- Home

- Publications and statistics

- Publications

- Critical raw materials: the dependence a...

Post n°325. The ecological transition requires large quantities of critical raw materials (CRM) but their supply is concentrated geographically and the principal extractive companies are mainly controlled by players from outside the European Union. This dependence on imports exposes the EU to major geopolitical risks and forces it to secure its supplies.

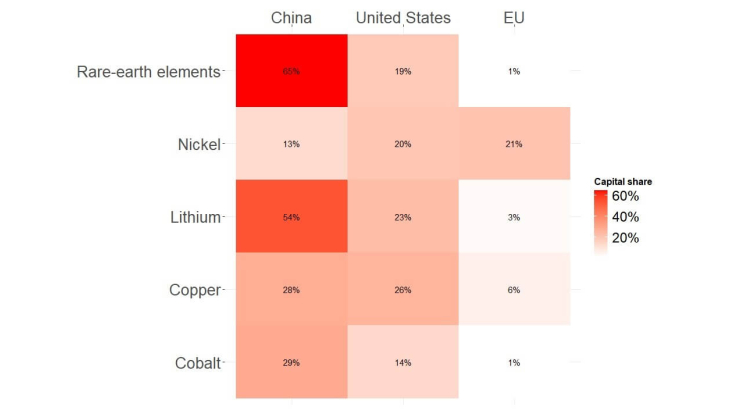

Sources: Refinitiv, authors' calculations.

Note: each listed mining company (excluding free float) is weighted by its share of global production of the metal in question. The darker the red, the higher the share of capital held by each area.

Faced with the risk of "geo-economic fragmentation" (Aiyar, 2023), the EU has recently introduced legislation aiming to increase the security of its supplies and its resilience to shocks, especially geopolitical shocks, and make itself more strategically autonomous. Moreover, its 'Fit for 55' strategy aims to reduce its greenhouse gas emissions by 55% by 2030 compared with 1990 levels, while achieving climate neutrality by 2050. In order to achieve its climate objectives, however, the EU is dependent on imports of critical raw materials (CRM).

These raw materials are considered critical because of their economic importance and the risks they entail for EU supplies. While the geographical concentration of resources is well documented, the ownership interests in extractive companies is less so. Yet, the analysis of a new database that we compiled on the origin of shareholders suggests that the supply of certain CRM appears to be mainly controlled by entities based in large economies competing with the EU (see Chart 1). Nickel, copper and cobalt production is concentrated among non European investors, notably American, Australian, British and Chinese, and more than three-quarters of the capital of rare earth and lithium mining companies is held by non-European investors.

CRM demand is set to rise sharply with the energy transition

Technologies essential to the energy transition, such as wind turbines, batteries and power grids, require large quantities of CRM. According to the International Energy Agency (IEA), producing an electric car requires six times more CRM than a conventional vehicle, while producing energy from an onshore wind farm requires twice as many CRM as a nuclear power station.

The technologies needed for the energy transition already account for a significant share of total CRM demand (Chart 2). This share is set to rise further: projections by the IEA (2023) and the European Commission (2023) suggest that the increase in global demand for CRM, driven mainly by the deployment of electric vehicles and networks, will be particularly strong for cobalt, lithium, nickel, graphite and copper. These projections are subject to considerable uncertainty, such as that associated with the implementation of decarbonisation policies and the difficulty in predicting technological developments and new consumer preferences. However, imbalances between CRM supply and demand could arise (Dees et al., 2023).

Source: IEA (2023)

Note: energy transition technologies account for 56% of global lithium demand in 2022. This share is expected to reach 87% in 2030 under an ambitious climate transition scenario (Net zero CO2 emissions by 2050).

There are many risks to the EU's supply of critical raw materials

The notion of criticality covers a wide range of risks. Some are economic in nature, reflecting the concentration of supply and the market power of CRM suppliers.

For geological, economic and socio-environmental reasons, CRM production is often geographically concentrated outside Europe (for example, in the Democratic Republic of Congo (DRC) for cobalt extraction, in Chile for copper or in Australia for lithium).

There are also geopolitical risks. Political instability in a producer country or geopolitical rivalries can lead to supply disruptions, particularly in the case of CRM concentrated among a few players, such as rare earth elements and cobalt. The geographical concentration of supply makes the EU vulnerable to trade restrictions. According to the OECD, over 70% of export restrictions concern CRM.

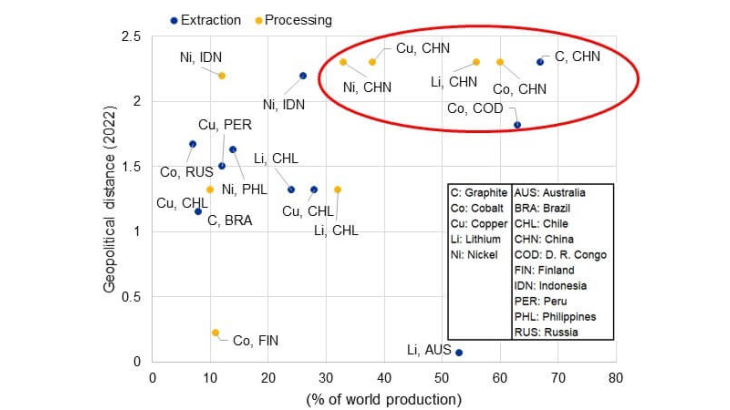

An analysis of CRM exporters' geopolitical distance from the EU, as measured by countries' voting patterns at the UN General Assembly (Bailey et al., 2017), reveals the geo-economic risks to the supply of certain CRM. Chart 3 shows that a large share of lithium and cobalt production comes from countries that are geopolitically distant from the EU (China, DRC). Greater geopolitical tensions could therefore exacerbate the EU's supply difficulties.

Sources: Bailey et al. (2017), EC (2023), authors’ calculations

Note: the vertical axis increases with geopolitical distance. Only the two main producers are shown for each mineral and production stage.

Furthermore, some CRM are subject to major geological constraints: known resources do not appear to be sufficient to meet additional demand. Moreover, their production entails environmental risks (pollution linked to production, pressure on water resources, etc.).

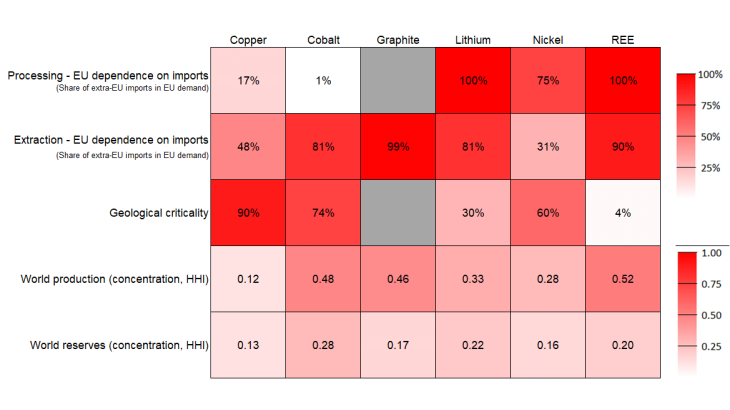

Chart 4 summarises the criticality of CRM for the EU using three indicators.

- Supply risk, measured by the degree of the EU's dependence on imports, which tends to be higher at the extraction stage.

- Geological criticality assessed by the projected cumulative consumption of a raw material between now and 2050, in relation to currently known resources.

- The geographical concentration of global CRM production (mining) and reserves, assessed by the Herfindahl-Hirschman index, with values ranging from 0 (low concentration) to 1 (high concentration).

Copper, which is essential to the deployment of electricity grids, is not very concentrated in terms of production and reserves, and the EU's dependence on imports is relatively limited, but its geological criticality is high. Cobalt, which is needed for batteries, has a highly concentrated production, the EU is heavily dependent on its imports and it is extremely critical from a geological point of view. In contrast, while production of lithium (essential for batteries) and rare earths (needed for wind turbines) is concentrated and the EU is heavily dependent on imports, geological criticality is low, suggesting that the EU's strategy should vary depending on the CRM in question.

Sources: US Geological Survey, European Commission, IFPEN, authors' calculations

Note: the darker the red, the more concentrated the supply, the greater the EU's dependence on imports and the greater the geological criticality (missing data in grey).

Capital holdings in extractive companies are also highly concentrated

The geographical concentration of production is compounded by a concentration of players controlling the supply of CRM. Moreover, in the event of tensions over the availability of resources or geopolitical stress, shareholders in these companies could steer exports towards certain markets to the detriment of others. In order to analyse this vulnerability, we created a database of global listed companies involved in the CRM sector. This database documents the geographical origin of these shareholders, allowing us to map the decision makers and the share of non-European investors. For each raw material, capital holdings in each company are weighted by the share of its own production in world production in 2022 (Chart 1).

The supply of certain CRM is seen to be mainly controlled by entities based in countries with rival interests to those of the EU, underlining the need for it to develop a strategy aimed at increasing its strategic autonomy. The European Commission, which has identified around thirty CRM, plans to diversify its suppliers and increase production and recycling within the EU. This is embodied in its draft Critical Raw Materials Act of 2023.

Download the PDF version of the publication

Updated on the 25th of July 2024