Cash industry efficiency

To support and keep pace with the cash industry, the Banque de France has been pushing ahead for a number of years with a strategy for adapting its operational cash-management structures. Banknotes and coins are a "physical" means of payment, whose use is based on a complex logistical management process within the cash industry. This drive for efficiency means eliminating redundant processing operations and transloading, and optimising cash and coin transport and storage. The strategy of adaptation is necessary to maintain the competitiveness of cash, in an environment that favours the development of electronic payments, and thus guarantee that everyone has the freedom to choose how they wish to pay.

The Banque de France national network

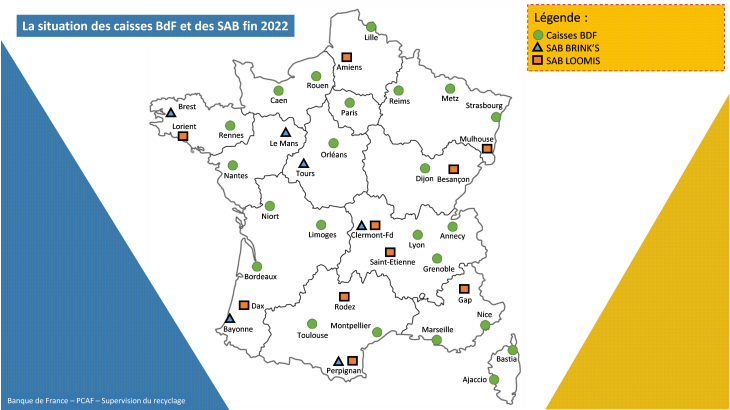

As part of these changes, the Banque de France signed agreements with the two main cash-in-transit companies to create auxiliary banknote storage facilities, referred to as SABs (stocks auxiliaires de billets), where cash owned by the Banque de France is held by the transporters.

The launch of the SABs, of which there were 16 in 2022, reflects a drive to pool real-estate and security investment across the cash industry. They help to reduce collective cash processing costs, ensuring that transactional uses of cash can be maintained.

The banknotes deposited in SABs are immediately credited to the credit institution's accounts. It is therefore quicker than using the Banque de France’s counters, which requires more travel time from the cash-in-transit companies. This mechanism speeds up the circulation of cash and reduces the carrying cost of financial flows.

As vaults are already required to comply with the high level of security laid down by the Decree of 18 September 2013, the cost of installing an SAB is marginal.

The cash stored in the SABs will be calibrated to supply the region and to reduce the need for Banque de France services. Above all, limiting the number of transports between the Banque de France and the vaults thanks to the SABs strengthens the security of the cash management circuit.

Auxiliary coin depositories (DAMs – dépôts auxiliaires de monnaies), also located at cash-in-transit companies and supplied directly from the Monnaie de Paris mint in Pessac, complete the system.

23

Number of Banque de France cash centres, with a further 16 SABs

Environmental efficiency

The Eurosystem makes sure that euro banknotes are safe to use by researching the potential impact of their production and circulation on public health and carrying out scientific examination and testing. The environmental footprint of banknotes is also assessed to identify opportunities to reduce their environmental impact via new products and processes. The euro banknotes and their production processes are thus becoming as sustainable, green and environmentally friendly as possible.

Updated on the 30th of October 2023