After decades of increasing global economic integration, rising geopolitical tensions have led to a surge in restrictions on trade and capital flows often motivated by national security considerations. Against this backdrop, most advanced economies have adopted or tightened their existing investment screening mechanisms (ISMs), which empower national authorities to review, and potentially condition or prohibit, transactions that may threaten domestic interests, including national security and public order. A number of advanced economies, which have traditionally been open to foreign investments, implemented stricter scrutiny of foreign transactions from the late 2010s onward. Alongside these national developments, in 2019 the EU adopted a common FDI cooperation screening framework.

In this paper, we analyze whether ISM mechanisms can reconcile openness to growth-fostering inward FDI with a desire to ensure enhanced scrutiny of potentially hostile foreign takeovers. Although ISMs may be necessary to protect strategic assets, they may also reduce the efficiency of capital allocation (Ioannou et al., 2023). We analyze the impact of FDI screening on attractiveness and check whether it has contributed to legislative convergence within the EU.

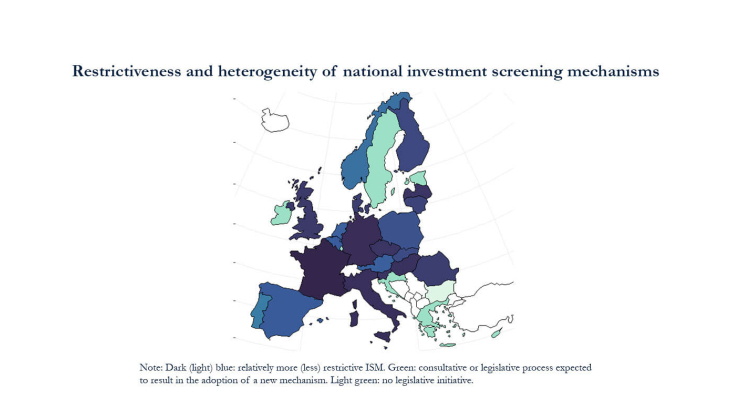

This paper makes several contributions to the scarce body of literature on ISMs (Danzman and Meunier 2023). First, we have built a comprehensive database mapping the main features of FDI screening regimes in major advanced economies (EU countries, the USA, the UK, Australia, Canada, Norway and Japan). We provide a composite index measuring the restrictiveness of screening regimes. EU countries do not systematically have the strictest regimes, suggesting they remain competitive in comparison to other advanced economies. The index is also helpful for tracking the pace of legislative convergence within the EU, in light of the European Commission’s evaluation of the EU cooperation mechanism expected by the end of 2023. While the EU regulation aims to facilitate convergence in national screening regimes, the index outlines their heterogeneity (see figure 1).

Second, we show that restrictive ISMs can coexist alongside an otherwise liberal investment environment. We compare the ISM restrictiveness index with other measures of FDI restrictiveness and show how it complements the existing literature. Overall, the recent tightening of national ISMs has not coincided with investors’ reappraisal of the most attractive destinations. Indeed, some of the most restrictive countries are attractive to foreign investors, at least as measured by FDI inflows. Transparent foreign investment screening regulations may even improve the perceived transparency of government regulations and hence, enhance attractiveness.

Third, we show how macroeconomic and geopolitical factors shape the restrictiveness of ISMs. We focus on three factors that may result in more restrictive regimes: i) exposure to China, ii) natural resources and technological specialization and iii) geopolitical factors. Advanced economies that are highly exposed to investments from China tend to be more restrictive. The restrictiveness of national ISMs also correlates with the number of patents per capita. Technology transfer associated with foreign acquisitions may be a greater concern in economies with a larger share of R&D in sectors related to critical technology. Countries that are geo-politically aligned with the USA tend to have stricter ISMs, while negative sentiment towards the Chinese Belt and Road Initiative (based on an analysis of international media sentiment, see García-Herrero and Schindowski, 2023) correlates with more restrictive ISMs.

Fourth, we assess the impact of ISMs on transactions. We analyse whether stricter national regulations result in a higher number of transactions being blocked. We build a comprehensive database on the outcome of screening decisions and document which target sectors and investors are most impacted by ISMs. Although a large number of transactions are subject to review, the number of blocked transactions is limited, suggesting that ISMs strike a balance between openness to FDI and the protection of national interests. Lastly, we show that the ISM restrictiveness index is a good predictor of implementation practices, with stricter regimes resulting in a higher number of screened, mitigated or blocked transactions.