- Home

- Publications et statistiques

- Publications

- Bank solvency, liquidity and financial c...

Post n°173. Bank solvency and liquidity risks mutually interact. Using a model that simultaneously estimates the solvency and liquidity ratios of French banks, it is possible to incorporate them jointly into a stress scenario. It shows that the financial environment has a significant impact, but only in times of crisis, and that solvency has an impact on liquidity, not vice versa.

Sources: ACPR, authors’ calculations.

Interactions between bank solvency and liquidity

Economic literature on banking highlights a paradox. The interactions between bank solvency and liquidity are well identified in analyses, yet there are few integrated models that estimate both of them jointly. It should first be recalled that the solvency of an institution refers to its ability to pay its debts over all horizons (short, medium and long term). It implies that the amount of the institution's assets exceeds the amount of its liabilities, i.e. its capital is positive or exceeds a minimum threshold; it is a kind of stock or balance sheet measure. Liquidity, on the other hand, refers to the institution's ability to meet its immediate financial obligations in order to avoid default, by mobilising its marketable assets or raising short-term funds (refinancing); it is therefore more of a measure of flow.

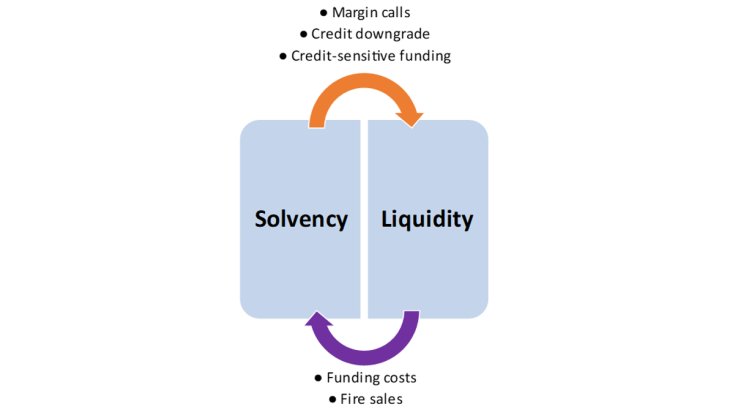

As regards the relationship between solvency and liquidity, the literature has identified several transmission channels in the case of financial shocks, such as funding costs, fire sales of assets at dislocated prices, uncertainty about asset quality, the confidence channel or asset profitability. These interactions are clearly summarised in the diagram below. They explain how, in the event of a crisis, a problem that initially appears to affect only the liquidity of a bank can quickly turn into a serious solvency problem and lead to the failure of the institution. Indeed, more capital means a larger share of stable funding, which is assumed to enhance the liquidity ratio. Conversely, during a liquidity crisis, a bank may find it difficult to obtain funding or obtain it at higher costs. This increase in financing costs reduces its profits, which means that a smaller amount of income can be set aside to bolster its capital. Moreover, in the event of a liquidity crisis, a bank may resort to fire sales of assets to raise cash, which can result in losses if the assets are marked to market and thus impair the bank's solvency.

Source Cont et al. (2019)

However, few articles are devoted to the development of an integrated model of joint solvency and liquidity stress testing, with the notable exception of Cont et al (2019) cited above. Several factors account for this gap. Firstly, before the entry into force of the Liquidity Coverage Ratio (LCR) in 2015 under the Basel III reform package, there was no internationally harmonised liquidity ratio. Secondly, data confidentiality makes it difficult to estimate bank liquidity in the academic sphere. And finally, two different accounting frameworks are applied to bank solvency and liquidity, since capital is valued at book value while liquid assets are recorded at market value.

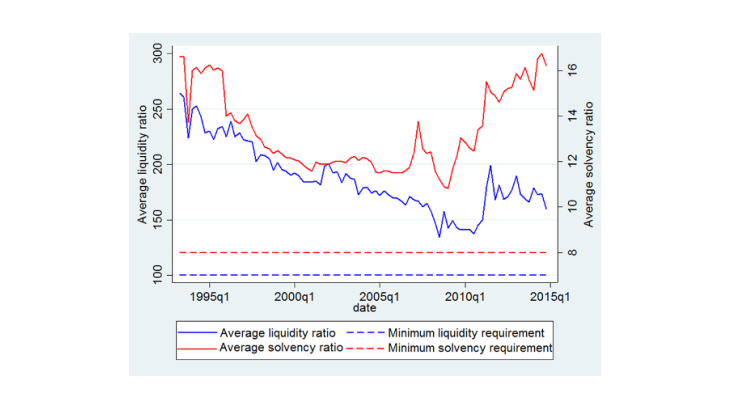

A bank liquidity model incorporating various interactions

In de Bandt et al (2019), we estimate a simultaneous equation model identifying the determinants of bank solvency and liquidity. Our panel data include 725 French banks on a non-consolidated basis, 102 quarters over the period 1993-2015, i.e. more than 23,000 observations. Our two dependent variables are, on the one hand, the solvency ratio, i.e. the ratio of banks' capital to their risk-weighted assets, and, on the other hand, the liquidity ratio applied to French banks between 1988 and 2014. This coefficient is calculated as the ratio between the liquid assets and own funds of French banks and their net cash outflows over a 30-day horizon. It was replaced by the LCR in 2015 and we ensure that the correlation between the French liquidity ratio and the LCR enables us to use the liquidity ratio as a good historical approximation of the LCR.

Using our model, we seek to identify the relationship between the liquidity ratio, the level of solvency and a series of explanatory variables. In particular, we attempt to take account of the various interactions whose importance has been highlighted in the literature, notably that between banks' funding liquidity and market liquidity. The latter is defined as the ability of a market or asset to absorb sales flows without changing price. For this reason, our model includes two variables representative of market liquidity:

- the VIX index, measuring volatility in the Chicago Board Options Exchange SPX market and traditionally used as a measure of the risk aversion of international investors;

- the spread between the 3-month Euribor interbank rate and the 3-month German Bund rate, taken as the risk-free rate.

We use several other explanatory variables, either macroeconomic (GDP growth, inflation rate) or banking (return on equity, share of transactions with non-financial customers in total assets, size of the bank).

Our estimates yield several noteworthy results. First, there is a "one-way" relationship between solvency and liquidity: the former has an impact on the latter, but we do not observe the opposite relationship. This lack of an impact of the liquidity ratio on solvency could reflect the large margin that French banks had over the regulatory minimum of 100% for liquidity. This minimum therefore appears to be much less restrictive than the minimum ratio of 8% which was imposed for capital. A decrease in the liquidity ratio had therefore a lesser impact than a decrease in the solvency ratio. Second, we only find a negative impact of aggregate financial risk variables in periods of high stress, highlighting the existence of non-linear effects. The impact of financial variables is more significant on net cash outflows, i.e. the denominator of the liquidity ratio, than on the stock of liquid assets in the numerator. This reflects the fact that, in the event of a crisis, banks can no longer finance themselves over the long term, so this shortening of the maturity of financing increases net cash outflows at a 30-day horizon.

A possible application for a bank liquidity stress test

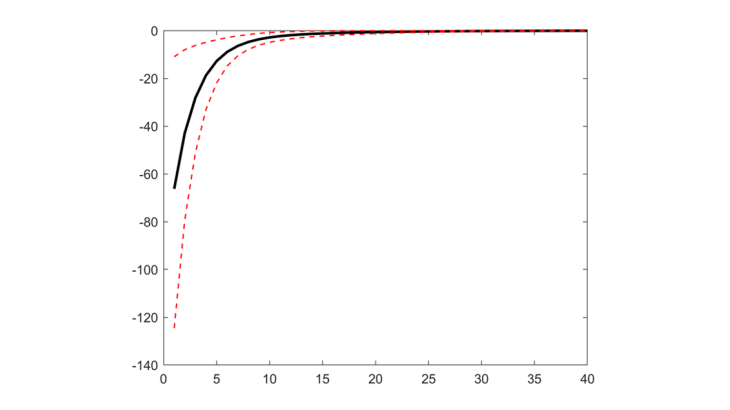

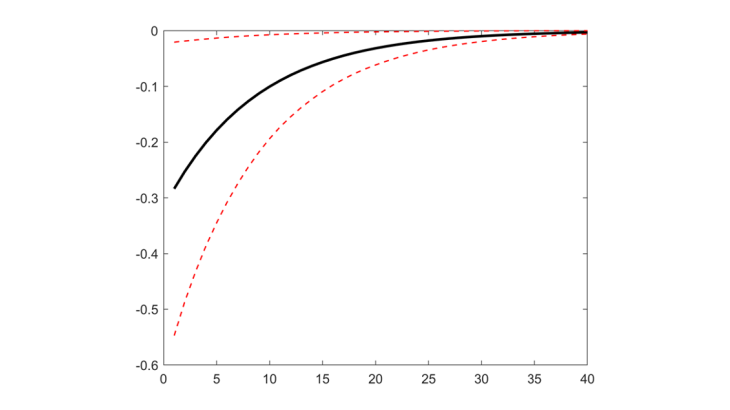

We propose a numerical application of the results of our model to determine the response of liquidity and solvency ratios to market shocks. To this end, we use the coefficients obtained from our econometric regression to infer the response of these two variables to an adverse shock, i.e., an increase in the VIX of 10 percentage points.

The results are presented in Charts 3 and 4, with the quarters on the x-axis. We observe that the impact of the shocks on solvency is much more persistent than on the liquidity ratio, since the impact on the latter disappears between 5 and 10 quarters, compared with more than 20 quarters for the solvency ratio. The solvency ratio seems to be more persistent, reflecting the higher autoregressive coefficient obtained in our simultaneous equations.

In conclusion, this post presents the results of a preliminary model estimating simultaneously bank solvency and liquidity ratios. In particular, it makes it possible to highlight the impact of a shock to market liquidity on bank funding liquidity. Avenues for further research lie in the direct estimate of the LCR when the time series are long enough.

Updated on the 25th of July 2024