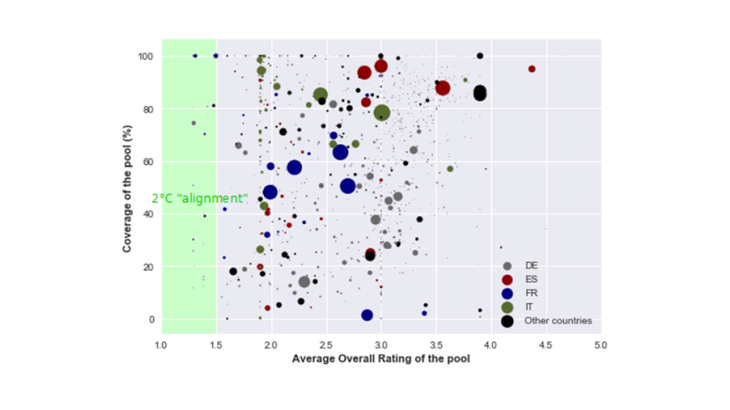

Note: The circles represent the pools of collateral pledged by counterparties and their relative size. On the x-axis, a rating of 1.5 and below means the pool is aligned with the Paris Agreement (green-shaded area), while 5 is the worst rating and indicates collateral that is most exposed to transition risks. On the y-axis, the coverage rate indicates the share of pool assets (by nominal value and including government securities) for which alignment data are available.

Central banks and the management of climate risks – a search for suitable approaches

Climate change poses a grave threat, not just to ecosystems, societies and the global economy (Pachauri et al., 2014), but also to the financial system (NGFS, 2019). Two main types of risk are generally identified. Physical risks refer to the potential losses that could result from the increase in the frequency and severity of extreme weather events and chronic environmental changes – such as rising sea levels – caused by global warming. Transition risks are the economic and financial consequences of a rapid transition to a low-carbon economy.

Central banks acknowledge that climate risks are not adequately priced in by financial markets (NGFS, 2019). This is due in part to a lack of comprehensive and standardised information on firms’ individual exposures. But another fundamental reason is the radical uncertainty surrounding climate risks (Bolton et al., 2020). In particular, calculating the probability of different political, technological and social scenarios associated with climate transition is notoriously difficult. As a result, for a central bank to base its climate risk management on the weighting of such scenarios would at best be risky, and could potentially undermine its credibility. In light of this, central banks are justified in looking for alternative approaches to safeguard financial stability (Allen et al., 2020), but also to protect their balance sheets.

The working paper published by the authors of this blog post (Oustry et al., 2020) explores the idea of a “protective” approach, aimed at limiting the transition risks to which the securities accepted as collateral by the Eurosystem for credit operations are exposed, without deviating from the existing principles of the collateral framework, which are:

- Equal treatment of the different securities eligible for use as collateral, in line with the principle of market neutrality

- Adequate protection for the Eurosystem against financial risks

- Equal access for counterparties to credit operations

- Operational simplicity

Reducing the exposure of collateral – the securities held by central banks – to transition risks: the advantages of climate “alignment” methodologies

To take into account the radical uncertainty and comply with the guiding principles of the collateral framework, one possible approach would be to use as a benchmark a climate trajectory defined as desirable by political authorities. For example, the EU’s target of reducing CO2 emissions by 55% by 2030 implies that the Eurosystem, in pursuing its primary objective of price stability, will have to factor in significant economic transformations in the short and medium term that could considerably impact the quality of the assets on its balance sheet.

Although it is impossible to determine the probability of each carbon reduction scenario and the resulting asset prices, we can estimate, at least roughly, the extent to which economic activities (and the associated assets) are “aligned” or “compatible” with certain scenarios in the short and medium term. Various alignment methodologies have been developed in recent years (Raynaud et al., 2020), which aim to estimate the compatibility between the business strategies pursued by financial asset issuers and the social and technological transformations needed to limit global warming to 1.5°C or 2°C.

These methodologies are not without their limitations. In particular, they do not measure financial risk exposure asset by asset. However, although simpler than other methodologies, they still provide relevant information: the more a portfolio of financial assets is “aligned with 2°C”, the better able it is to withstand transition risks. All other things being equal, therefore, it is more prudent for a central bank to hedge its transition risk by accepting “2°C-aligned” collateral than to take no action because it is incapable of measuring risk in a situation of radical uncertainty.

On this basis, it is possible to experiment with a rule whereby the collateral pools pledged by bank counterparties in Eurosystem credit operations have to be “aligned”. This pool-based approach would have the advantage of leaving counterparties free to choose (subject to constraints) the assets that they pledge (in principle there would be no ineligible assets), and of not being reliant on standard valuations of transition risk, which are not currently available.

In aggregate, neither eligible nor pledged Eurosystem collateral appears to be “2°C-aligned”

Based on this logic, we applied two “2°C alignment” methodologies developed respectively by S&P Trucost and Carbon4Finance to Eurosystem collateral data. Our analysis covered some 80% of outstanding eligible securities, and 60% of securities pledged by monetary policy counterparties in May 2020. Despite some divergences, both methodologies show that, on average, eligible and pledged collateral are not aligned with the targets of the Paris Agreement, and can therefore be considered to be exposed to transition risks.

The analysis also suggests that there is a stock of eligible collateral that, if pledged, could increase the alignment of the pools and provide better hedging against transition risks. This does not mean, however, that it would be easy to align the collateral pools, as numerous questions remain. For example, there is no guarantee that counterparties could actually pledge the eligible “aligned” collateral. A pledging rule could also have both positive and negative spillovers that are not evaluated in our working paper (on the positive side, the quantity of eligible and “aligned” assets could increase if markets interpreted the rule as a clear signal enabling them to better value climate risks; on the negative side, the price of eligible but “misaligned” assets could be affected). Finally, the results obtained with the different “alignment” methodologies may diverge and need to be assessed with caution.

These and other questions will be analysed by the ECB as part of its strategic review, which includes a segment specifically dedicated to climate challenges.