- Home

- Publications et statistiques

- Publications

- Covid-19 and monitoring economic activit...

Covid-19 and monitoring economic activity: the contribution of high-frequency data

Post n°174. The COVID-19 crisis has required a real-time monitoring of economic activity, which has not been possible with the usual data. However, by using high-frequency data, such as electricity consumption and credit card transactions, it has been possible to estimate the magnitude of the shock and the timing of the rebound at an early stage, for both industrial production and for household consumption.

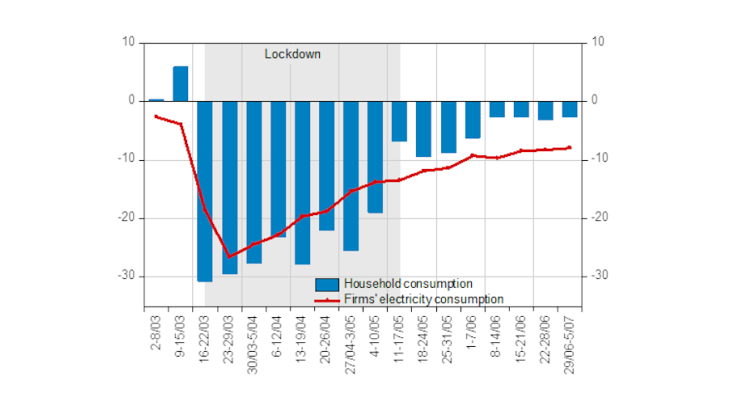

Note: Deviation from a normal level (households) or from the historical average (firms). Household consumption is estimated by credit card transactions. Electricity consumption is adjusted for temperatures and working days.

The health crisis and lockdown measures have led to an unprecedented drop in economic activity in France. This new context has made it necessary to monitor economic activity in real time. The cyclical data traditionally used for short-term analysis and forecasting (surveys, industrial production, consumption of goods) have proven to be insufficient, due to their monthly production frequency and publication dates ranging from the end of the current month to 40 days later. High-frequency data, such as firms' electricity consumption and credit card transactions, have provided additional information that is available more quickly, making it possible to refine the assessment of the business climate. In particular, they have made it possible to estimate the magnitude of the shock very early on and to identify a decoupling of supply and demand at an early stage: while productive activity began a gradual return to its normal level at the beginning of April, household consumption remained persistently subdued until the end of lockdown (see Chart 1).

Firms' electricity consumption as a measure of their production

Electricity is used intensively by companies as part of their production process and represents an indispensable intermediate consumption.

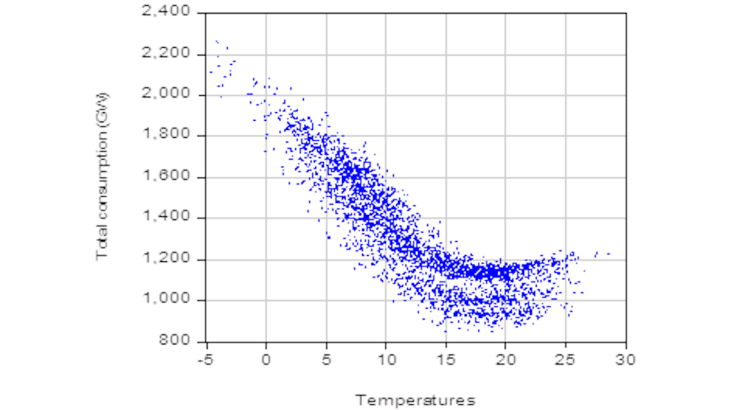

The power consumption series, available with a lag of one day to two weeks depending on the supplier, therefore allow for almost real time monitoring of corporate activity, but require several processing operations. They are adjusted for calendar effects (weekends, holidays and long weekends) as well as temperature variations that affect the use of heating and air-conditioning irrespective of production activity (see Chart 2a). The method used is the degree-day method, in a simple version called "weather" with a threshold set at 17°C. The method involves modelling the use of heating as a function (which we assume to be quadratic) of heating degree-days, which is the number of degrees below the threshold for the average temperature of the day. Symmetrically, air conditioning is a function of cold degree-days (number of degrees above the threshold). The resulting series are smoothed over seven days to eliminate residual calendar effects and compared to their average of the corresponding days over the available historical years.

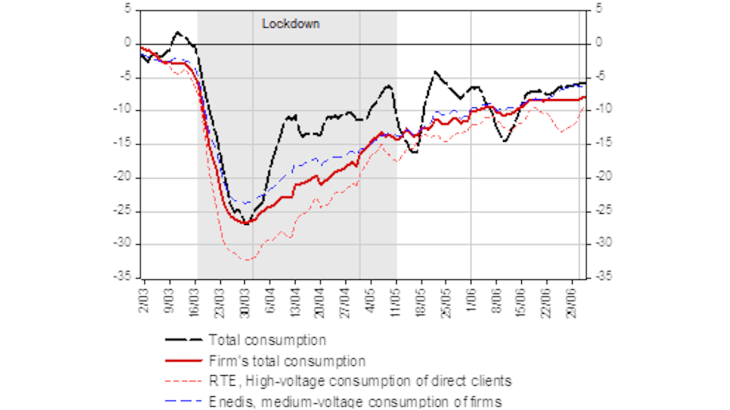

Chart 2b shows changes in total consumption supplied by RTE (electricity transmission network - companies and households, black line), as well as the different series of consumption by companies: high-voltage consumption by customers directly connected to RTE (dotted pink curve), medium-voltage consumption by companies via the distributor Enedis (dotted blue curve). The sum of the two (red curve) gives a measure of the total consumption of firms, as a deviation from the historical average.

Sources: RTE and Enedis (electricity consumption), Météo France (temperatures); adjustment of temperatures and working days by the authors.

Note: At 31 March, total electricity consumption was down 27% compared to its historical average.

Sources: RTE and Enedis (electricity consumption), Météo France (temperatures); adjustment of temperatures and working days by the authors.

Note: At 31 March, total electricity consumption was down 27% compared to its historical average.

At the beginning of March, the series obtained were close to their historical average. With the implementation of lockdown measures, electricity consumption fell very sharply in the last two weeks of March, reaching a low of around -27% at the end of March. After this trough, electricity consumption followed a "bird's wing" profile. It gradually recovered as of the beginning of April, showing that companies were able to adapt their production process to the health constraints even before the end of lockdown. But the rebound has only been very slow and partial: since the beginning of June, consumption has plateaued at around 8-10% below its historical average.

Bank card transactions as a measure of household consumption

Lockdown measures as of 17 March, together with retail store closures, have subdued household consumption and altered its composition. In order to estimate in real time the impact of lockdown on household consumption, we used data on daily bank card transactions and withdrawals, provided with a lag of around 10 days by the Groupement des Cartes Bancaires CB (CB Bank Card Consortium), based on a significant sample of the total transactions carried out. Using the breakdown by type of activity, we studied the distortion of consumption and monitored the activity of certain sectors, particularly services. To do so, we matched these activities with the national accounts classification of household final consumption. For each item, we estimated the change in consumption based on the corresponding transactions. For some consumer items, such as car purchases, card payments are marginal or unrepresentative, so we have used alternative sources or expert judgement.

The blue bars in Chart 1 represent the changes in total consumption obtained as a deviation from a normal situation (which corresponds to the trend observed before lockdown). The health crisis has had a very significant impact on consumer habits. While there was an increase in purchases during the second week of March, particularly at food retailers (probably due to a postponement of consumption in restaurants and canteens and the stockpiling of food by households), lockdown caused a sharp fall in consumption, of around 30%, during the last two weeks of March. It then progressed slightly to about 20% below normal, but it wasn't until the lifting of lockdown in the week of 11 to 17 May that it really recovered. According to the latest data, at the beginning of July it is still expected to be around 3% below its normal level.

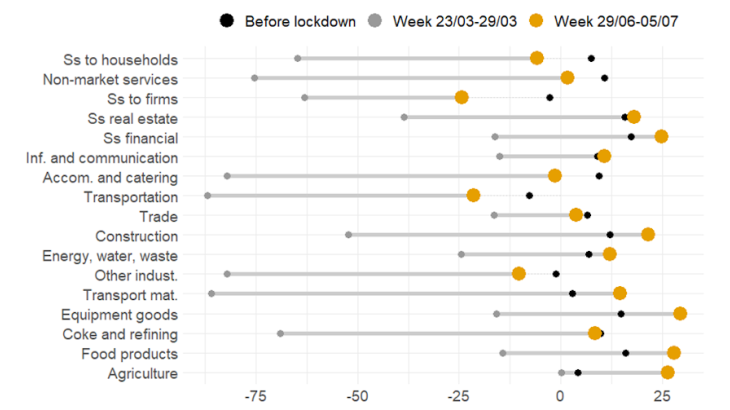

Chart 3 compares the year-on-year change in credit card transactions in different sectors for several time periods. At the start of lockdown, consumer spending fell in most sectors. Only retailers selling food, drinks and alcohol showed a marked increase during this period, dampening the fall in the retailer sector. After the exit from lockdown, consumption in the goods producing sectors returned to its pre-crisis level and even increased beyond it. Some service activities, such as transport and accommodation and catering, are still performing badly, due to their later reopening as well as possibly to changes in consumption patterns.

The use of high-frequency indicators in times of crisis

The use of this high-frequency data provided the Banque de France's economists with an animated sequence of the current crisis, which enabled them to quickly determine the magnitude of the shock. It corroborated and contributed to the broader monthly snapshot of the French economic landscape published each month in our business assessment, which is based on the Banque de France business survey. Although promising, the contribution of these high-frequency indicators for analysing and forecasting in normal periods has not yet been demonstrated. It is nevertheless an avenue of research that today involves several national (Banque de France, INSEE, OFCE) and international (OECD) institutions.

Updated on the 25th of July 2024