Climate change and modelling issues

In its Monetary Policy Strategy Review, the Governing Council of the ECB made a strong commitment to further integrate climate change considerations into its monetary policy framework. The development of new models will help to better monitor the economic and financial implications of climate change and transition policies, and their impact on the transmission of monetary policy (see ECB (2021)).

It is indeed essential that central banks deepen their understanding of the effects of climate change on both prices and growth, both over the economic cycle and over much longer time horizons.

A concrete action plan for macroeconomic projections

The Eurosystem has focused in particular on the three-year macroeconomic forecasts, which are produced every quarter and are often decisive for monetary decision-making. The GDP and inflation trajectories are at the heart of these exercises, which go into a fair degree of detail (consumption, investment, unemployment; total inflation versus inflation excluding energy and food, etc.), as well as an assessment of the 10-year growth potential. Despite the relatively short time horizon of the projections, it would be a mistake to ignore the consequences of climate change. The ramping-up of transition policies or the increase in the frequency of extreme weather events may indeed affect the trajectory of the European economy over the next 3 to 4 years, especially if these policies also affect long-term potential GDP.

The macroeconomic effects of certain transition policies, for example the introduction of a carbon price, subsidies for private investment or public spending in national budget plans, are already covered by the projections.

In contrast, changes in terms of regulations or behaviour are more difficult to assess. As regards extreme weather events, which are not predictable by nature, it is more a question of acquiring the means to analyse them when they occur. Finally, determining whether long-term physical risks, such as rising temperatures, will lead to significant structural changes over a three-year horizon remains an open question.

The Eurosystem has undertaken five actions to improve the consideration of climate change in projections:

- better assess the effects on prices along the production chains of the EU-Emissions Trading System (EU-ETS), the key tool for managing carbon dioxide emission reductions;

- assess the specific impact of climate policies on GDP and inflation, e.g. investments included in the NGEU recovery plan;

- improve the tools for projecting energy prices in Europe, with a better description of how these prices are formed on wholesale markets and passed on to end consumers;

- examine the impact of physical risks and transition policies on long-term trends, in particular on productivity trends and capital accumulation;

- analyse the risks around the central projection, both the risks of extreme weather events, with low a probability but important consequences, and the risks linked to the roll-out of transition policies.

What is the strategy for developing central bank models?

The Eurosystem aims at developing tools for taking account of climate issues in its projections, but also more generally for scenario analysis.

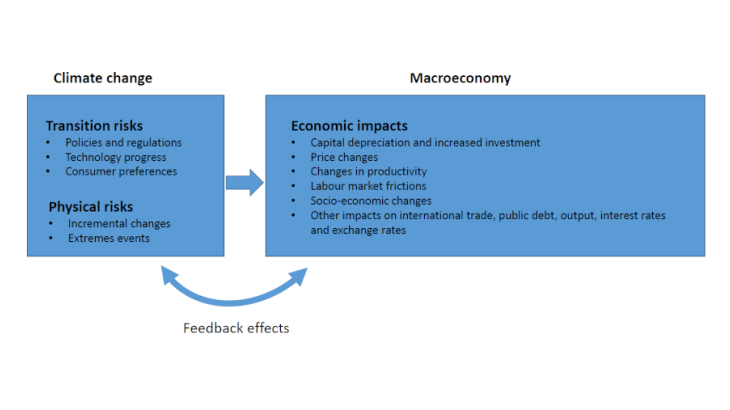

Although a number of quantitative models already exist, known as integrated assessment models (IAMs), which link the climate system and economic developments, these models have very simplified representations of the economy, as most transmission channels are absent, and feedback effects between the climate and the macroeconomy remain limited. Moreover, these models tend to specify physical risk and transition channels independently and do not capture the macroeconomic effects on inflation of GDP and employment components, which are essential variables for central bank analysis.

Some central banks (including the Banque de France) and financial institutions started to develop tools to better understand the macroeconomic effects of climate risk (within the framework of the Network for Greening the Financial System (NGFS), for example). In the short term, the strategy for integrating the relationship between climate models and macroeconomic models is that of the "model suite", which makes it possible to translate climate scenarios obtained from climate models, such as IAMs, into macroeconomic, sectoral and financial variables (see, for example, Allen et al., 2020).

In the longer term, climate risk also needs to be included in the models at the heart of central bank analysis in order to take account of their interactions with other more conventional risks over the usual monetary policy horizon. This implies changing the main reference models, notably the semi-structural models, which are at the heart of forecasting and simulation exercises of alternative scenarios at the same horizons, and certain dynamic stochastic general equilibrium models (DSGE). In any case, in order to better reflect climate risk, central bank models will gradually need to be enhanced with new mechanisms that could become key. In addition to taking into account specific instruments for climate change mitigation (such as carbon emission allowances), the impact of the energy sector on economic dynamics, including on international trade, the valuation of certain financial assets and, if possible, new international macro-financial channels will need to be further examined. Beyond the monetary policy horizon, it is important to assess the impact of climate risk on potential growth and its consequences for price stability.