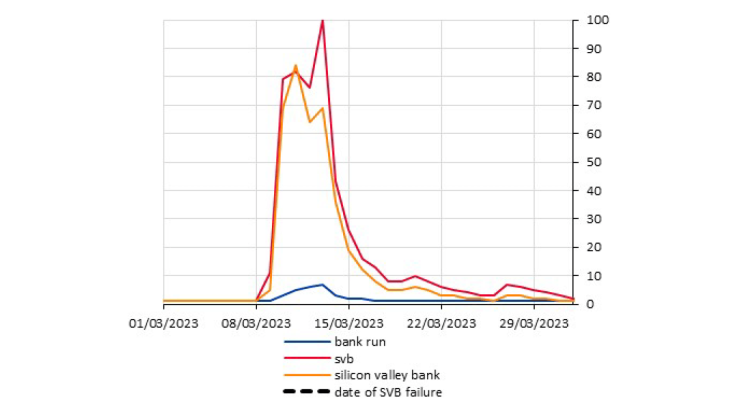

Between 8 and 13 March 2023, there was a surge in Google searches for occurrences linked to Silicon Valley Bank (SVB), pointing to sudden fears over the bank’s finances that may have accelerated the bank run and the subsequent failure. A bank run occurs when many customers simultaneously withdraw their deposits due to concerns over the bank's financial health.

Alongside SVB, various regional US banks, including Silvergate and Signature Bank, also collapsed in March 2023 following a bank run. The failures were caused by structural weaknesses, such as depositor concentration and a high share of uninsured deposits, although the precise reasons and sequence of events differed for each bank. Silvergate customers withdrew 68% of their deposits in the final quarter of 2022, whereas SVB experienced a very rapid bank run, with customers pulling out 25% of their total assets in just 24 hours (9 March 2023).

To protect savers and limit the risk of rapid failure, banks are subject to prudential capital and liquidity rules that require them to keep a minimum capital buffer to cover potential losses, along with sufficient liquid assets. In the United States, however, these requirements are proportionate to each bank’s size and activity.

In parallel, deposit guarantee schemes reimburse depositors up to a certain amount – EUR 100,000 in Europe and USD 250,000 in the United States in the event of a bank failure. In SVB’s case, the guarantee proved insufficient as over 90% of deposits exceeded the maximum compensation amount. However, US authorities decided to fully reimburse all deposits.

The digitalisation of banking services can accelerate deposit outflows

The growing digitalisation of banking services (24/7 access to internet and mobile banking, instant payments and withdrawals, etc.) is having an impact on customer behaviour, and this trend accelerated rapidly with the Covid-19 pandemic. In 2022, 96% of French people accessed their bank’s website or mobile app, while 74% had downloaded their banking app compared with just 55% in 2018 (French Banking Federation, 2023). These online services offer various benefits to customers, including easy account access and rapid transaction execution.

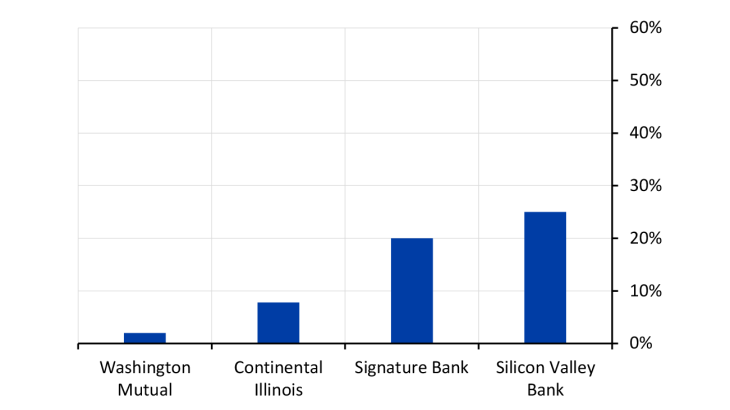

However, the growing use of mobile banking can also make it easier and quicker to withdraw deposits. Instant transfers are available 24/7 via banking apps, significantly reducing the time it takes to make a withdrawal. SVB’s collapse occurred after just two days of deposit withdrawals, compared with ten days for Continental Illinois in 1984 and nine days for Washington Mutual in 2008. Daily withdrawals reached a maximum of 25% of deposits (USD 42 billion) for SVB, compared with just 2% for Washington Mutual (Chart 2), precipitating SVB’s failure on 10 March 2023.

Chart 2: Maximum daily deposit withdrawals as a share of total book value