A guarantee of stability

Cooperation between France and its 15 African partners helps to maintain the financial stability in these countries. It offers protection against the risk of balance of payments crises, thanks to France’s provision of a convertibility guarantee. It also constitutes a regional financial arrangement that forms part of the global financial safety net (GFSN)1, which has the International Monetary Fund (IMF) at its core. Lastly, the cooperation is based on strong historical and cultural ties, and seeks to find common solutions to the challenges posed by development and the international economic environment.

The cooperation framework is based on two fundamental principles;

- The fixed exchange rate with the euro, pegged at 1 euro = 655.957 CFA francs (XAF/XOF) and 1 euro = 491.968 Comorian francs (KMF). This peg has enabled the Comoros, WAEMU and CEMAC to enjoy much lower inflation than other sub-Saharan African countries for several decades.

- The unconditional and unlimited guarantee of convertibility offered by the French Treasury, in the form of an advance to central banks, in the event of the depletion of foreign exchange reserves. This financial safety net ensures the credibility of the currency peg to the euro and provides effective protection against balance of payments shocks.

France and its African partners also cooperate in efforts to combat money laundering and terrorist financing. This work is notably carried out by an Anti-Money Laundering Liaison Committee (CLAB), a consultation and technical support body whose permanent secretariat is provided by the Banque de France.

History

Origins

On 9 September 1939, just after the start of the Second World War, a decree was passed establishing a single monetary area between France and its overseas territories to protect the latter from sudden exchange rate fluctuations. The decree introduced common exchange rate regulations and centralised the management of foreign exchange reserves: capital movements became free and unrestricted, and currencies were made freely convertible into one another, with fixed parities. In December 1945, alongside the Bretton Woods negotiations, a single currency was created in the African countries under French sovereignty: the franc of the French Colonies of Africa or CFA franc, which in 1958 became the franc of the French Community of Africa.

Following their independence, achieved between 1958 and 1960, most of the sub-Saharan African states that emerged from the French colonial empire chose to maintain close cooperation ties with France. The colonial note-issuing banks were transformed, giving rise to the Central Bank of West African States (the BCEAO), with the African Financial Community franc (XOF) as its currency, and the Central Bank of Equatorial African States and Cameroon (the BCEAEC, later the BEAC), which issues the Central Africa CFA franc (XAF).

The agreements concluded between France and the members of each of the monetary unions set out the principles of cooperation: maintenance of fixed parities, freedom of transfers, centralisation of foreign exchange reserves and an unlimited guarantee of convertibility through transaction accounts. The French administration and the Banque de France also provide substantial material and technical support to the note-issuing banks.

Since March 1965, the finance ministers of the franc zone have met every six months, prior to the annual and spring meetings of the IMF.

Increased role of African central banks

New monetary cooperation agreements were signed in November 1972 for Central Africa and in December 1973 for West Africa. These marked a turning point in the relationship between France and its African partners, with the latter taking greater responsibility for the governance of their central banks. The share of French representatives on the BEAC and BCEAO boards of directors was reduced, the number of African executives was gradually increased, and the headquarters of the two institutions were transferred from Paris to Africa – to Yaoundé (Cameroon) in 1977 in the case of the BEAC, and to Dakar (Senegal) in 1978 in the case of the BCEAO. In return for its convertibility guarantee, however, France continues to participate in the management and oversight of these central banks.

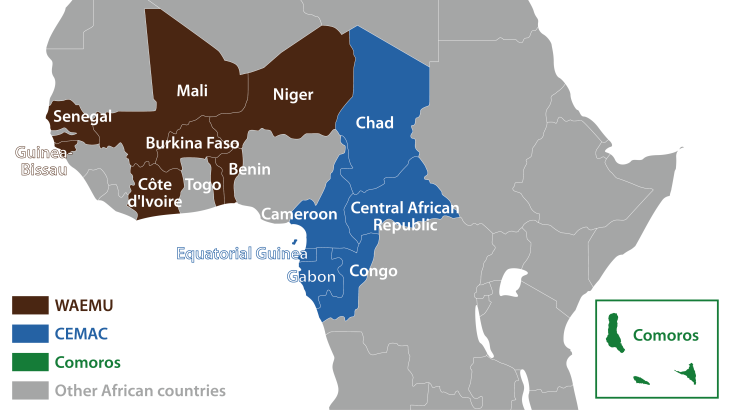

Signing up to cooperation agreements is always a free and sovereign choice of the states involved. Some countries, such as Mauritania (1972) and Madagascar (1973), have opted out. Conversely, Mali signed a bilateral agreement with France in 1967, before joining the West African Monetary Union (WAMU) in 1984. The Comoros, which became independent in 1975, signed a monetary cooperation agreement with France in November 1979. The Central African Monetary Union (UMAC) was enlarged in 1985 to include Equatorial Guinea and the West African Monetary Union (WAEMU) in 1997 to include Guinea-Bissau.

From the franc to the euro

The 1990s saw the strengthening of regional integration and the replacement of the French franc by the euro. To address the decline in the economic competitiveness of African partners, the CFA and Comorian francs were devalued respectively by 50% and 33% on 11 January 1994. These one-time devaluations were accompanied by a deepening of monetary union, with the adoption of the treaties establishing the West African Economic and Monetary Union (WAEMU) and the Central African Economic and Monetary Community (CEMAC) on 10 January and 16 March 1994 respectively.

When it was introduced on 1 January 1999, the single European currency replaced the French franc as the monetary anchor for the CFA and Comorian francs, with no change in parity.

The monetary cooperation agreements remained in force after France adopted the euro. France and its African partners remain solely responsible for their implementation.

A decision of the Council of the European Union is nevertheless necessary in two cases:

- in the event of a change in the scope of the agreements – such as the accession of a new country

- in the event of a change in the nature of the agreements – such as a modification of the French guarantee or the exchange rate peg

The agreement signed in 2019 with the WAEMU member states changed the monetary cooperation framework for these countries. Under the provisions of the new agreement, France no longer appoints a representative to the central bank's governing bodies, except when there is a possibility that its guarantee might be invoked. The BCEAO's transaction account with the French Treasury was closed and France has become a financial guarantor.

Sound institutions

Monetary cooperation between Africa and France is conducted through central banks, key Banque de France partners, and institutional bodies in the two monetary unions.

The central banks define and conduct the African states’ monetary policy

The Central Bank of West African States (BCEAO), based in Dakar, is the note-issuing bank for the WAEMU. It is headed by a Governor, who is appointed for a renewable term of six years by the Conference of Heads of State and Government. The Governor chairs the Board of Directors, which is responsible for issues relating to the management of the BCEAO, the Monetary Policy Committee, which defines the monetary policy of the WAEMU and its instruments, and the Banking Commission of the WAEMU, which is the supervisory authority for credit institutions and microfinance institutions. Its College comprises the Governor of the central bank, a representative appointed by each member state, and members appointed by the WAEMU Council of Ministers, on the proposal of the Governor, on the basis of their competence in the banking field. The central bank provides the Banking Commission’s secretariat and covers its costs.

Pursuant to the agreements of 21 December 2019, France no longer appoints a representative to either the BCEAO's Board of Directors or the Monetary Policy Committee. However, the latter includes an independent and qualified member, appointed intuitu personae by the WAEMU Council of Ministers in consultation with the French government.

The Bank of West African States (BEAC), based in Yaoundé, is the note-issuing bank for the CEMAC. It is headed by a Governor, who is appointed for a non-renewable term of seven years by the Conference of Heads of State and Government. The Governor chairs the Monetary Policy Committee, which defines the monetary policy of the CEMAC and its instruments, as well as the Central African Banking Commission (COBAC), which is responsible for the supervision of credit institutions and microfinance institutions. The Board of Directors of the BEAC, which manages the central bank and ensures its smooth operation, is chaired by the Chairman of the Ministerial Committee of the Central African Monetary Union (UMAC).

Under the UMAC treaty and the BEAC statutes, France, like the six CEMAC states, appoints two directors and two members of the Monetary Policy Committee.

The Central Bank of the Comoros (BCC), based in Moroni, is the note-issuing bank and the supervisory authority for the Comorian banking sector. It is headed by a Governor, who is appointed for a renewable five-year term by the President of the Comoros. The Board of Directors defines and implements monetary policy, manages the central bank and takes decisions on banking supervision.

Under the BCC's statutes, four of the eight members of the Board of Directors are appointed by the French government, and the other four by the Comorian government. The Chair of the Board of Directors is elected by the Board from among its Comorian members.

WAEMU and CEMAC: two monetary unions supplemented by economic unions

Established in Dakar (Senegal) on 10 January 1994, against the backdrop of the devaluation of the XOF, the WAEMU was created as a complement to the Monetary Union, with four objectives: the harmonisation of the legal and regulatory framework, the creation of a common market to replace the existing customs union, the multilateral supervision of macroeconomic policies and the coordination of national sectoral policies.

The main political guidelines of the WAEMU are defined by the Conference of Heads of State and Government and implemented by the Council of Ministers. The WAEMU Commission, based in Ouagadougou, Burkina Faso, is its executive body.

Created in N'Djamena (Chad) on 16 March 1994, the CEMAC is made up of two entities: the Central African Economic Union (UEAC), a framework for legal harmonisation, trade integration and economic convergence, and the UMAC.

The Conference of Heads of State and Government is the supreme authority of the CEMAC and is responsible for determining its policy. It steers the work of the UEAC Council of Ministers, which heads the Economic Union, and that of the UMAC Ministerial Committee, which has extensive powers in the management of the BEAC and ensures that national economic policies are consistent with the common monetary policy. The CEMAC Commission, based in Bangui (Central African Republic), is the executive body of the Community.

The WAEMU and the CEMAC are both implementing a process of regional economic convergence and integration, which contributes to the stability of their single currency. In this respect, they have multilateral supervision mechanisms: in both unions, compliance with the convergence criteria is monitored by the Commission, which submits corrective measures to the Council of Ministers if necessary.

1 The global financial safety net is a set of mechanisms and instruments designed to provide insurance to prevent or deal with balance of payments crises by supplying international liquidity. It consists of foreign exchange reserves, bilateral swap arrangements between central banks, IMF resources and regional financial arrangements.