- Home

- Governor's speeches

- Monetary Policy in Times of Conflicts

Monetary Policy in Times of Conflicts

François Villeroy de Galhau, Governor of the Banque de France

Published on 20th of November 2023

SPE Annual Dinner – London, 20 November 2023

Good evening.

It is a pleasure for me to be in London today, particularly at the invitation of the Society of Professional Economists. London evokes a lot of things for French people. French economists appreciate the concentration of excellent economic research in London – tonight’s list of attendees is particularly impressive in this respect. But for French citizens, London also conjures up an important page in our history: we have not forgotten that during World War II London hosted the government in exile of the General de Gaulle and the Free French. It may be a surprise that I evoke this now, as central bankers typically speak about recent economic developments. But today I would like to consider a longer perspective, and focus on a key aspect of our current environment: conflicts.

In retrospect, the Great Moderation, which started soon after the Fall of the Berlin Wall, was a period of peace, rapid economic development and globalisation, stability, and relative political consensus. Economists were not the only ones to be lulled into thinking that this might be a permanent new steady-state, be it the “End of History” or more modestly the end of economic crises and inflation. Although the situation had already deteriorated somewhat in the previous decade, in just a few years there has been a dramatic worsening due to worldwide tensions and fragmentation, and increasing political conflicts within our countries or groups of countries. What are the implications of this for central bankers? I will first try to describe the “almost indescribable”: the nature of these shocks and their economic consequences, and then turn to how I think central banks should travel through this new and troubled landscape.

1. A new, more conflictual environment

a) A multiplication of exogenous shocks with far-reaching consequences

Shocks are unavoidable. However, in recent years, we have witnessed their multiplication with a consequent flourishing in new words such as “polycrisis” and “megathreats”. Current shocks no longer come from “within” the economic and financial cycles themselves; they are exogenous and strongly adverse: the worst pandemic since the 1918 Spanish flu, the increase in extreme natural catastrophes as a result of climate change, heightened domestic political tensions as well as “geopolitical tensions” – which is a euphemism for a word that we were hoping had disappeared from our vocabulary: war.

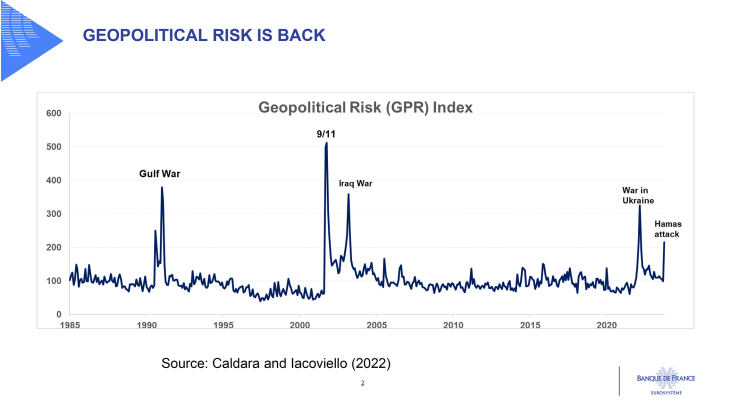

Let me illustrate these rapid changes with a few charts. Slide 2 looks at geopolitical risk. Some researchers have designed a synthetic index; here, I am using an index based on news coverage. After a period of roughly twenty years of relative calm, the issue of geopolitical tensions now takes center stage again.

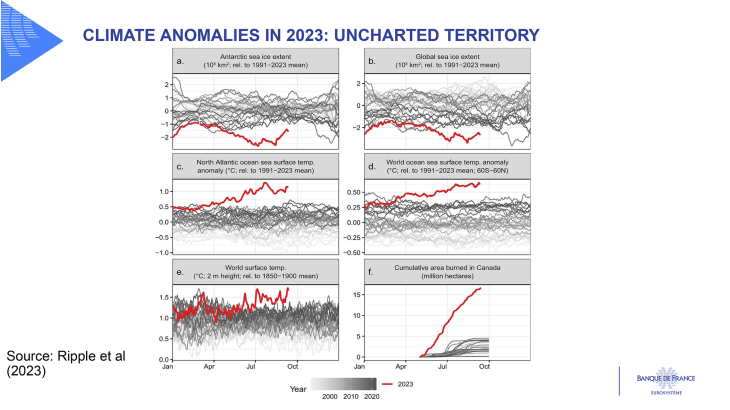

Slide 3 presents various metrics of climate change – an admittedly complex and multi-faceted phenomenon. On all of these charts the year 2023 appears in red: whatever metric is used, this year should be the worst, by far. Climate change cannot be denied anymore, and it seems to be accelerating. It sows the seeds for potential conflicts: between countries, and between generations due to the famous “tragedy of the horizon”.

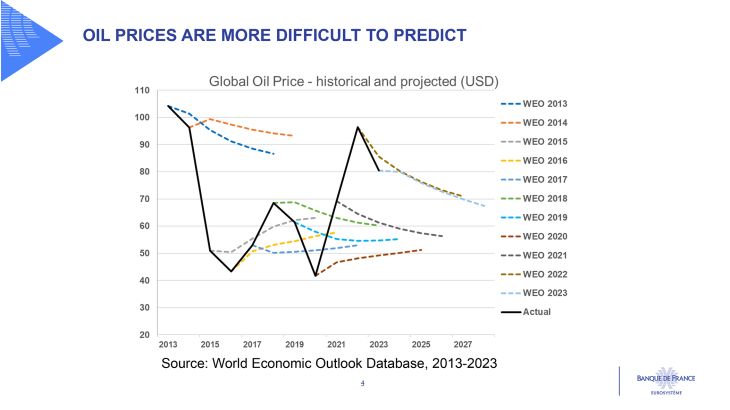

The economic consequences of these global evolutions are paramount, and I will tonight focus on geopolitical conflicts. The most immediate channel is through commodity prices. These are a major determinant of inflation and accordingly they play a key role in central bank forecasts. They are notoriously difficult to predict, as can be seen in slide 4, which represents historical and projected oil prices from various IMF WEO vintages.

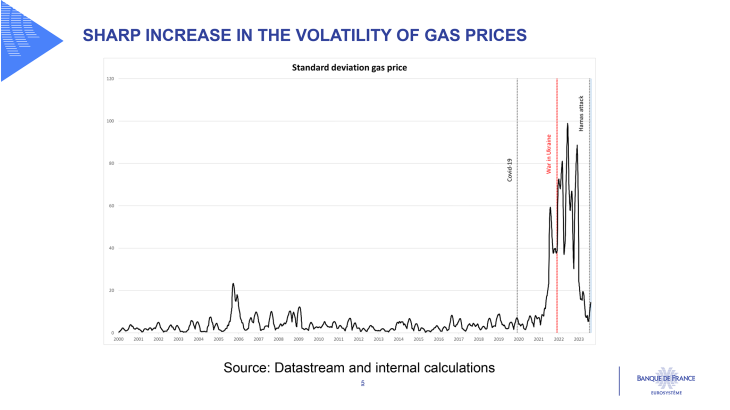

Large swings in oil prices have been overlooked in the past; looking forward, it could become even harder to predict them. Indeed, commodity prices strongly react to geopolitical events, as can be seen in my next slide (slide 5), which shows the volatility of gas prices before and after the invasion of Ukraine. A world littered with geopolitical tensions is not only more dangerous, it is also much more uncertain.

Second, conflicts mean increased pressure on public finances: governments are under pressure to increase defence spending, but also to protect their fellow citizens from the adverse consequences of these shocks, as “an insurer of first resort”: for example, after the Covid measures, the various – and onerous –“energy shields” were deployed in Europe – and the UK – in the last two years.

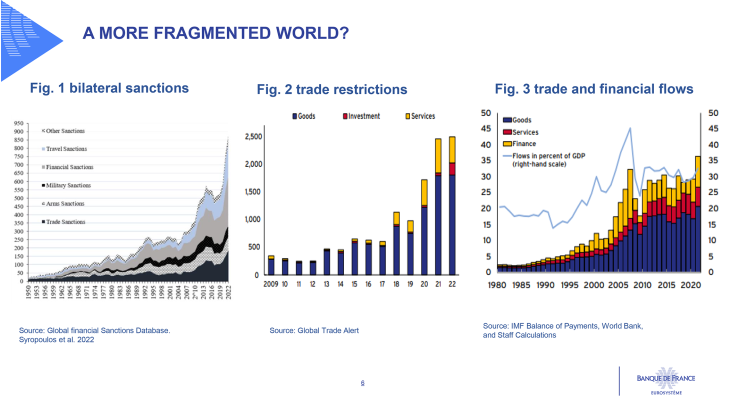

A third channel is fragmentation. In slide 6, the first chart displays the number of sanctions, by type, and the second one focuses on trade sanctions: both charts indicate a sharp increase. The third chart shows global trade and financial flows, which are now stagnating, after a long period of growth: while it is too early to speak of de-globalisation, the heydays of globalisation are clearly over.

Finally, another implication of geopolitical tensions and conflicts is that multilateralism is in a crisis without precedent since 1945: in the WTO obviously, but also in the G20 and even in the IMF despite the recent welcome agreement on quota increase. This is at once a paradox and a problem, as more issues than ever are all global, and require global cooperation: climate change, pandemic preparedness, digital finance and cryptos, to name only a few topics of what I call a “pragmatic multilateralism”.

More uncertainty and more inflationary shocks; more public expenditures; more fragmentation; and less multilateralism: these are the global economic risks induced by these “times of conflicts”. Before coming to our possible answers, let me turn to the domestic dimension of conflicts– while more peaceful, it also has significant effects.

b) The response by economic stakeholders and decision makers is itself increasingly conflictual

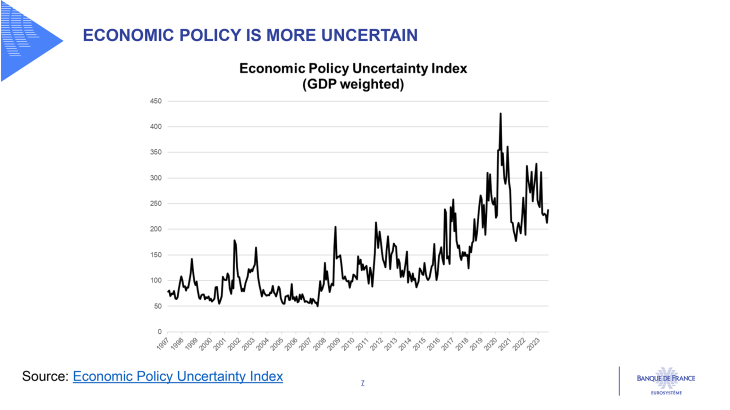

In many countries the political decision-making process has become more conflictual. Brexit is of course a first example that comes to mind. But in the United States, bipartisan solutions are increasingly difficult to reach. And within EU Member States, government majority is harder to achieve, due to the decline of mainstream political parties and increased political fragmentation. The Economic Policy Uncertainty Index is a convenient way to summarise these evolutions. Slide 7 reports the global index, but country-specific indices also show an upward trend.

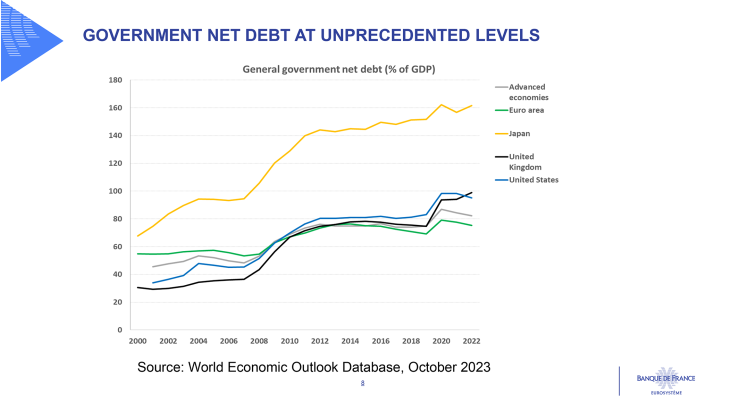

We know that risk-averse economic agents respond rapidly to increased uncertainty by curtailing investment and purchases of durables and hoarding liquidity. But there is a significant indirect effect as well, which is that necessary structural reforms tend to be avoided when the political landscape is more divided. It is especially detrimental when economic challenges are on the supply-side – as is presently the case – and no longer on the demand side. This is particularly true for public finances. Slide 8 shows the general government debt level for G7 countries.

Public debt has never been so high. This results from a variety of factors, including of course the Covid pandemic, but it should not hide more profound difficulties. It is difficult for weaker governments to resist the "conflicting demands" to increase spending and cut taxes: higher deficits are often too easy an answer to these opposing objectives. This complicates the task of central banks in combating inflation in too many countries today – including perhaps the most important one –, monetary tightening is not sufficiently backed by fiscal tightening. In our Monetary Policy Statement, we regularly reiterate that such a mismatch could “call for even tighter monetary policy".

Let me mention another possible dimension of domestic “conflicts”. Inflation has an inherent conflictual component, as recalled in a recent paper by Guido Lorenzoni and Ivan Werning, echoing previous work by Olivier Blanchard. Conflicts between incompatible markup and wage aspirations can take place between firms and employees, and potentially lead to an inflationary spiral. Inflation is potentially a distribution conflict : we know it since the 1970’s. And we have recently seen episodes of greedflation in certain countries or sectors, or excessive wage demands. That said, from a macroeconomic perspective, the past recent surge in inflation has not been significantly fuelled by a wage-price spiral, nor a profit-price spiral. Several factors have limited the scope for such spirals. First, the prevalence of automatic wage indexation has declined and wage negotiations are more decentralised. Second, government policies have directly or indirectly limited the impact on households and firms of the surge in energy costs – although at the expense of heavier public debt. Last but not least, central banks credibility combined with their swift reactions has helped to anchor and coordinate the inflation expectations of employers and employees.

This latter consideration naturally leads me to the second part of my speech, so I will now turn to how we central banks should travel through this new and troubled landscape.

2. Central banks are more humble but not disarmed

The current environment is admittedly highly challenging and leaves central banks more humble, but not disarmed. Since “conflict” is the red thread of my talk, allow me to borrow from Clausewitz’s “fog of war” concept: “War is the realm of uncertainty; three quarters of the factors on which action in war is based are wrapped in a fog of greater or lesser uncertainty. A sensitive and discriminating judgment is called for; a skilled intelligence to scent out the truth.” To a large extent, this comment could apply to central banking (in a more peaceful way!). And let me elaborate on three possible characteristics of this “skilled intelligence”: humility; pragmatism; and nevertheless confidence.

a) Central banks need to be humble

To start with, let me stress one thing straight away, echoing Christine Lagarde’s remarkable speech in Jackson Hole: central banks need to be humble. The current environment is particularly difficult to predict. Moreover, current shocks – and probably future ones – are no longer demand-driven – for which monetary policy is the most appropriate – but supply-driven. Tackling the causes and consequence of these supply side shocks is mainly the responsibility of government policies, in combination with the private sector. And for a central bank, it is more difficult to control inflation when it is predominantly caused by supply-side factors. Inflationary supply shocks tend to exert downward pressure on real incomes: a too prompt monetary policy response may exacerbate inflation volatility while eventually provoking a recession if the transmission lags are not correctly taken into account. On the other hand, when supply shocks are persistent and threaten to de-anchor inflation expectations, the central bank should react to keep core inflationary pressures in check and prevent so-called second round effects.

Yet, these are not reasons for central banks to give up, quite the contrary. Being humble means being clear on what we central banks can and cannot achieve, and what we do and do not know, and I would suggest some “rules of conduct” in this spirit:

• Focus on our primary mandate of price stability. I continue to be a strong proponent of the role of central banking in climate change: but climate change has such a significant effect on activity and prices that it obviously must be incorporated in order to ensure price stability. On other legitimate challenges, like inequalities and unemployment, fighting inflation is at present the most efficient way to promote inclusive and strong growth.

• Focus on actual data, at least as much as on models. “Microlistening” to entrepreneurs and our fellow citizens is at least as important as “macromodelling”, which remains useful but cannot claim to be fully accurate with the present interplay of multiple and unprecedented shocks.

• And learn from some past excesses of forward guidance: our reliance on forward guidance on rates was probably excessive in principle in the face of exceptionally large and unexpected shocks, and too rigid in its substance. We cannot totally bind our hands with rules, and should keep some discretion in addressing unexpected data or events. Central banks should be predictable, but not pre-committed. In the future, I wouldn’t rule out a return to some form of forward guidance, but seen as more indicative, more state-dependent… and more modest – i.e. less powerful as an instrument. The purpose of such guidance should be to diminish volatility, not to claim “forging the economic order” for the future: this would be hubris.

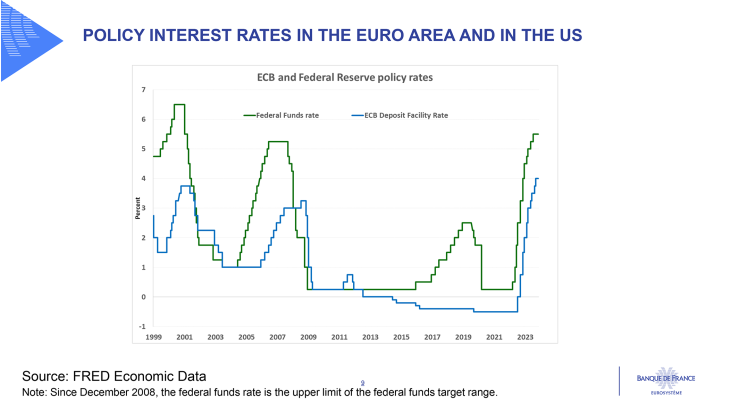

b) Pragmatism, in the face of the challenge of more volatile long-term interest rates

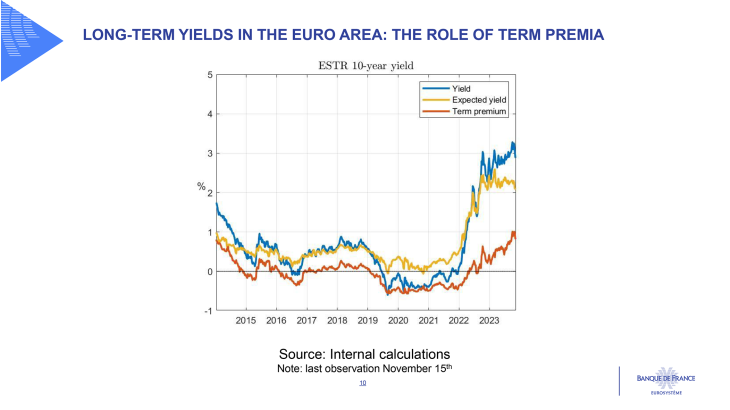

Central banks are currently facing an additional challenge in terms of ‘weaponry’. When they hit their effective lower bound on short-term policy rates after the Global Financial Crisis, they increasingly pushed down longer-term interest rates. The combination of the dampening effect of the effective lower bound, the term premium compression due to asset purchases and the endogenous stabilisation through the policy reaction function – thanks to forward guidance – meant that long-term interest rates were heavily influenced by monetary policies. This process has gone into reverse now that policy rates have moved far away from the effective lower bound (slide 9) and central banks have communicated that short-term rates are the active policy instrument, with furthermore a gradual normalisation of the balance sheet. As a consequence, long-term interest rates are increasingly market driven and term premia are rising, as can be seen in Slide 10.

Why so? According to some, the natural rate of interest seems to be increasing. Still more likely, high and growing sovereign indebtedness, and the uncertainty regarding the future path of public finances, as mentioned earlier, are contributing to the rise in real and nominal risk premia. This is another reason to call for a coherent policy mix, with sound fiscal policies.

In the euro area, most of the rise in long-term rates that we have seen until the recent correction seemed to have resulted from contagion from the United States (in this respect, the world has not de-globalised). It is too early to say whether such upward pressures on long-term bond yields will resume. But we have to expect more volatility in global bond markets, more decoupling of short term and long term rates and we will need to pragmatically take account of the implications for our domestic monetary policy. The most straightforward option would be to factor this into the future trajectory of our key short-term policy rate: renewed increases in long-term rates would be a further tightening of financial conditions and one additional reason not to continue hiking short-term interest rates.

Regarding balance sheet policies, we will have to discontinue our PEPP reinvestments in due time – and possibly earlier than end 2024. But I see no reason today to tie our hands on a specific order of sequencing between our future first rate cut and the end of the PEPP full reinvestments. As long as our rates are in restrictive territory – which will clearly remain the case – , withdrawing past balance sheet expansion can be consistent with our overall monetary stance.

c) Confidence: central banks acting efficiently as an anchor

In the current environment, central banks must and can more than ever act as an anchor, to reduce uncertainty. The closer we are to the 2% target for average inflation, the less disturbing and the less persistent shocks on relative prices will be for the economy – and such supply shocks are likely to be more frequent than in the past. With a sufficiently low average inflation, we could come back to “rational inattention” from consumers and firms, and hence diminish the risk of inflationary conflicts. Internal work at the Banque de France shows a non-linear relationship between the level of inflation and inflation attention, with a threshold around 2.5% in the case of France.

Hence, in this very uncertain environment, let me express two reasons for confidence:

• We, the ECB, will bring inflation back towards 2% by 2025. This includes some judgment: I am not fixated on 2.0% to the nearest decimal place and I am not obsessed by the alleged challenge of “the last mile”. That said, changing our inflation target, as suggested by some economists, would risk blurring expectations, and fail to fulfil our mandate. And there can be no doubt about our determination to reach our target: we have already made significant progress, reducing in one year headline inflation from 10.6% to 2.9%, and in six months core inflation from 5.7% to 4.2%. There could be some ups and downs in the next months, but the disinflationary trend is solid and somewhat quicker than expected on both sides of the Atlantic: look especially at the encouraging figures for services (estimated at 4.6% in October in the euro area, down from a peak at 5.6% in July). The latest developments in Israel and the oil market shouldn’t significantly change this trend: each day we are moving further from a general commodity shock like in 2021-22.

• As we are confident on our target, we can be patient on our instrument. “Intelligent patience”, so to speak, which is quite different from stubborn obstinacy: we’ll adapt to data, including on economic activity – and I still think we should and can avoid recession, preferring a soft landing path. But the question too quickly shifted from “when will you stop hiking?” to “when will you start cutting?”. Well, in a mountainous environment, there aren't just peaks and descents: there are also plateaus, where you can experience the effects of altitude and appreciate the view. That's what we'll probably be doing for at least the next several meetings and the next few quarters. I said as early as last January that we would probably finish raising rates "by summer 2023" - and we have done so; today I won't give a date for the first rate cut. Rather than a calendar, I do believe that there is one key criterion for getting through this future "navigation lock": a return to an inflation outlook that is compatible with our 2% target, firmly and durably. Firmly in the sense of being supported by actual data on headline inflation, as well as on underlying inflation and wages. Durably in the sense of forecasting 2% sufficiently ahead of the end of our projection horizon, and including a decline towards 2% of households’ and businesses’ inflation expectations.

Let me wrap up with the famous words of Winston Churchill, who declared in the House of Common in 1940: “We shall not flag or fail (…). We shall fight with growing confidence and growing strength”. In a world subject to increasing conflictuality, you can be sure that we, as central bankers, shall never surrender against inflation and thus do our part to reduce what I called “domestic conflicts”. We should do it with humility, focusing on our primary mandate and on actual data, rather than claiming to forge the whole economic future; and with pragmatism, facing among others more volatile long term interest rates. But we shall deliver by 2025 with increased confidence: expect our next meetings, as said, to be a bit more boring. But if this is synonym for somewhat reduced uncertainty and intelligent patience before future rate cuts, nobody should regret it. Thank you for your attention.

i F. Fukuyama, The End of History and the Last Man, 1992.

ii G. Gopinath, The temptation to finance all spending through debt must be resisted, Financial Times, 27 October 2023.

iii F. Villeroy de Galhau, The future of multilateralism: three hard facts, three needs and one belief, Speech at Emerging Markets Forum, 11 October 2023.

iv P.-O. Gourinchas, Resilient Global Economy Still Limping Along, With Growing Divergences, IMF Blog, 10 October 2023.

v G. Lorenzoni, and I. Werning, "Inflation is Conflict", Working Paper 31099, National Bureau of Economic Research, April 2023.

vi O. Blanchard, "The Wage Price Spiral", The Quarterly Journal of Economics, August 1986, 101(3), 543-565.

vii C. Lagarde, Policymaking in an age of shifts and break, Speech, Jackson Hole, 25 August 2023.

viii F. Villeroy de Galhau, Monetary policy in uncertain times, speech at London School of Economics, 15 February 2022

ix Below 2.5%, attention is low and insensitive to the actual level of inflation, but when inflation is above this threshold, inflation attention rises strongly with inflation. Korenok et al. (2022) find similar results for a large sample of countries using Google searches for inflation. O. de Bandt et al., (2023) also show the good forecasting properties on future inflation developments from data on inflation perception derived from newspapers. This warrants monitoring such data from newspapers and social media.

x F. Villeroy de Galhau, How monetary policy will defeat inflation: channels and locks, Speech at Centre des professions financières, 17 February 2023.

xi W. Churchill, House of Commons, 4 June 1940.

Slides

Updated on the 25th of July 2024