This article analyses companies’ economic and financial situation in 2021, using the corporate financial statements contained in the Banque

de France’s Fichier bancaire des entreprises (FIBEN) (see methodological appendix). The scope of the study covers companies based in France, which are subject to corporate income tax, generate a turnover of over EUR 750,000 and do not belong to the financial sector. The study is based on the annual accounts of more than 360,000 legal units, which are grouped into 240,000 companies defined according to the Law on the Modernisation of the Economy (LME), i.e., small and medium-sized enterprises (SMEs), intermediate-sized enterprises (ISEs) and large enterprises (LEs).

1. Activity picked up significantly in 2021

The majority of companies returned to their pre-crisis level of turnover

Activity picked up significantly in 2021, after the slump in 2020 caused by the outbreak of the health crisis. Turnover thus increased by 12.3% in 2021 compared to 2020, after a 7.3% drop in 2020 (see Table 1). This rise concerned not only SMEs (+12.4%) but also ISEs (+10.0%) and LEs (+14.1%).

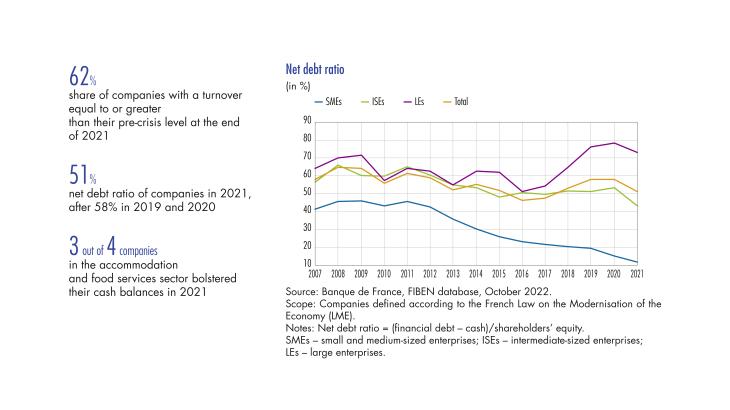

Overall, turnover even exceeded its pre-crisis level: it was up by 2.9% in 2021 compared to 2019. However, while most of the major sectors returned to turnover levels close to or above pre-crisis levels (up 5.0% in trade or down 1.5% in manufacturing, for example), the accommodation and food services sector recovered only slowly, with turnover still 23% below its pre-crisis level. In this context, only 23% of companies in the accommodation and food services sector had returned to a level of activity equal to or greater than their pre-crisis level by 2021, compared to 62% for all French companies.

Value added and EBITDA posted a particularly strong rebound in 2021

Value added picked up markedly across all company sizes: +13.1% for SMEs, +10.1% for ISEs and +16.4% for LEs (see Table 2). As in 2020, the change in value added is strongly correlated with that of turnover. This suggests that, on average, companies were able to adjust their intermediate consumption – both downwards in 2020, at the height of the crisis, and upwards in 2021 despite the tensions observed in supply chains.

Unsurprisingly, personnel costs rose significantly in 2021 (+7.6%).

[to read more, please download the article]