Household consumption was severely impacted by the Covid-19 crisis and the invasion of Ukraine. These shocks were followed by price rises of varying intensity depending on the product, resulting in a change in the relative price structure and in consumer behaviour. In this post, we analyse two measures of consumption: spending in terms of value in current euros, and spending in terms of volume, adjusted for price increases and therefore directly reflecting quantities consumed.

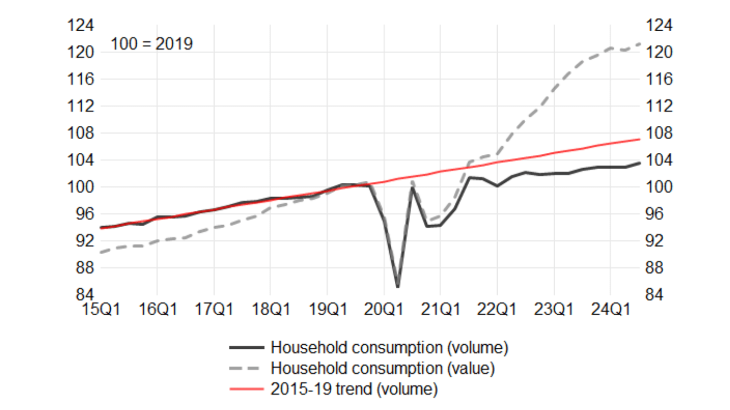

After falling sharply in 2020 and 2021, consumption in volume terms has returned to its pre-Covid level, and even exceeded this by almost 3% in Q3 2024. Nevertheless, this growth remains almost 4% below the trend calculated over the 2015-19 period (Chart 1).

In value terms, while the rate of increase was only slightly higher than it was before the crisis in volume terms, it has been much higher since 2022. There has been a sharp 21% rise in consumption in value terms since 2019, reflecting the sharp price increase.

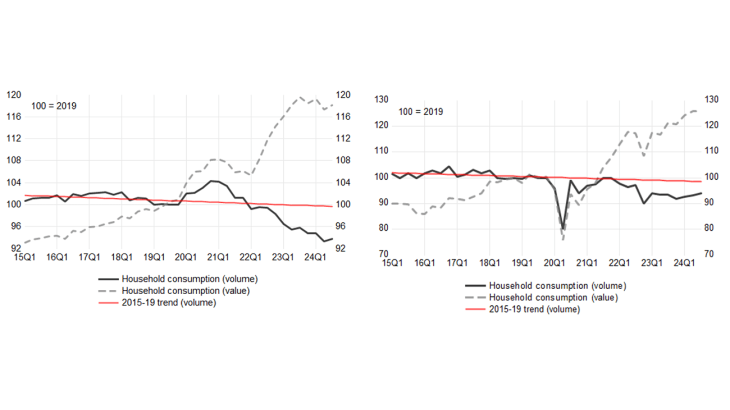

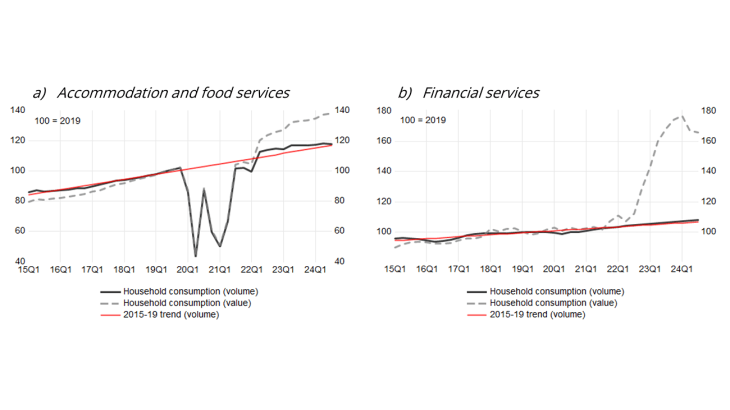

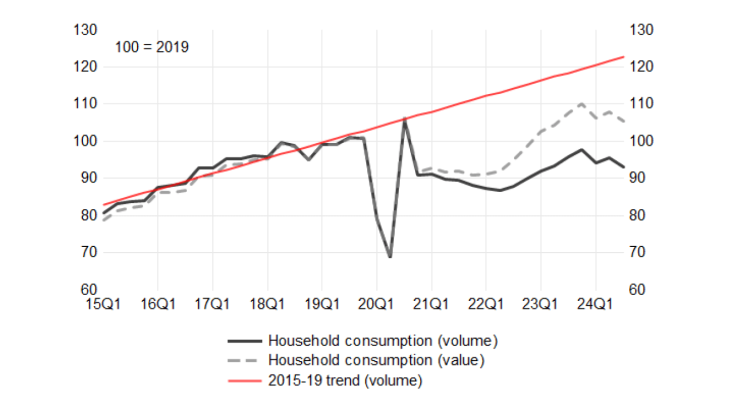

These shocks have affected the structure of consumption by product. In volume terms, consumption of goods fell by 4% between 2019 and 2024, while consumption of services rose by 11%. In value terms, household consumption of goods grew by 15%, while consumption of services grew by even more (up 27%). Within goods and services, we can highlight several product categories.

For certain products, the increase in consumption in value terms has been accompanied by a fall in consumption in volume terms

When compared with the trend for the 2015-19 period, the consumption of some products in value terms has risen, while consumption in volume terms has fallen. Examples include food products, energy products, other industrial goods, trade services and transport services (Chart 2). Price increases for these products led to a drop in consumption in volume terms, with a price elasticity of less than one.

The fall in food and energy consumption resulting from the sharp price rises for these goods has been documented by INSEE. In its October 2023 Economic Outlook, INSEE questioned households about changes in their consumption habits as a result of inflation. Nearly three quarters of households said they had altered their consumption habits. Home energy expenditure was the item for which most households had altered their habits (51%), followed by food (47%). In the case of food, this drop in consumption volume may reflect actual reductions in quantities consumed, but also changes in the quality of products purchased (more recourse to lower-cost products (INSEE (2023 [in French])). Moreover, not all households have been equally exposed to price hikes as the structure of consumption differs between household categories (INSEE (2023)). Inflation has been higher for more elderly households, for those living in rural areas or small towns, and for lower income households.

Chart 2: Household consumption by product in value and volume terms (100 = Q4 2019)