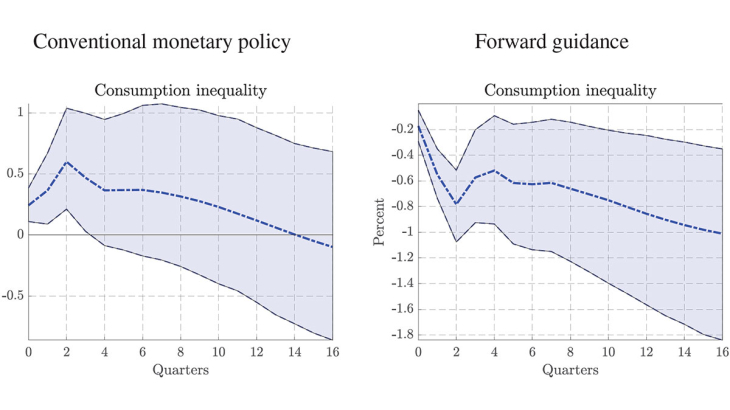

This paper compares the distributional effects of conventional monetary policy (CMP) and forward guidance (FG) on consumption. Using U.S. household-level survey data and a time series model that disentangles these two policy tools, we first examine their impact on aggregate macroeconomic outcomes and the distribution of household consumption. While both CMP and FG generate similar aggregate real and financial responses, they have opposite effects on consumption inequality. A conventional interest rate hike raises inequality by disproportionately affecting low-consumption households, whereas an anticipated rate hike via FG tends to reduce inequality by affecting higher-consumption households more.

We highlight the central role of fiscal policy in explaining the divergent effects of monetary policy tools on consumption inequality. Interest rate hikes influence government borrowing costs by increasing debt servicing expenses or lowering the market value of newly issued bonds. In response, fiscal authorities may adjust transfer payments to households in an effort to stabilize public finances. Following a CMP shock, government transfers to households decline sharply, disproportionately affecting financially constrained households and exacerbating the rise in inequality. In contrast, FG postpones both the interest rate increase and the resulting fiscal adjustment, leading to smaller reductions in transfers and more muted distributional consequences.

To formalize these mechanisms, we develop a tractable New Keynesian model featuring two household types: savers and hand-to-mouth consumers. The model includes fiscal redistribution via lump-sum transfers that respond endogenously to both public debt levels and the state of the business cycle. Consistent with the empirical evidence, the model demonstrates that the timing of interest rate changes directly affects the government’s debt burden, which in turn drives the fiscal response. The fiscal channel ultimately determines the opposing effects of CMP and FG shocks on consumption inequality.

Keywords: Household Heterogeneity, Forward Guidance, Inequality, Monetary Policy, Hand-to-Mouth, Fiscal Transfers

Codes JEL : D31, E21, E52, E58, E62