1 The transmission of climate shocks

Climate change presents an unprecedented challenge to economies and, by extension, to the financial system. The risks associated with climate change are generally broken down into two types: physical risks, associated with the direct impacts of climate change (increased frequency and severity of extreme weather events); and transition risks, related to more or less orderly transitions towards a low-carbon economy and its associated economic structural changes. Each of these two “families” of risks has their own different channels of transmission to the economy and hence to the financial system.

The increase in the frequency and severity of extreme weather events will trigger, for example, the destruction of infrastructure or real estate assets and disruption to the operations of firms and financial players, necessitating spending on reconstruction or adaptation. For households, these events could, for instance, lead to losses of income due to adverse effects on labour productivity, or of wealth, through damage to property. At the macroeconomic level, they would lead to an increase in the capital

depreciation rate, a greater need for investment, disruptions to international trade, and a reduction in tax revenues due to the decline in economic activity. Without additional transition measures, the NGFS estimates that total cumulative GDP losses from physical risks will amount to 13% globally in 2100, but with major variations from region to region (NGFS, 2021).

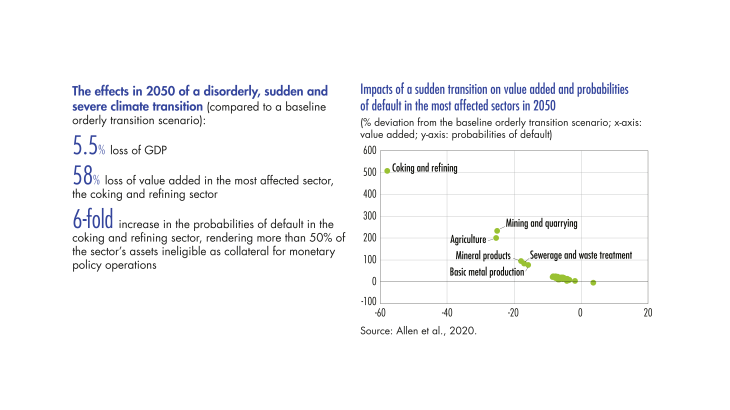

Transition risks arise from the potential repercussions of the transition towards a low-carbon economy, which could lead to economic shocks with financial implications, particularly if the transition is implemented in a disorderly manner, i.e. inadequately anticipated, poorly coordinated or simply too late. These shocks can be very different in nature. Climate policies, such as introducing a carbon tax, banning combustion engine vehicles or imposing energy efficiency improvements, are intended to promote “decarbonised” solutions and to penalise activities that emit greenhouse gases (GHG). As such, they impact the profitability of these activities and could, for example, lead to expected returns being dramatically reassessed in certain – particularly carbon-intensive – sectors in the event of sudden changes in expectations. The market value of assets referred to as stranded assets could suffer a severe correction. Disruptive technological innovations would have similar effects, rendering previous production processes and their investments obsolete. Changes in consumer and investor preferences and behaviours could also lead to the reassessment of growth outlooks and asset values in certain sectors.

[to read more, please download the article]