Since 2020, many developing countries have faced a succession of crises (COVID-19, volatility of commodity prices, geopolitical tensions, climate hazards), which have weighed on fiscal deficits and squeezed access to affordable financing. This has resulted in increasing risks of debt distress, with a majority of low-income countries in high risk or in debt distress in 2024. Sovereign debt restructuring (DR) is typically seen as a last-recourse option to restore fiscal space and debt sustainability when all other financing options have been exhausted. While studies on DRs financial and macroeconomic impact has been extensive, research on its impact on the private sector has remained scarce. Our research aims at filling this gap by examining whether debt restructuring boosts firm sales growth and by exploring associated transmission mechanisms.

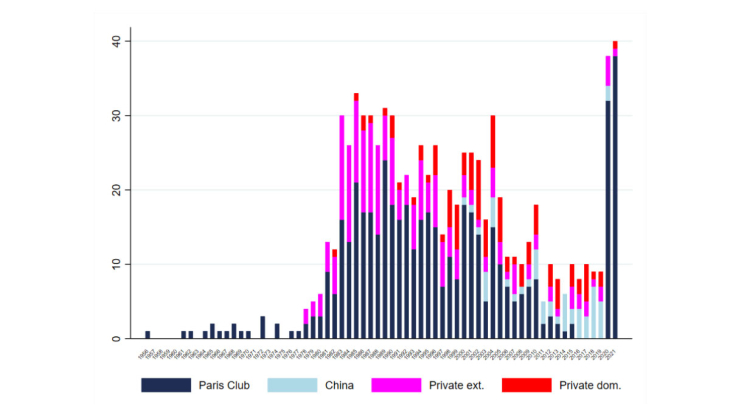

To provide new insights, this study compiles a comprehensive dataset of sovereign debt restructurings – covering both official creditors (Paris Club and including China) and private creditors (external and domestic) and firm-level data from the World Bank Enterprise Surveys (WBES) spanning 2004 to 2023 across 88 countries. We adopt a robust difference-in-differences (DiD) approach that compares firm performance before and after restructuring events, and accounts for staggered exposure to DR. We analyze heterogeneous effects of debt restructuring according to creditor and DR types. To explore possible transmission mechanisms, we also differentiate firms according to the structural intensity of their industry (in human capital, finance, public utilities, transports and construction). Finally, we introduce new data on time lags to explore how delays in implementing DR may affect private sector growth.

Our findings reveal that sovereign debt restructuring is associated with an average increase in firms sales growth of approximately 5 to 9 percentage points. This boost benefits domestic privately owned companies, irrespective of size, export status, website ownership, or perceptions of corruption and financial constraints. Our analysis also shows that industries highly dependent on public utilities, human capital and finance tend to experience stronger positive effects. We also show that this positive impact on firm growth is mostly driven by swift DR by official creditors. DR involving other types and combinations of creditors, or associated with longer time lags, appear to have a weak or even negative impact on firms’ growth.

These results suggest that the domestic financial sector may play a crucial role in transmitting the benefits of debt restructuring and we believe further research is called for on possible transmission channels via credit supply, credit costs and bank portfolio reallocations. In low-income countries characterized by large investment in public debt by local banks, investigating how DR relaxes this bank-sovereign nexus and frees capital to finance the private sector represents a promising avenue for further research.

From a policy perspective, our study underscores the importance of swift, well-coordinated restructuring processes to minimize uncertainty and time lags and optimize freed-up fiscal space and positive spillovers to the private sector. Since 2021, the G20-Paris Club-sponsored Common aims at bringing together key stakeholders including China to ensure timely and comparable treatment for all creditors in the case of external DR for low-income countries. Given the rapidly growing share of domestic financial markets in financing sovereign debt, reinforcing coordination between domestic and external DR may become the next step to maximize the impact of DRs on private-sector growth.

Keywords: Debt Restructuring, Debt Distress, WBES, Difference-in-Differences (DiD), Paris Club

Codes JEL : D22, F34 et O16