- Home

- Press Releases

- The Banque de France publishes a report ...

The Banque de France publishes a report on its experiments with wholesale Central Bank Digital Currency (CBDC), conducted in 2020 and 2021

The Banque de France has reached an important milestone in its programme of experiments with a wholesale CBDC, with the publication of its report on the results of the first phase of the programme, launched in March 2020.

Published on 8th of November 2021

The tests focused on ways of integrating a CBDC into innovative procedures for the exchange and settlement of financial assets, based on new technologies such as Distributed Ledger Technology (DLT), and in a multi-currency and cross-border setting.

Promoting the role of central bank money, the safest settlement asset.

The programme complements and builds on the investigation phase for a retail CBDC (digital euro) launched in July by the Governing Council of the European Central Bank (ECB), and in which the Banque de France is actively participating. The goal in both cases is to preserve the pivotal role of central bank money in the settlement of retail payments (digital euro) and transactions between financial intermediaries (wholesale CBDC), to ensure that financial transactions remain secure.

Central bank money remains the safest and most liquid form of settlement asset for all economic agents.

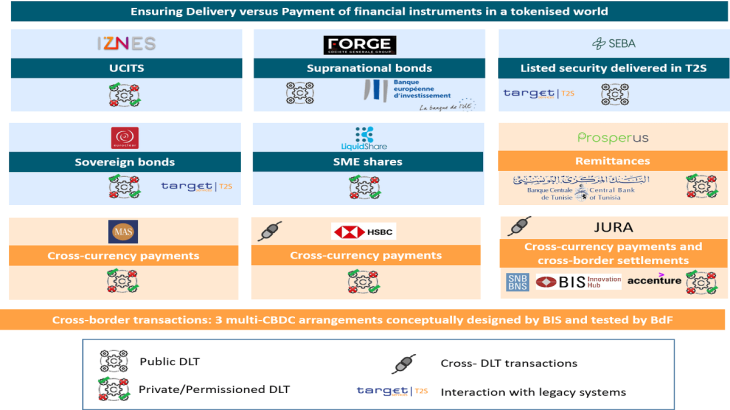

The report covers nine experiments, selected from close to 40 proposals, which were conducted as of September 2020 in conjunction with domestic and international private sector players, as well as other central banks and public authorities. Numerous technological partners were also involved, enabling the experiments to explore a broad range of technologies (see illustration below).

The report covers nine experiments, selected from close to 40 proposals, which were conducted as of September 2020 in conjunction with domestic and international private sector players, as well as other central banks and public authorities. Numerous technological partners were also involved, enabling the experiments to explore a broad range of technologies (see illustration below).

Demonstrating the potential of a wholesale CBDC to secure financial transactions involving tokenised instruments and facilitate cross-border payments.

“These experiments with a wholesale CBDC were carried out in record time, in less than a year, and show how interested market participants are in the subject, as well as their expectations regarding public authorities. With the emergence of financial assets in tokenised form, we have shown that a CBDC, combined with the potential of new technologies, can ensure the safe settlement of transactions in these assets and thereby contribute to the secure development of these innovations. We have also demonstrated that a wholesale CBDC would be of benefit for cross-border and cross-currency payments as it would improve the efficiency of processing chains,” said Nathalie Aufauvre, Director General of Financial Stability and Operations, and head of the Banque de France’s experimentation programme.

Continuing our work on the implications of a wholesale CBDC, and the questions raised during the experiments.

The experiments raised some important questions that need to be examined further. Most importantly, the issuance of a wholesale CBDC that was available to a large number of market participants could affect the role of financial intermediaries and the transmission of monetary policy. It is essential, therefore, that central banks retain full control over a wholesale CBDC once it has entered circulation.

“We also need to look in detail at the technologies that could be used to issue and distribute a wholesale CBDC, and examine all available options in light of the strict requirements for availability, performance and energy efficiency,” said Nathalie Aufauvre.

The report is available on the website of the Banque de France.

Contact us

Updated on the 29th of January 2024