Activation of countercyclical capital buffers in Europe: initial experiences

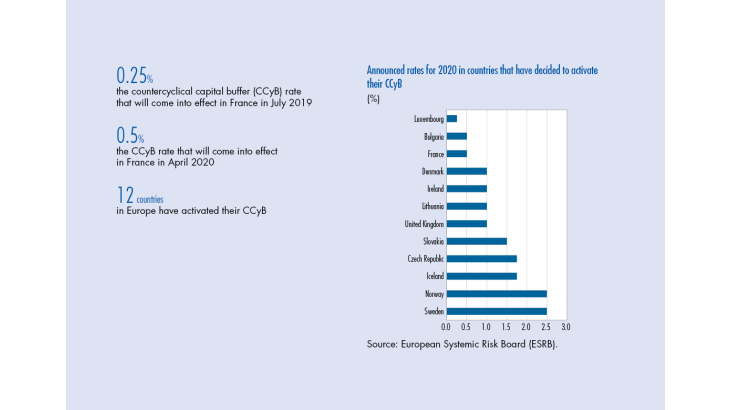

Bulletin n°222, article 1. When there is a downturn in the financial cycle, banks restrict credit in anticipation of an increase in risks and related provisions. Macroprudential authorities have a specific instrument at their disposal to deal with this: the countercyclical capital buffer (CCyB). During favourable periods, the CCyB can be increased to impose additional capital holdings on banks, which can then be used during unfavourable periods to absorb losses and ensure an appropriate supply of financing to the economy. Nevertheless, the concern remains that increasing the CCyB could burden the economy with a cost that far outweighs the expected benefits. These fears are unwarranted however: countries that have activated the CCyB have experienced no negative effects and now have widened the policy space that could respond to potential crises. As a precautionary measure, the French macroprudential authority, the Haut Conseil de stabilité financière (HCSF – High Council for Financial Stability), recently increased the countercyclical capital buffer in two steps.