1st prize in the 2023 Eco Notepad competition

Graduate of ENSAE and Public Policy Masters Student at Sciences Po

Post n°342. Overall, inflation results in an increase in production costs for businesses and a fall in purchasing power for households. However, the inflation really incurred by economic agents may, depending on their characteristics, differ from "actual" average inflation, reported in particular by the consumer price index (CPI).

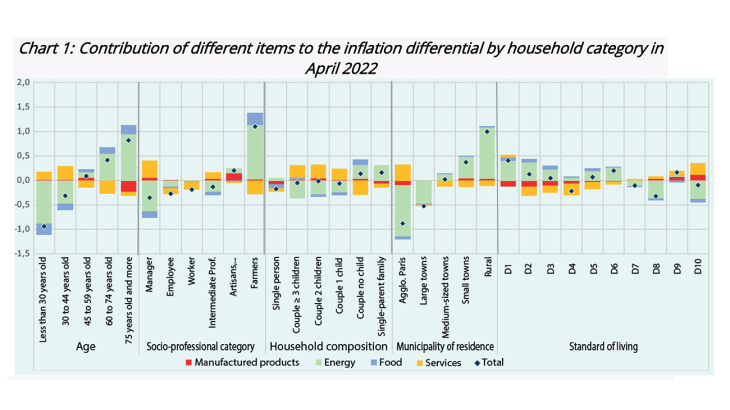

Notes: in April 2022, inflation was 1 percentage point higher for households living in rural areas than for headline inflation. Energy contributed 1.1 percentage point to this differential.

In April 2023, according to INSEE, consumer prices in France rose by 5.9% year-on-year, driven by energy (6.8%), food (15.0%) and services (3.2%). For households, the impact of inflation and the ability to adapt to it vary according to age, living standards, socio-professional category and place of residence, as evidenced by the differences between household categories (see Chart 1). For businesses, the effects vary according to sector (Insee-CAE)), size, financing structures and their markets. This is why a disaggregated approach is needed to analyse its effects.

Breakdown of the impact of inflation between households and businesses

Inflation above 2% in the medium term could trigger a spiral in which households and businesses redistribute the effects among themselves to minimise their respective costs. In order to preserve their margins, businesses pass on the rise in production costs to prices. But inflation changes relative prices and forces firms to make a trade-off between preserving margins and remaining competitive. According to a joint Insee-CAE study, margins appear to absorb up to 50% of the rise in marginal costs due to an increase in imported costs in the short term. As household incomes rise more slowly than prices, their purchasing power falls, which can prompt them to demand higher wages, which in turn increases production costs and can trigger an inflation-wage spiral.

Inflation is also likely to generate more inflation, particularly when economic agents anticipate it in order to protect themselves. On the one hand, businesses, fearing that their costs will rise, may decide to raise their prices immediately, thereby rendering expected inflation a reality and having a greater impact on purchasing power. On the other hand, households, fearing persistent inflation, may decide to consume more today to avoid paying a higher price for the same item tomorrow, thus stimulating inflation through demand.

Households and businesses are unevenly exposed to the impact of inflation

The impact of inflation varies according to consumption patterns and income levels. According to INSEE, the lower weight of energy (particularly heating) and food in young people's budgets has meant that they have been less affected than the rest of the population. These two items contributed -0.9 and -0.2 percentage point respectively to the negative inflation differential relative to the average actual inflation observed in April 2022 for households whose reference age is under 30, and the opposite is true for those aged 75 and over (see Chart 1). Similarly, residents of large cities, who are less car-dependent, were less affected than households living in rural areas.

Income structure, i.e. the propensity of agents to consume or save, is also a determining factor. On the one hand, as consumer spending represents a smaller share of the income of the wealthiest households, they may appear to be relatively better protected against inflation. On the other hand, while inflation benefits fixed-rate borrowers by reducing the real cost of debt, it can also reduce the real value of some of their assets. In this way, inflation can also affect the wealthiest households.

Moreover, indexation mechanisms can also change economic agents' exposure to inflation. Although the indexation of pensions, the minimum wage and social benefits is intended to protect the most vulnerable from inflation, these categories are more sensitive to observed price rises and may nevertheless be particularly affected.

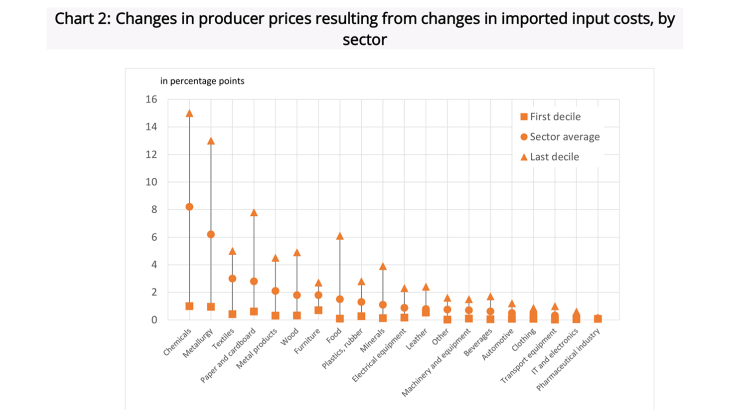

Notes: In the case of the food sector, the change in imported costs increased prices by an average of 1.5 points, and by 6.1 points for the 10% of the most affected industries.

As regards businesses, the impact of inflation varies across and within sectors, due to unequal sensitivity to the rise in the cost of energy and imported inputs. For instance, in the textiles and chemicals sectors, where 56% and 50% respectively of production costs are made up of imported inputs, the average sectoral selling price rose by 3.0 and 8.2 percentage points respectively (see Chart 2). Similarly, energy-intensive sectors saw a more marked rise in prices. But according to the Insee-CAE study, the impact in terms of price dispersion is greater between firms in the same sector than between sectors, due to different input suppliers, firm sizes and price-demand elasticities.

An uneven ability to adapt to the impact of inflation

The fall in consumption of goods driven by food (-1% in volume terms in April 2023 according to INSEE) shows that, faced with an inflationary shock, households can also adapt, but their ability to do so has been uneven. According to an article by the French Treasury, it was the lowest 10% who drew on their Covid savings to cope with the rise in prices. So, while for the upper living standard deciles, inflation can be an incentive to change consumption patterns and reduce unnecessary spending, for the lower deciles it can also be synonymous with deprivation. By forcing them to reduce the quality and quantity of what they consume, inflation can also lead to a feeling of social decline According to INSEE, households' perception of their past financial situation reached a particularly low level in April 2022.

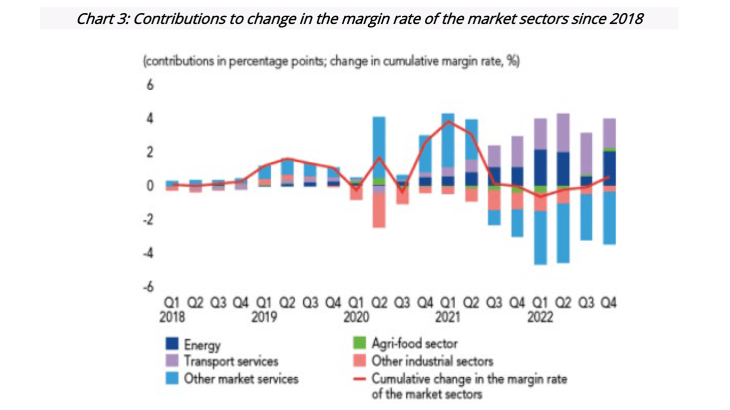

Notes: in France, in Q4 2021, the margin rate stood at the same level as in 2018. Transport services have contributed 2 percentage points to the cumulative change in the margin rate since 2018.

Firms' ability to adapt also varies. While those operating in competitive markets moderate their prices, those with significant market power maintain high margins, as shown by the positive contributions made by the energy, transport services and, more recently, agri-food sectors, to the change in the margin rate for market sectors since 2018 (see Chart 3). In some cases, the rise in production prices was greater than the rise in costs. This strategy, known as “greedflation”, can ultimately exacerbate inflation through the second round effects it generates: this dynamic is known as "tit-for-tat inflation". Lastly, size and financing structure also determine adaptability. Smaller, unlisted companies are more dependent than others on access to credit. With less access to bond financing, 43% of them use bank credit. (Vinas and Lé, 2023). As a result, faced with a restrictive monetary policy that makes access to credit more difficult, these firms are more affected because they are unable to diversify their sources of financing and switch to less costly sources.

More targeted economic policies to offset the uneven impact of inflation

There is a consensus on the need to provide public support to the worst affected businesses and households. Such is the role played by the early increase in welfare benefits, exceptional back-to-school assistance, energy vouchers, the tariff shield and fuel allowances. According to OFCE, without these subsidies, the fall in purchasing power per consumption unit between the end of 2022 and the end of 2023 could have reached 5% under the least favourable scenario, instead of 2%. These measures supplement monetary policy, which is the only fundamental way of targeting the causes of inflation.

Furthermore, support measures based on households' past consumption patterns, such as the payment of transport subsidies to households that have historically spent a high proportion of their income on this item, could be considered. Moreover, the additional revenue from taxes - such as VAT - whose base has mechanically increased with inflation could be redistributed to the most affected households. Lastly, a tax or "temporary solidarity contribution" on windfall profits in specific sectors, such as that recently introduced, would discourage greedflation and allow redistribution to SMEs. In addition to the energy sector, which has already been targeted, the transport services sector could also be included (see Chart 3). The tax base could be calculated as the difference between current profits and a pre-covid benchmark, provided that the implementation difficulties associated with such a measure are overcome.

The winners were selected by an independent jury of experts and researchers. Eco Notepad has allowed all opinions to be expressed as long as they are well-founded. The views expressed in these winning entries are those of the authors and do not in any way reflect the position of the Banque de France or the members of the jury.

Download the PDF version of the publication

Updated on the 25th of July 2024