Climate change and monetary policy space

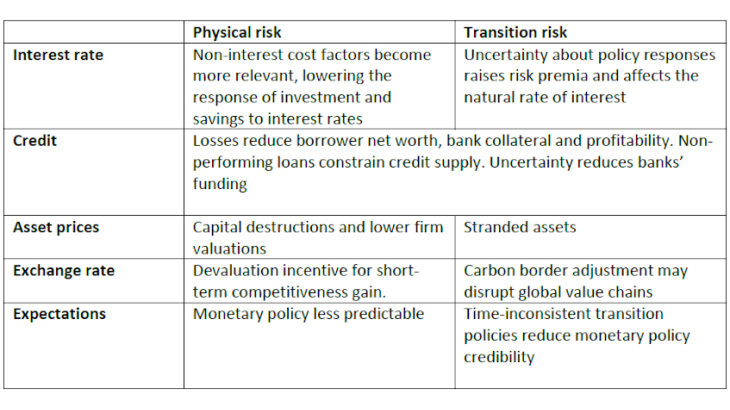

Climate change can affect the policy space of central banks, i.e. the distance between the natural rate of interest r* (the rate consistent with stable inflation and potential growth) and the effective lower bound, as climate change could affect r*. These impacts are uncertain and there are many channels at play.

Some factors, such as higher demand for investment could possibly have a positive impact on r*. Negative factors include lower productivity and increased risk aversion. Productivity growth can be impacted directly, as heat reduces labour productivity and innovation is hampered by resources diverted for reconstruction and adaptation. It can also be indirectly affected, as increased damages to the capital stock may lower long-term growth and transition policies could turn productive investments into stranded assets. Climate change and transition policies go hand in hand with higher uncertainty, which in turn increases risk aversion, the propensity to save and the demand for low-risk assets, two factors that can reduce r*.

If r* declines, the policy space for conventional monetary policy may shrink and non-standard measures may have to be used more actively and persistently.

Climate risks and the conduct of monetary policy

As climate change typically results in supply shocks, including through higher energy prices during the transition, the central bank will be confronted with the challenge of stabilising inflation without disrupting activity. As such shocks are likely to be more frequent and more severe, it may become increasingly difficult for central banks to “look through” such shocks.

Moreover, climate change is expected to have heterogeneous and asymmetric effects on the euro area economy, which may make it harder to formulate a single monetary policy and its effectiveness more differentiated across countries. Physical risks across member countries are more heterogeneous than in a small, open economy and transition policies will have asymmetric effects, because of different starting levels of greenhouse gas (GHG) emissions.

Quantifying the monetary policy challenges posed by climate change

Scenario analyses can help central banks to identify and to quantify plausible future developments where climate change might complicate the conduct of monetary policy and affect their ability to ensure price stability.

Their results show first that extreme weather events are likely to expose the euro area to new types of shocks, which may have large and unpredictable economic consequences. Assuming that disasters, designed as a random set of demand and supply shocks, would become more likely, and be recessionary, average inflation could fall markedly below the ECB’s target. This fall would be even greater if the natural rate of interest is assumed to decline because monetary policy would find it more difficult to counteract the shock. A simulation of more frequent disaster shocks shows that, with r* at 1%, inflation averages would decline to 0.5% and effective lower bound episodes would occur more frequently and last longer (simulation conducted using the New Area-Wide Model-II of Coenen et al., 2018).

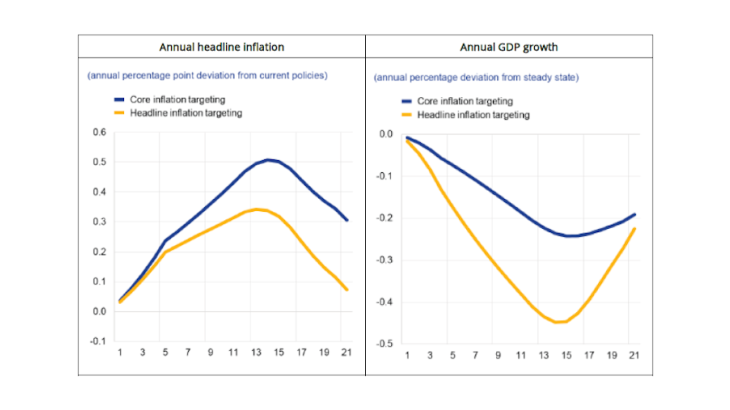

Second, the transition to a low-carbon economy is also likely to influence inflation and output growth, and hence the optimal response of monetary policy. In the event of a disorderly transition, featuring a sharp, unanticipated increase in carbon prices, and if the central bank “looks through” the relative price change (core inflation targeting), annual headline inflation would be likely to increase, rising to 0.5 percentage point above the baseline. Annual GDP growth would be somewhat lower, by just over 0.2 percentage point by the fourth year (simulations conducted with the model of Adjemian and Darracq-Pariès, 2008). Should the central bank choose to lean against the increase in headline inflation, inflation would be more contained but the downward impact on GDP growth would be exacerbated.

Disruptions linked to climate change and transition policies could therefore affect the ability of the ECB to best deliver its price stability mandate. Disorderly and insufficiently ambitious transition could reduce the central bank’s policy space and create output and price stabilisation trade-offs that would hamper the ECB’s ability to respond optimally. Therefore governments need to send long-term signals and anchor credible, ambitious commitments in order to make the transition orderly and predictable.