This preservation of household income in France was counterbalanced by a deterioration not only in the fiscal deficit (as in other European economies), but also in corporate income. Accompanied by a fairly high level of investment given the usual determinants (see the latest Banque de France macroeconomic projections), the increase in companies' net borrowing, which came on top of those of the general government, resulted in a deterioration in the external balance, as these increases were not offset by higher household financial savings (net lending).

This post compares the 2020 episode to the periods when the fiscal deficit and the external deficit increased, to describe its origin from a household and/or corporate savings angle.

Combined deterioration in the fiscal and external deficits in 2020, contrasting with 2009

The sharp increase in the fiscal deficit in France in 2020 enabled household income to be preserved, while the sum of incomes contracted. The difference between the sum of incomes and the sum of spending (consumption and investment) is the nation's net lending/borrowinf, which reached -2.5% of GDP in 2020 (external deficit). When not taking into account external income flows, the sum of incomes is equal to the value added produced in the country.

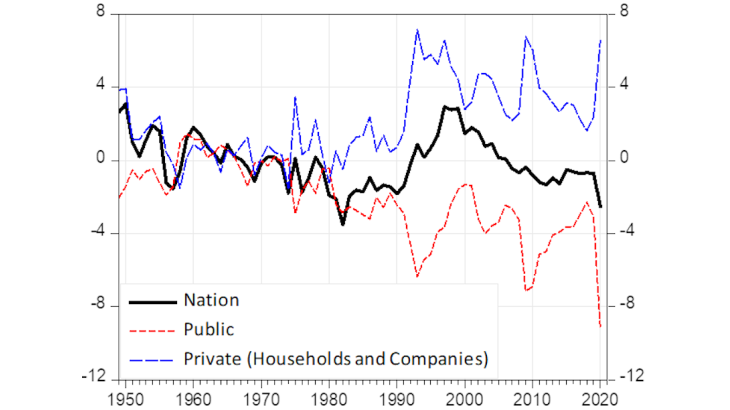

The nation's net lending/borrowing, which corresponds to the balance with the rest of the world, is also the sum of those of the private sector (households and companies) and general government (which is negative in the case of a fiscal deficit). When the fiscal deficit increases, the external balance deteriorates, unless the private sector's net lending improves and offsets this.

The sum of net debt flows is the "net external position", which corresponds to the nation's net financial wealth. At the end of 2019, it was in negative territory by a little over EUR 550 billion (23% of GDP). It was well below the alert threshold used in the European macroeconomic imbalance procedure (35% of GDP).

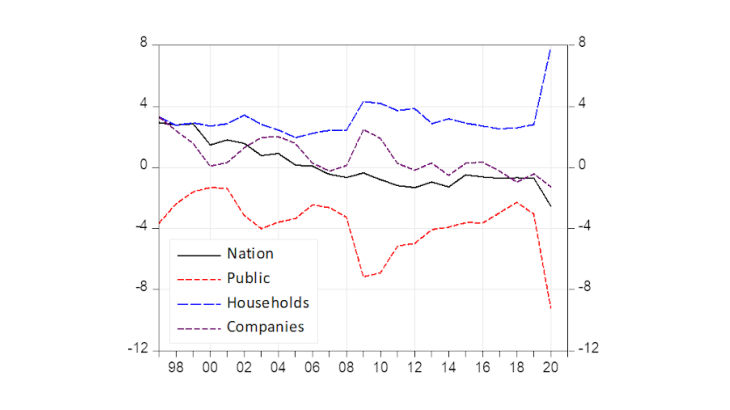

The 2009 crisis led to an increase in the private sector financing capacity identical to that of 2020, but with a very different distribution between households and companies (see Chart 2 for private net lending). As the increase in the fiscal deficit was smaller than in 2020, it was not accompanied by an external deficit. Household financial savings, at nearly 8 points of GDP, were exceptionally high in 2020 (Chart 1). In 2009, it was the increase in corporate net lending, following the decrease in investment (see above for income trends), that explained the increase in private financing capacity. This offset the public dissaving.

Past external deficits were less attributable - or not attributable at all - to the fiscal deficit