The paper addresses a significant challenge: understanding the economic effects of the climate transition induced by government policy, not only in the distant future, but also in the next few years. Historically, the climate transition has been treated as a long-term issue, with economic models focusing either on far-off outcomes or short-term factors like its impact on purchasing power and consumer spending. But these separate approaches miss the joint impact of the low-carbon transition on the economy in the medium- and long-run.

To bridge this gap, we combine two types of economic models: a new real micro-founded general equilibrium model called FR-GREEN that looks at how different types of energy (clean vs. dirty) and technological choices affect the economy; and a more detailed nominal forecasting model for France called FR-BDF, in the spirit of the FRB/US model of the Federal Reserve Board, that accounts for short-term dynamics like inflation and demand. Using this approach, we assess the impact in France by 2030 of the Fit-for-55 package, modelled as a carbon tax. We enrich this tax scenario in FR-BDF with shocks on total factor productivity (TFP) and on the share of consumption devoted to fossil fuel energy obtained from a simulation of FR-GREEN and intended to capture channels missing in FR-BDF, i.e. the usage of energy as an input by firms, reallocation of production across sectors and composition effects within consumption.

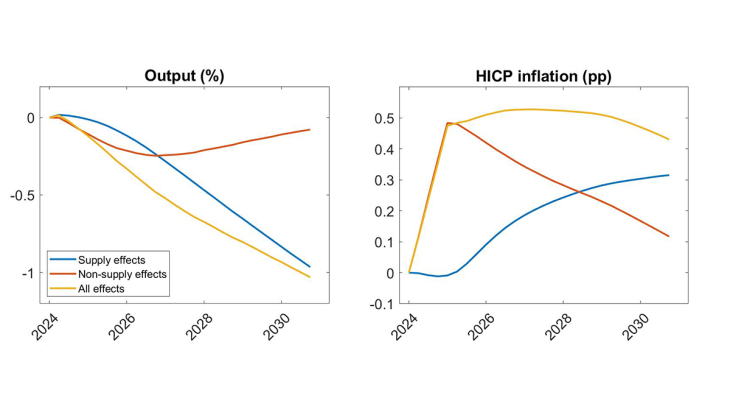

We find four key results (see Figure 1):

- The shift from fossil fuels to green energy technologies leads to lower supply of output. In a model where these energies are not modelled explicitly, this corresponds to an apparent productivity loss during the transition, in the absence of any favourable assumption regarding technological progress potentially driven by the transition.

- Carbon taxes raise inflation in the short run, peaking at around 0.5 percentage points higher, at first due to the direct effect of these taxes on final consumer prices and afterward mostly due to supply effects related to higher energy costs for firms.

- Total output falls, by about 1.0% by 2030, primarily due to supply-side disruption as industries adjust to cleaner technologies.

- These results depend on the response of monetary policy. Keeping real interest rates constant, as assumed in the baseline scenario, leads to a moderate inflation surge and output losses. By worsening output losses, a more aggressive monetary response could limit inflation in the medium run, in line with the Phillips curve mechanisms embedded in the model.

This paper provides a more complete picture of how transition policies can ripple through the economy. It shows that while such policies are necessary to fight climate change, they can have substantial economic effects that policymakers must prepare for.

Keywords: Energy, Climate, Transition, Carbon Tax, General Equilibrium

Codes JEL : Q43, Q54, Q58, E37