- Home

- Publications and statistics

- Publications

- Corporate and residential real estate: w...

Corporate and residential real estate: what spillovers in the context of the health crisis?

Post n°220. The price dynamics of corporate and residential real estate are highly correlated in France, both historically and geographically. The health crisis is firstly an asymmetrical shock affecting primarily the demand for corporate real estate. Nevertheless, we show that a fall in prices in this sector could affect residential property prices, particularly in areas where supply is most constrained.

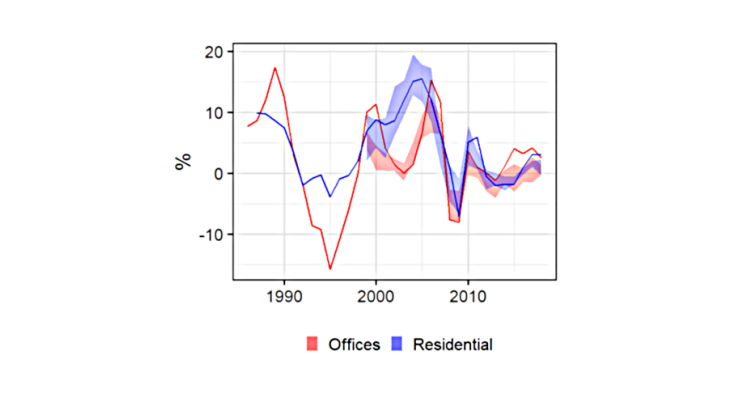

Note: the lines correspond to the national average; the coloured areas correspond to the interquartile range of the distribution by département for 39 départements for offices and 64 for residential real estate, available since 1998. Sources: MSCI, Notaries Index, OECD.

Strongly correlated price cycles

Real estate is divided into two categories: housing ("residential real estate") and premises for professional use ("corporate real estate"). Standard economic models (Roback 1982) predict similar price developments for the two real estate sectors over the long term. Indeed, price formation is driven by common macroeconomic fundamentals. Moreover, the two sectors share a common component with the price of land and arbitrage mechanisms prevent a lasting divergence: the possibility, in the existing dwelling sector, of transforming housing into commercial premises (or vice versa), and the competition on buildable land for new buildings. Kishor (2019) thus decomposes price developments in the two markets into common factors and spill over effects.

Indeed, the correlation between residential and commercial real estate prices among the 64 départements in our panel is 60% in France, and price cycles are fairly synchronous for all segments (offices, retail and industrial premises). In particular, long-run office and house prices series show that the correction episodes of the 1990s and 2008 affected both sectors simultaneously (Chart 1). This correlation of price changes goes hand in hand with a stability in the relative price of offices and industrial premises (ratio of prices per m² to residential), but a decline in the relative price of retail premises, reflecting structural changes such as the rise of e-commerce. Lastly, this strong correlation is not unique to France: Gyourko (2009) already identified "more similarities than differences" between these markets in the US, with a 40% correlation.

For existing dwellings, changes in the use of property are subject to regulatory constraints

The possibility of changing the use of a property fosters price convergence. This effect is theoretically more pronounced in areas where supply is more constrained, as the price of land will be a greater component of prices and changes in property use may be more attractive. However, regulatory constraints limit the substitutability of the use of properties. Davis Huang and Sapci (2020) show that these regulatory discrepancies can explain up to 20% of the differences in price correlation between cities in the United States.

In France, a project to convert a dwelling into business premises (or vice versa) requires an administrative application for a change of use and can involve significant costs for the development of premises.

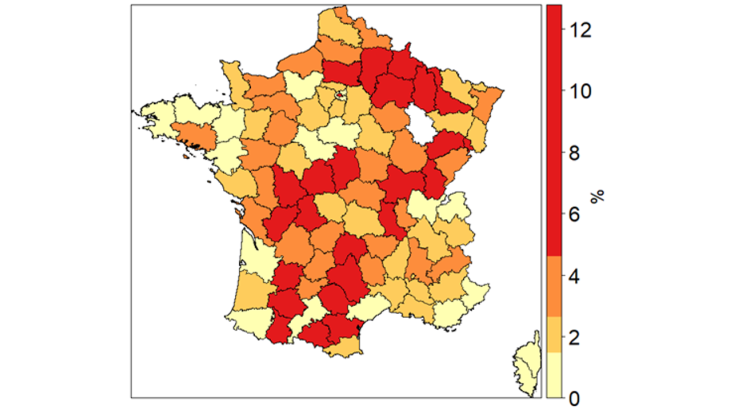

With the exception of Paris, where the pressure on supply is greatest, the share of changes of use in construction permit applications is especially high in lower-density areas (Chart 2). Interestingly, this observation was already made in a 2006 administrative paper covering the 1990-2005 period, at a time when the excess supply of business premises may have encouraged the transformation of these spaces into housing (Nappi-Choulet 2013) in the less economically vibrant areas.

Analysing these changes of use also shows an expected asymmetry between the conversion of business premises into housing (2.1% of construction permit applications between 2017 and 2019), and the vice versa (0.9%). The construction code provides a stricter framework for the latter, notably by requiring an application for a change of use in the most constrained areas.

Source : Sitadel. Note: The colour codes correspond to the quartiles in the distribution of the share of construction permit applications consisting of a change of use.

In the new-build sector, competition for land is limited to densely populated areas

The second price convergence mechanism stems from competition for land: in 2018, 57% of the area under construction was for residential housing and 43% for business premises. Developers shift construction to the most profitable sector, increasing supply in that sector, and thereby reducing the relative price and the initial advantage in terms of profitability. However, this mechanism only operates in the most densely populated areas where new property developments are constrained by a lack of building land.

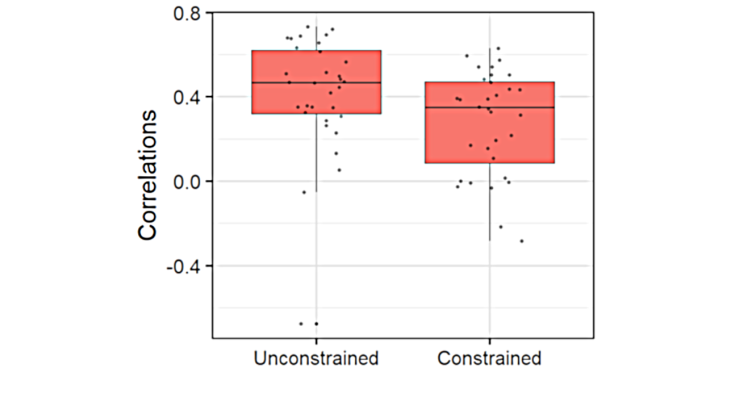

Without constraints on access to land, the correlation between the two types of construction is high, reflecting the underlying economic cycle. Conversely, a constraint on land availability cannot result in large volumes of construction simultaneously in both sectors: Chart 3 shows that the correlation of construction is lower in densely populated areas.

This effect can be confirmed by an econometric estimate that measures the impact of a change in the relative prices of corporate real estate (compared to residential) on the change in relative construction activity. The construction of business premises is 1.8 times more sensitive to an increase in relative prices in constrained areas than in unconstrained areas: an increase in the relative price of corporate real estate of 1% would result in a relative increase in construction in this sector of 0.16% in constrained areas compared with only 0.09% in the other départements.

Source: Sitadel.

What implications for the impact of Covid-19?

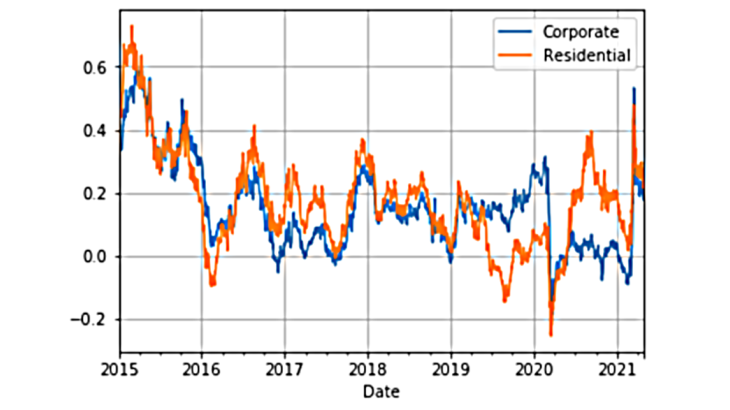

The current health crisis initially resulted in an asymmetric shock to household and business incomes, with the former less affected than the latter. Moreover, the crisis has accelerated the deployment of telework, which could have a lasting effect on the demand for business premises: the Atlanta Fed, for example, expects telework to triple once the crisis is over, compared to the previous period. According to an estimate by the Institut de l'Epargne Imobilière et Foncière ("IEIF"), the development of teleworking could reduce the amount of office space required by companies in the Ile-de-France by 12% to 36%. These developments create a greater downside risk for corporate real estate prices. In 2020, corporate real estate price indices fell by 0.4%, while residential real estate prices continued to rise at 5.3%. An analysis of the returns of German real estate companies, a market in which large residential and corporate real estate companies participate, confirms these developments. Professional real estate companies indeed fell behind their residential counterparts in 2020, although they catched up in 2021 (Chart 4).

Source: Bloomberg

The lack of historical depth of data and the unprecedented nature of the current crisis call for caution. However, as the price ratios between these two sectors are stable over the long term, a reaction in residential real estate prices can be expected, at least in the medium term. In addition to the pressures resulting from the macroeconomic context, a fall in corporate real estate prices could spill over to the residential sector, due to the combined impact of the reconversion of vacant business premises and reduced competition for access to land. This impact is likely to be greater in areas where supply is most constrained and/or where changes of use are relatively inexpensive.

Updated on the 25th of July 2024