The summer of 2023 was the hottest on record at the global level, with an average temperature of 16.77 °C, i.e. 0.66 °C above the reference level (Copernicus, 2023). In 2022, France had already experienced extreme summer weather conditions, with a proliferation of violent storms, repeated heatwaves and exceptional drought (Météo-France, 2022), all of which contributed to forest fires on an unprecedented scale, both in terms of spread and location. In July 2022, France Assureurs estimated the damage caused to homes alone by the bad weather in June at more than EUR 1 billion (France Assureurs, 2022), and counted more than 930,000 new weather-related home claims over the full year (France Assureurs, 2023).

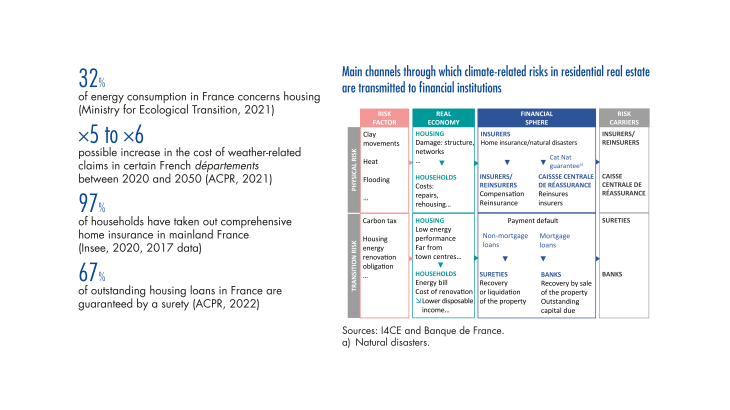

In addition, the real estate sector accounts for around 32% of energy consumption and 11% of greenhouse gas emissions in France (Ministry of Ecological Transition, 2021; Citepa, 2022). It therefore represents one of the key areas for the French economy’s transition to carbon neutrality.

At the same time, French households spend EUR 551 billion on housing (22% of GDP in 2021), which is the largest item of expenditure for the poorest households (Insee, 2022). Finally, real estate accounts for 61% of household wealth and is the largest asset for households in the third to fourth decile (Insee, 2021; Bricongne et al., 2019), while 33% of households repay a mortgage (Insee, 2021).

Climate issues are therefore particularly significant for residential real estate, which is exposed to “physical” and “transition” climate risks. Although these climate-related dynamics and unprecedented developments primarily affect households and their homes, the banking sector cannot ignore them. With outstanding loans of EUR 1,286 billion and an annual amount of new loans of around EUR 218 billion (for 2022, excluding renegotiations), home loans in France account for almost 85% of outstanding loans to households in France, i.e. the bulk of new loans to individuals (Banque de France, 2023a – data as at April 2023).

However, climate risks associated with residential real estate are not necessarily directly transmitted to banking institutions. A number of risk pooling mechanisms exist that can reduce the banking sector’s exposure and vulnerability.

[To read more, please download the article]