This paper investigates the impact of multinational enterprises’ (MNEs) use of tax havens on the aggregate labor share of added value, a key measure of inequality. The labor share is defined as the ratio of the total wage bill to value added, and the study explores how MNEs’ tax haven presence affects both the numerator (the wage bill) and the denominator (value added) of this ratio. Using firm-level data from France between 1997 and 2014, the paper provides a detailed analysis of how entry of French MNEs in tax havens alters the distribution of income between workers and shareholders at the aggregate level.

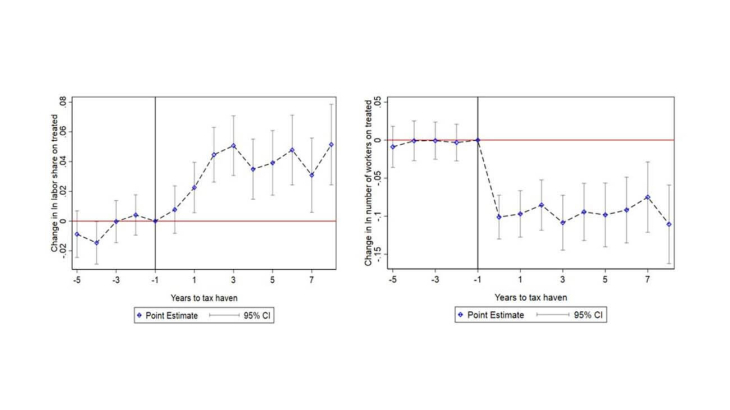

The findings reveal two distinct mechanisms by which tax haven entry affects the labor share. First, the "tax channel," extensively discussed in the literature, explains how profit-shifting reduces the value added reported in high-tax jurisdictions, artificially inflating the labor share in these countries. Second, the paper uncovers a novel "financial opacity channel," through which tax havens allow MNEs to circumvent costly labor regulations and restructure their operations, leading to significant reductions in employment. The analysis shows that, at the micro level, an MNE’s entry into a tax haven is associated with an average increase in its labor share of 2.6%. However, this increase masks competing effects. Firms experience an 11.4% decline in value added, partly due to profit-shifting, accounting for 40% of the effect, and partly due to reduced real activity, accounting for the remaining 60%. Simultaneously, the total wage bill decreases by 8.8%, driven almost entirely by a sharp decline in employment (-8.5%), while average wages remain unchanged. The paper proposes a methodogy to map the micro-level estimates to the macro-level change in the labor share, whereby MNE’s usage of tax havens explains 0.49 basis points (bp) of the increase of the aggregate labor share in France over 1997-2014. Given that the observed change of the aggregate labor share over 1997-2014 is 5.16 percentage points (pp), 0.49 represents around 10% of the observed increase in France’s aggregate labor share during the sample period.

The "financial opacity channel" highlighted in this paper is novel in the sense that it reveals a real effect on employment, whereas prior literature had focused on how opacity allows reducing profits on which workers bargain their wages. By providing financial secrecy, tax havens enable firms to artificially demonstrate a decline in sales, which, under French labor law, can justify collective layoffs. Beyond allowing the firm to justify a collective layoff procedure, it allows firms to reduce the costs associated to these as they depend on the firms’ profits. The paper also finds no evidence that the employment reductions associated with tax haven entry are linked to increased capital intensity, reinforcing the argument that these reductions stem from systematic firm restructuring enabled by financial opacity and not by a decline in the cost of capital following the decline in taxes paid by the firm. In summary, this study contributes to the literature by demonstrating that MNEs’ use of tax havens has significant effects on the aggregate labor share through both the tax channel and the financial opacity channel. These findings have important implications for understanding the relationship between global finance and labor market outcomes.

Keywords: Tax Havens, Labor Shares, Profit Shifting FDI, Inequalities.

JEL classification: D33, F23, H26, H87, F66.